On-chain knowledge means that dumping from 11-year outdated cash value $20 million could also be behind the current Bitcoin worth drop.

11-12 months Outdated Bitcoin Moved Shortly Earlier than The Drop beneath $40k

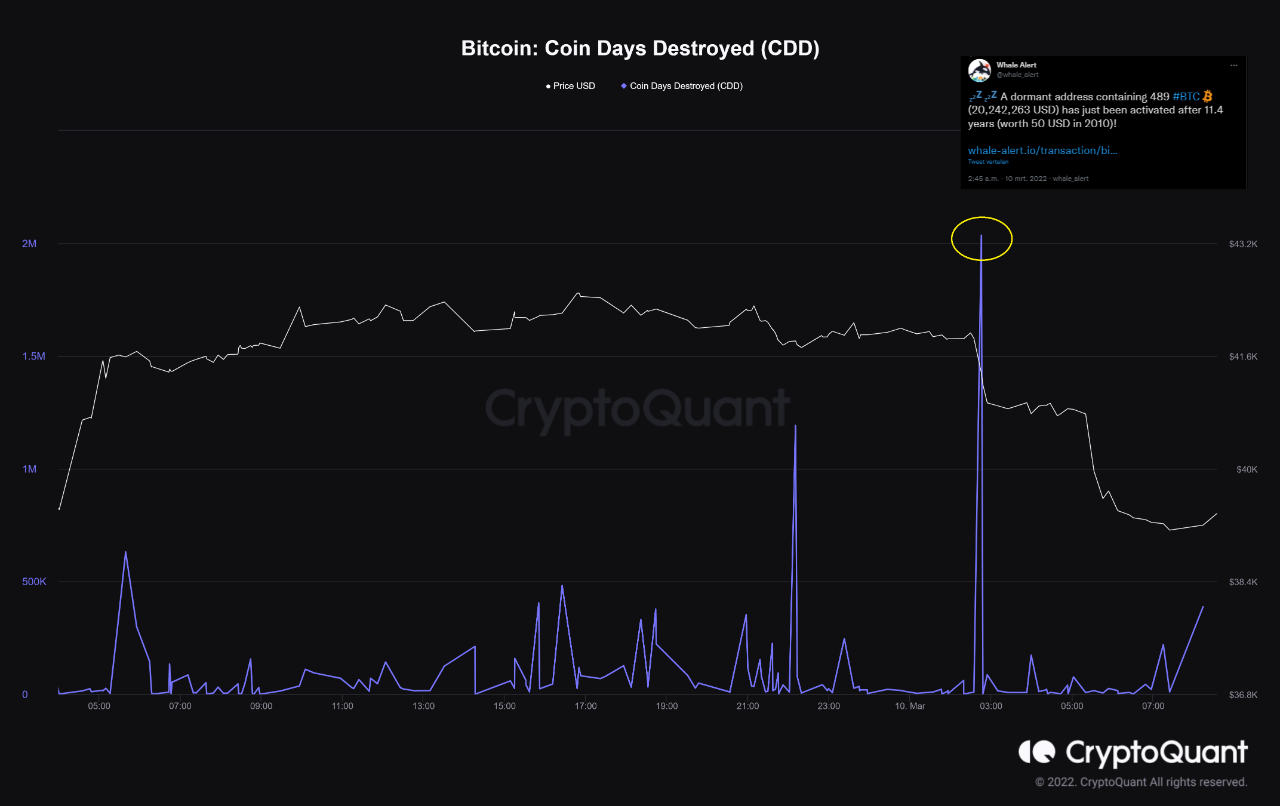

As identified by an analyst in a CryptoQuant post, a considerable amount of dormant cash since eleven years in the past appears to have moved a bit earlier than at the moment’s drop beneath the $40k degree.

The related indicator right here is the “coin days destroyed” (CDD) metric. “Coin days” are outlined because the variety of days {that a} Bitcoin stays unspent for.

When 1 BTC stays nonetheless for someday, it accumulates 1 coin day. Equally, 0.5 BTC would accumulate 1 coin day solely after it hasn’t moved for 2 days.

As soon as these cash are spent or transferred, the coin days are stated to be “destroyed” because the variety of them reset again to zero. The variety of such days destroyed is what the CDD indicator measures.

When the metric reveals a big spike in its worth, it means a considerable amount of dormant cash have simply been moved. This will point out dumping from long-term holders, a bearish signal for the value of Bitcoin.

Associated Studying | Data: Bitcoin Transaction Fees Registers Unusually Low Values For 7th Straight Month

Now, here’s a chart that reveals the development within the BTC CDD over the previous day:

The indicator's worth appears to have proven a big spike just lately | Supply: CryptoQuant

As you’ll be able to see within the above graph, the BTC CDD metric’s worth shot up just lately. In accordance with the quant, the spike is because of a motion of an 11-year outdated BTC stash with 489 cash, value solely $50 in 2010 when it went dormant, however at the moment values over $20 million.

Associated Studying | Binance’s Bitcoin Dominance Sharply Rises, Now Holds 22.6% Of Total Exchange Supply

This motion in these outdated cash appears to be like to have occurred shortly earlier than the decline within the worth of BTC earlier at the moment, making it appear logical that these cash being dumped could also be one of many components behind the drop,

BTC Worth

On the time of writing, Bitcoin’s price floats round $39k, down 10% within the final seven days. Over the previous month, the crypto has misplaced 11% in worth.

The beneath chart reveals the development within the worth of the coin during the last 5 days.

Seems to be like the value of BTC has plunged down over the previous twenty-four hours | Supply: BTCUSD on TradingView

After a number of days of sideways motion, Bitcoin lastly confirmed some sharp uptrend yesterday and broke above the $42k mark. Nevertheless it didn’t final for lengthy.

In the present day, the crypto has come again all the way down to the sub $40k ranges and it’s unclear in the intervening time when some actual restoration could also be seen due to the uncertainty brought on by the Russian invasion of Ukraine.

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com