The Bitcoin difficulty-adjusted puell a number of has been under one not too long ago, right here’s why this may increasingly recommend that the BTC miners are nonetheless beneath stress.

Bitcoin Issue Adjusted Puell A number of Is But To Break Above 1

Based on a researcher on the on-chain analytics agency Glassnode, miners are nonetheless incomes round 12% lower than the common for the previous 12 months. The indicator of curiosity right here is the “puell multiple,” which measures the ratio between the each day Bitcoin miner income (in USD) and 365-day transferring common (MA) of the identical.

When the worth of this metric is bigger than one, it means the miners are at present making greater than their common for the previous 12 months. Throughout such intervals, miners usually discover mining to be worthwhile.

Then again, values under this threshold suggest the miner revenues are under the yearly common, probably suggesting that this cohort could also be coming beneath stress.

There is a matter with the puell a number of, nevertheless, and it’s that it solely will depend on the worth of the cryptocurrency. The metric doesn’t consider one other essential issue for the miners: the mining difficulty.

The mining issue is a built-in function of the Bitcoin blockchain that decides how onerous miners would at present discover it to mine blocks on the community. This idea exists as a result of the BTC blockchain goals to maintain the block manufacturing price (or extra merely, the speed at which miners deal with transactions) at a relentless worth.

When the community hashrate (a measure of the full computing energy linked to the chain) goes up, miners are in a position to hash blocks sooner. However because the chain doesn’t want for this to occur, it will increase the problem to decelerate miners simply sufficient to get them again to the specified tempo.

Due to the problem’s existence, revenues for particular person miners shrink every time the hashrate goes up. This is because of the truth that the block rewards at all times stay the identical (aside from throughout halving occasions, the place they’re halved), which means that if extra miners hook up with the community, the person shares of everybody concerned change into smaller.

The “difficulty-adjusted puell a number of” is a modified model of the indicator that gives a extra life like illustration of the scenario of the miners, because it accounts for the mining issue.

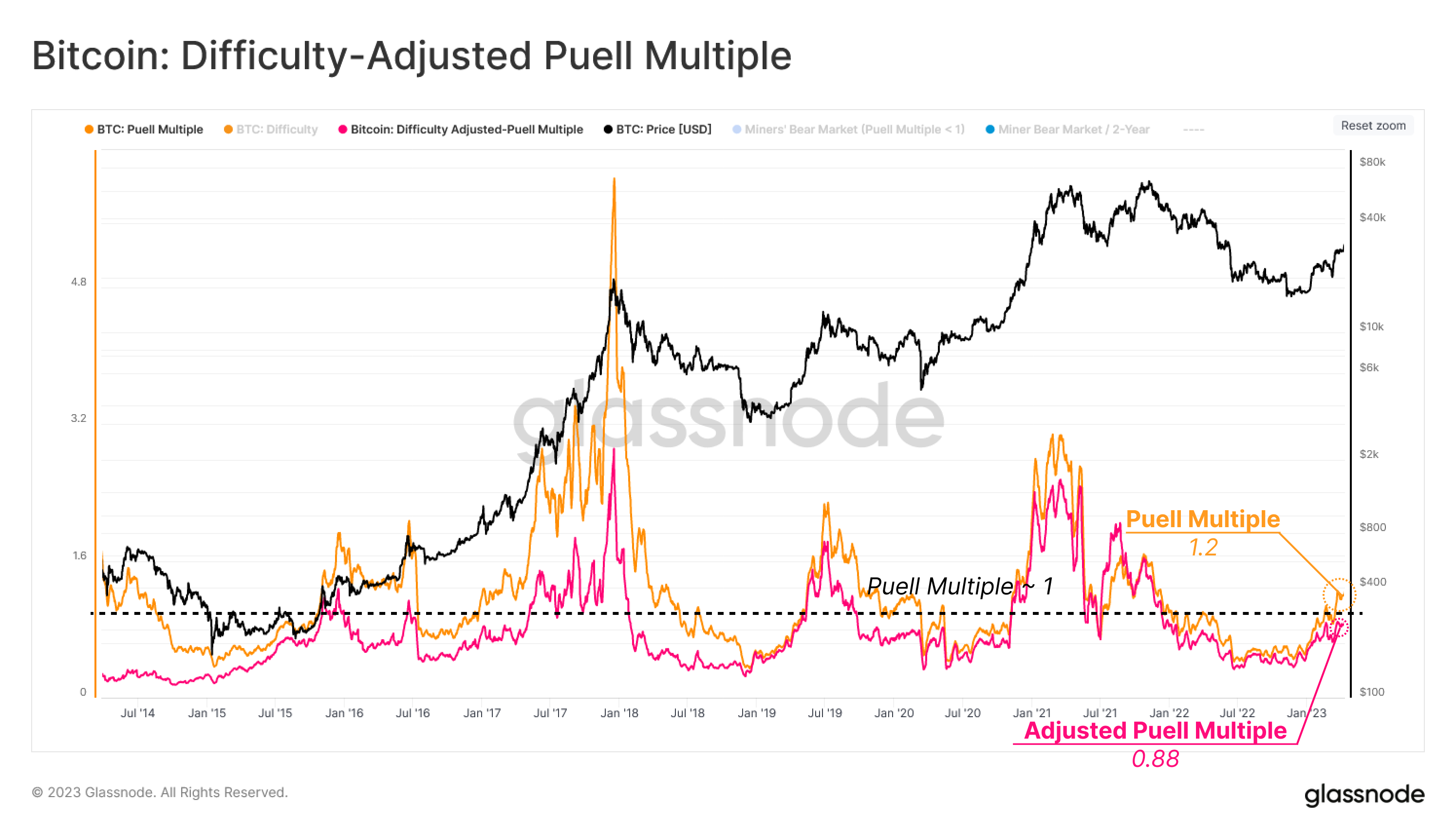

Here’s a chart that shows the development on this metric over the past a number of years:

The worth of the metric appears to have been under one not too long ago | Supply: Glassnode on Twitter

As proven within the above graph, the Bitcoin puell a number of crossed above the one mark earlier within the 12 months when the continuing rally within the asset’s worth began. At present, this indicator has a worth of 1.2, suggesting that miners as a complete are making notably greater than the yearly common.

The problem-adjusted model of the metric, nevertheless, remains to be under one and has been for the whole bear market, regardless of the worth observing a big surge not too long ago.

On the present stage of 0.88, miners are making 12% lower than the yearly common, implying that they could nonetheless be beneath some stress proper now, though not as extreme as through the bear market lows.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,400, up 9% within the final week.

Appears like BTC has sharply surged | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, Glassnode.com