In keeping with the newest on-chain knowledge, Bitcoin miners refuse to dump their BTC holdings regardless of profitability being traditionally low.

BTC Transaction Charges At Lowest Degree Since 2012

In a brand new put up on X, blockchain analytics agency Alphractal revealed that Bitcoin miners are nonetheless holding on to their reserves regardless of the decline in income. The on-chain knowledge platform mentioned the explanations behind this pattern and its potential implications on the BTC mining trade.

Firstly, Alphractal highlighted low on-chain exercise on this cycle as one of many causes behind the numerous decline in miner revenues. On account of the lowered exercise, the overall transaction charges paid on the Bitcoin community have dropped to their lowest ranges since 2012.

The market intelligence platform additionally talked about that the mining problem has remained excessive regardless that the hash rate recently witnessed a drop. Usually, there’s a direct relationship or constructive correlation between the hashrate and mining problem. Nonetheless, in keeping with Alphractal, this latest lag or dissociation additional strains miner profitability and delays community equilibrium.

Moreover, Alphractal revealed on X that the Bitcoin hash price volatility has reached new all-time highs. This mainly implies that the community is witnessing the very best hash price fluctuations or modifications in its historical past.

The blockchain analytics agency added:

That is doubtless attributable to massive mining operations shutting down ASIC machines, probably as a result of falling revenues and low community demand.

Supply: @Alphractal on X

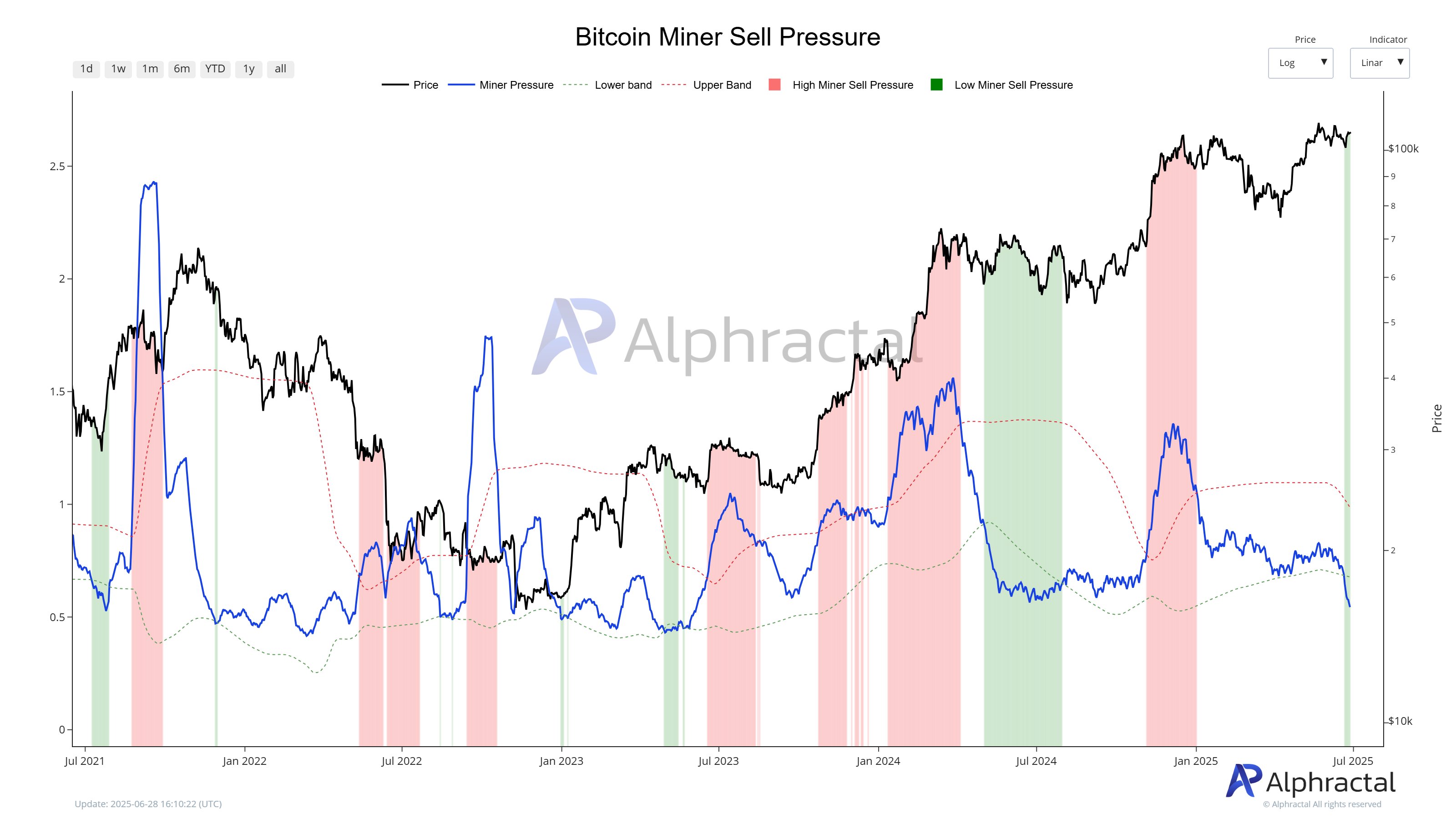

Regardless of the community revenues and the excessive mining problem, promoting stress from miners has remained at low ranges. As exhibited by the low Miner Promote Stress metric, this means that miners should not aggressively offloading their holdings for revenue.

Alphractal admitted that the low promoting stress from miners is a constructive signal, particularly for the worth of Bitcoin. The blockchain agency famous the potential for some mining swimming pools cutting down their operations in response to the decreased exercise on the Bitcoin community. “As BTC trades above $107K, we might merely be witnessing miners reallocating their hash energy to adapt to the present demand,” Alphractal added.

Usually, BTC miners are likely to sell their coins for profit during times of fast value will increase and excessive blockchain exercise. Nonetheless, Alphractal believes the present absence of each suggests a interval of adjustment reasonably than capitulation amongst the miners.

Bitcoin Worth At A Look

As of this writing, BTC is valued at round $107,375, persevering with its sideways motion with a mere 0.3% improve previously 24 hours.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.