Bitcoin mining profitability has plummeted by greater than 75% from the market peak, and is now at its lowest degree since October 2020.

Bitcoin Value Plummets Additional

Bitcoin’s value plummeted to a 52-week low of $20,800 on Wednesday, down from an all-time excessive of $68,788 by greater than 70%. Even if the worth has already returned above $21,000, vital market indications point out that bears nonetheless have a robust grip on the present market.

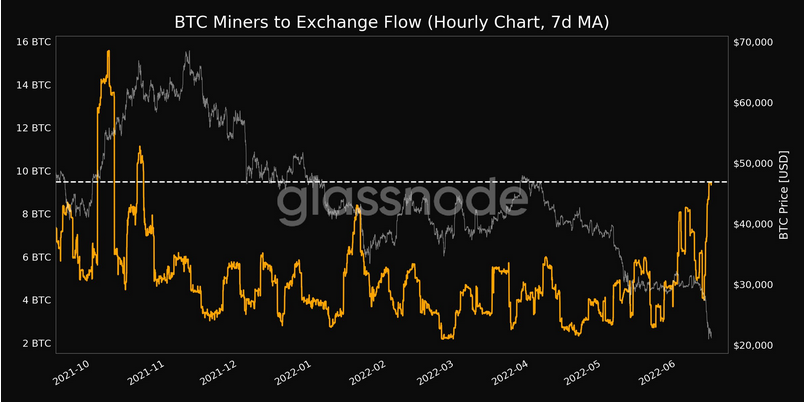

The Bitcoin Miners to Change Move, a metric that measures the quantity of BTC transferred from miners to crypto exchanges, hit a seven-month excessive of 9,476. The rise in alternate flows means that miners are promoting their BTC in anticipation of a price drop.

BTC miners'alternate movement. Supply: Glassnode.

Associated article | Exchange Inflows Ramp Up As Crypto Investors Clamor To Exit Market

Miners Actions Indicators Market Sentiment

BTC miners’ actions usually mirror broader market sentiment, as they usually promote BTC to keep away from shedding cash on their mining payouts. The massive drop in mining profitability explains the rise in Bitcoin miners promoting exercise.

Mining profitability has plummeted by greater than 75% since its peak, and Bitcoin’s hash value is at $0.0950/TH/day, the bottom since October 2020.

BTC/USD falls to a 52-week low. Supply: TradingView

The netflow of miners to exchanges has additionally improved. When the miner netflow is constructive, it signifies that extra cash are being transmitted to exchanges than to particular person wallets. One of these exercise signifies that miners are damaging on the worth and are feeling pressured to promote.

With the worth of BTC falling beneath $21,000, many BTC mining rigs have develop into unprofitable and could also be shut down if the worth doesn’t get better. As the entire market worth went beneath $1 trillion, the remainder of the crypto market adopted BTC’s value conduct.

BTC has gone via a lot of bull cycles within the final decade, every adopted by an 80%-90% drop from its peak. The BTC value, alternatively, has by no means gone beneath the earlier cycle’s all-time excessive. BTC is presently buying and selling at its 2017 excessive of $19,783, and any sell-off from right here may drive it again into 2017 territory.

Associated article | TA: Bitcoin Shows Signs of Recovery, $23K Presents Resistance

Featured picture from Getty Pictures, chart from TradingView.com