On-chain information exhibits the Bitcoin miner promoting energy is at its lowest for the 12 months, one thing that could possibly be favorable for the value of the crypto.

Bitcoin Miner Promoting Energy Has Been Going Down In Current Weeks

As identified by an analyst in a CryptoQuant post, the metric has noticed surges in its worth a number of instances this 12 months, and every time the BTC value has gone down.

The “miner promoting energy” is an indicator that’s outlined because the ratio between the Bitcoin miner outflows and the entire variety of cash held by this cohort (30-day shifting common, log-scaled)

Right here, the “miner outflows” is a measure of the entire quantity of BTC that miners are transferring out of their private wallets.

When the worth of the miner promoting energy rises, it means the flexibility of miners to dump their cash goes up proper now as they’re withdrawing extra of them from their reserve. Naturally, such a development might be bearish for the worth of the crypto.

Alternatively, low values of the indicator counsel miners aren’t placing a lot selling pressure available on the market in the mean time, and therefore would possibly show to be bullish for the BTC value.

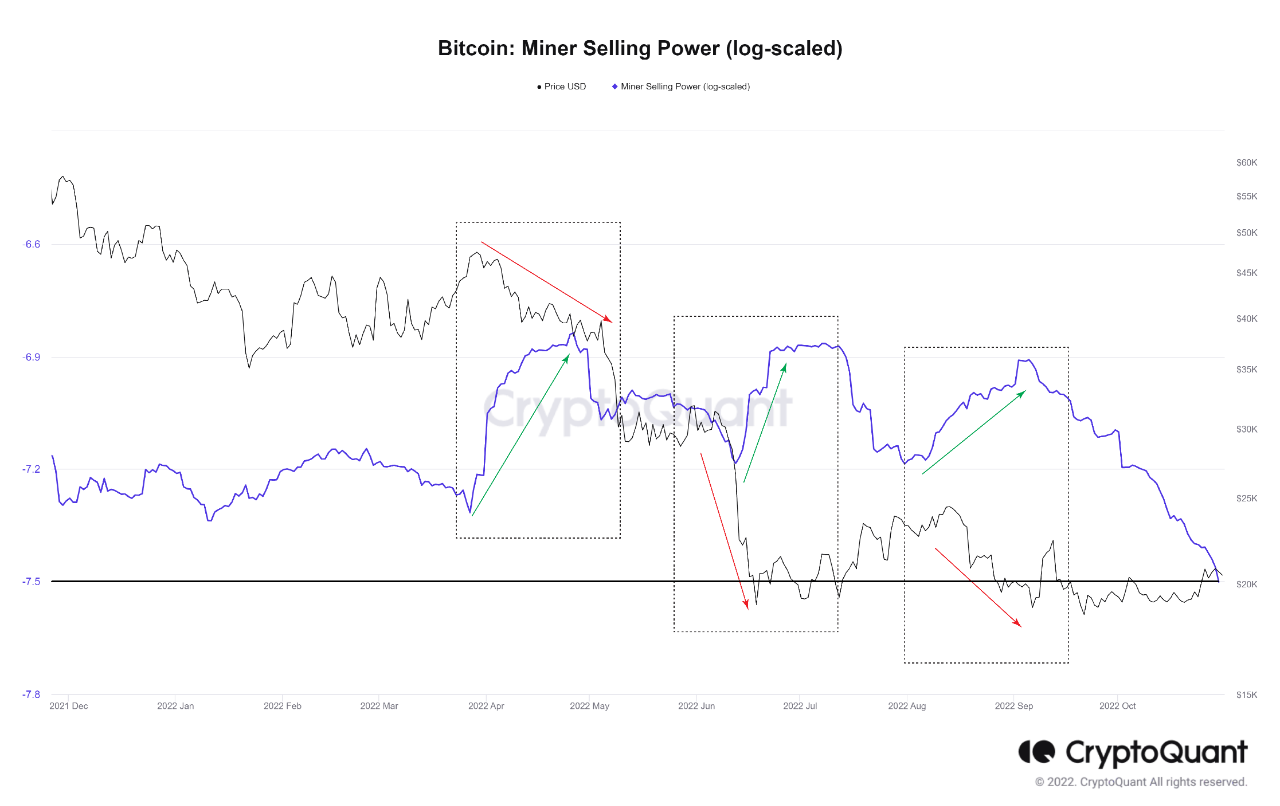

Now, here’s a chart that exhibits the development within the Bitcoin miner promoting energy (log-scaled) over the 12 months 2022 thus far:

Appears to be like just like the log-scaled worth of the metric has been on the best way down not too long ago | Supply: CryptoQuant

As you’ll be able to see within the above graph, the quant has marked the related factors of development for the Bitcoin miner promoting energy.

It looks as if in the course of the previous 12 months, the indicator has noticed three cases of sharp development, and across the time of every of those surges, the value of the crypto has taken a beating.

In the previous few weeks, the metric has been on a relentless decline, suggesting that miners haven’t been promoting a lot in the course of the interval.

Because of this downtrend, the Bitcoin miner promoting energy has now reached its lowest worth for the final 12 months. Going by the earlier development, this could possibly be a optimistic signal for the present rally within the crypto.

BTC Value

On the time of writing, Bitcoin’s price floats round $20.5k, up 6% within the final week. Over the previous month, the crypto has gained 5% in worth.

The beneath chart exhibits the development within the value of the coin over the past 5 days.

The worth of the crypto appears to have been shifting sideways between $20k and $21k | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, CryptoQuant.com