On-chain knowledge reveals Bitcoin netflows have more and more turn out to be destructive because the crash, that means buyers have been shopping for the dip.

Bitcoin Netflows Changing into Extra Unfavourable Since The Crash

As identified by an analyst in a CryptoQuant post, BTC netflows have began to show extra destructive because the crash just a few days again.

The “all exchanges netflow” is an indicator that measures the web quantity of Bitcoin coming into or exiting wallets of all exchanges. The metric’s worth is solely calculated because the distinction between the inflows and the outflows.

When the worth of the indicator is constructive, it means there are at the moment extra inflows than the outflows. Such values indicate that buyers are transferring a web quantity of cash to exchanges, presumably for promoting functions.

Subsequently, constructive netflow values can show to be bearish for the value of Bitcoin as they result in a rise within the promoting provide of the coin.

However, constructive values indicate a web quantity of cash are being withdrawn from exchanges. As holders normally switch their BTC out of exchanges for hodling them, this development might be bullish for the crypto.

Associated Studying | Digging Into The Data Of Bitcoin Mining Decentralization

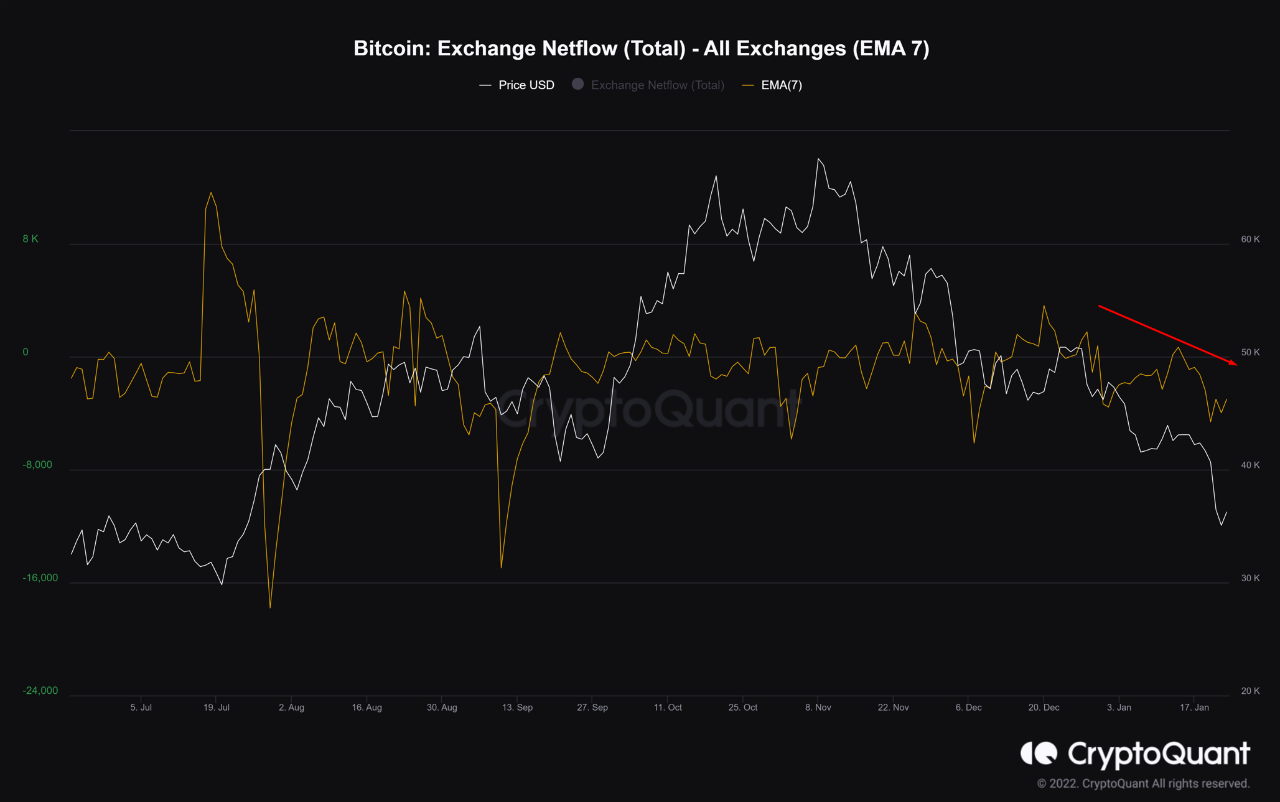

Now, here’s a chart that reveals the development within the Bitcoin netflows during the last six months:

Appears like the worth of the indicator has been taking place just lately | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin netflow has turn out to be more and more destructive over the previous couple of weeks as the value of the crypto has crashed down.

This reveals that buyers have been shopping for the “dip” as they’re transferring a web quantity of cash out of exchanges.

Associated Studying | NYC Mayor Will Keep His Promise And Convert First Paycheck To Bitcoin And Ethereum

As talked about earlier than, the availability on exchanges is commonly thought of the “promoting provide” of BTC. So, the development of it lowering over the previous couple of weeks could be bullish for the value in the long run.

BTC Worth

On the time of writing, Bitcoin’s price floats round $36.5k, down 12% within the final seven days. Over the previous month, the crypto has misplaced 28% in worth.

The under chart reveals the development within the worth of BTC during the last 5 days.

BTC's worth has plunged down over the previous week | Supply: BTCUSD on TradingView

Yesterday, the value of Bitcoin crashed all the way down to as little as $33k, earlier than recovering again above the $36k degree right this moment.

In the mean time, it’s unclear if the coin has bottomed or if extra draw back is coming. Nonetheless, if the netflows are something to go by, the mid to long run outlook should still be bullish.

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com