Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

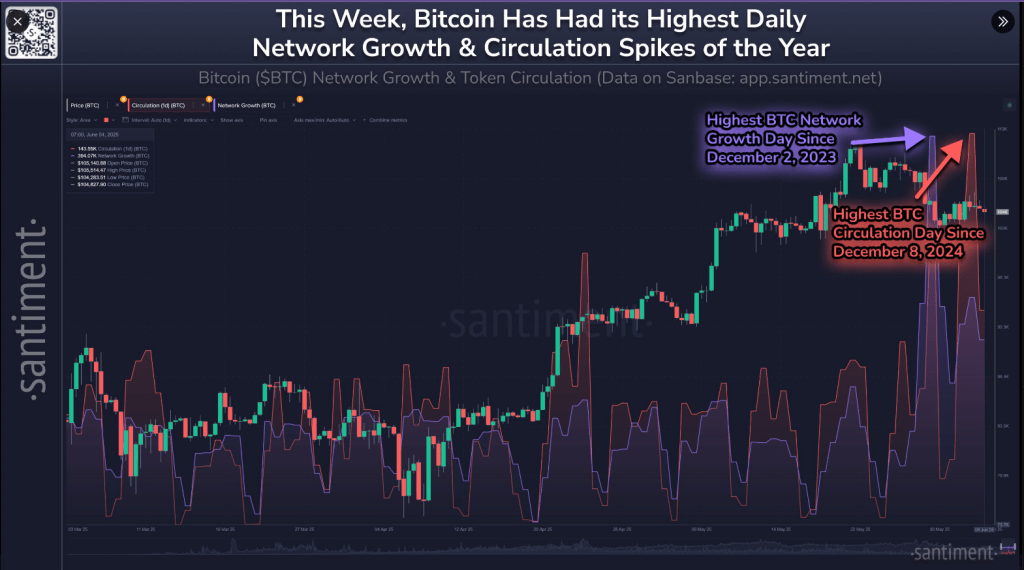

Bitcoin’s worth has barely moved within the final week, however different indicators level to rising exercise on the community. On June 5, Bitcoin traded round $104,300, down 0.50% in 24 hours and off 2.5% over the previous seven days. But knowledge exhibits extra persons are becoming a member of the community, and extra cash are being handed round.

Associated Studying

Pockets Creation Soar

In response to Santiment, on Might 29 practically 557,000 new wallets appeared. That was the best quantity since December 2023. It means 1000’s of persons are opening wallets despite the fact that worth has stayed just below $105,000.

Individuals usually open new wallets to ship and obtain bitcoins however they one way or the other come throughout the thought by way of new sources, elevated talks amongst pals or create easy curiosity. In any case, an elevated pockets holding certainly signifies a a lot wider utilization.

📊 Bitcoin’s on-chain exercise has seen sharp rises this week as its worth hovers slightly below $105K:

📈 Might twenty ninth: 556,830 new $BTC wallets created (Highest since December 2, 2023)

🔄 June 2nd: 241,360 cash circulated (Highest since December 8, 2024)

Progress in a community’s… pic.twitter.com/2DxknVXrKT

— Santiment (@santimentfeed) June 5, 2025

Elevated Token Motion

On June 2, over 241,360 BTC modified arms. This was deemed the busiest day since December 2024. Stories from Santiment counsel that prime coin turnover often coincides with elevated visitors.

Merchants could be transferring cash out and in of exchanges, or traders could possibly be shifting wallets. Large swings in each day token motion can level to a shift in sentiment—folks both on the point of purchase or promote.

Proper now, it principally appears to be like like extra customers are sending cash to one another, which retains the community busy even when worth sits nonetheless.

Large Holders Step In

Information from IntoTheBlock exhibits that giant holders—typically referred to as “whales”—are stocking up. Their coin inflows jumped by 145% over the past seven days, and by 214% over the previous 30 days.

When huge gamers load up, it may tighten provide on exchanges. That makes it harder for brand new patrons to get in with out driving worth greater. If whales preserve shopping for at this charge, it might result in extra upward stress on worth as soon as on a regular basis traders step in once more.

Associated Studying

Mid Tier Traders Purchase

It’s not simply the actually huge holders including cash. Wallets holding between 10 and 10,000 BTC added greater than 79,000 BTC in only one week. Which means these mid-tier holders picked up round 11,320 BTC per day on common.

As of June 2, they held over 13 million BTC in complete. When each huge whales and these mid-level holders preserve stacking, it additional cuts down the variety of cash floating on exchanges. Fewer cash accessible typically imply any shift in demand might transfer worth extra.

Featured picture from Imagen, chart from TradingView