Bitcoin’s worth motion remains to be above the $100,000 threshold and inside placing distance of its all-time excessive at $111,700, however its on-chain exercise tells a totally totally different story. In accordance with the most recent report from on-chain analytics agency Glassnode, although Bitcoin’s worth is pushing to new heights, underlying blockchain metrics have slipped into territories more commonly related to bear market phases.

Quiet Blockchain Exercise Regardless of Value Power

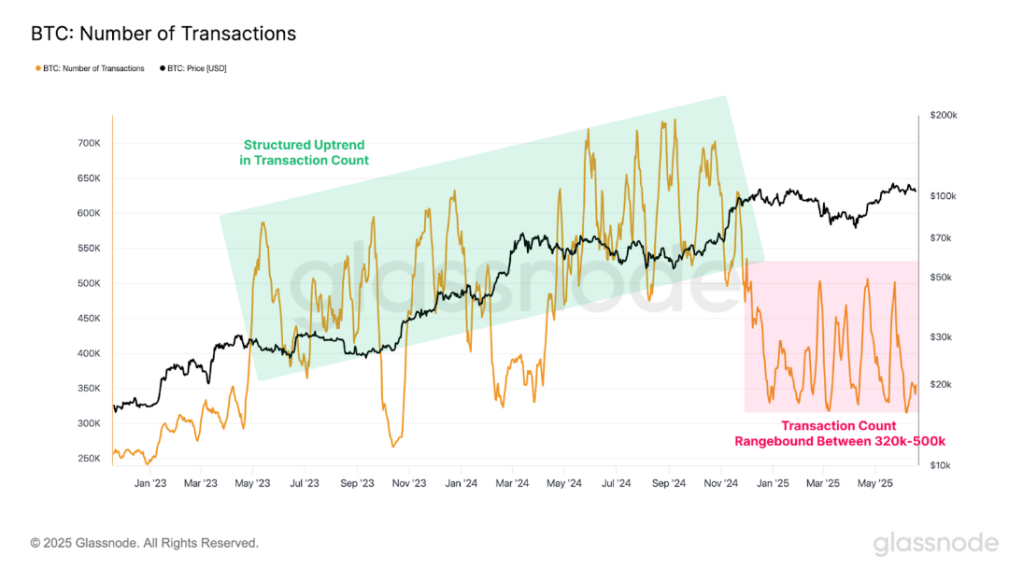

In accordance with a report looking at varied on-chain metrics from on-chain analytics firm Glassnode, Bitcoin has largely been highlighted by quiet blockchain exercise regardless of its present worth foray above $100,000. For instance, each day transactions have now dropped to a variety between 320,000 and 500,000, down from a peak of over 730,000 in 2024. It is a important lower in throughput for a network operating in a bullish price environment.

The slowdown in each day Bitcoin transactions is principally tied to a corresponding decline in non-monetary exercise reminiscent of Inscriptions and Runes, which had beforehand contributed to transaction spikes. The precise transfers of worth in financial transactions have been comparatively regular, however general, the drop in community utilization has created a noticeable divergence the place earlier rallies to all-time highs have been often accompanied by an increase in on-chain transactions.

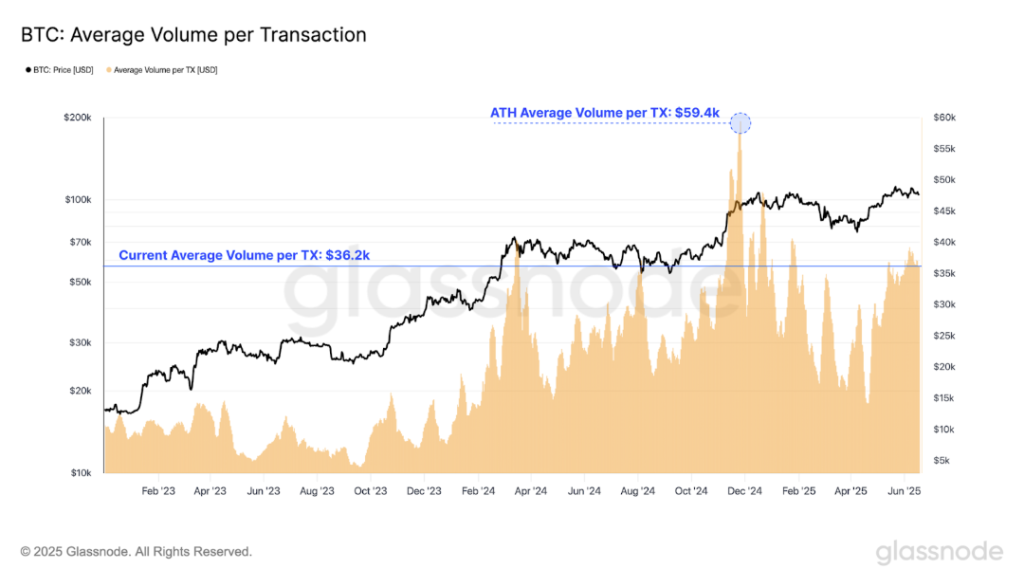

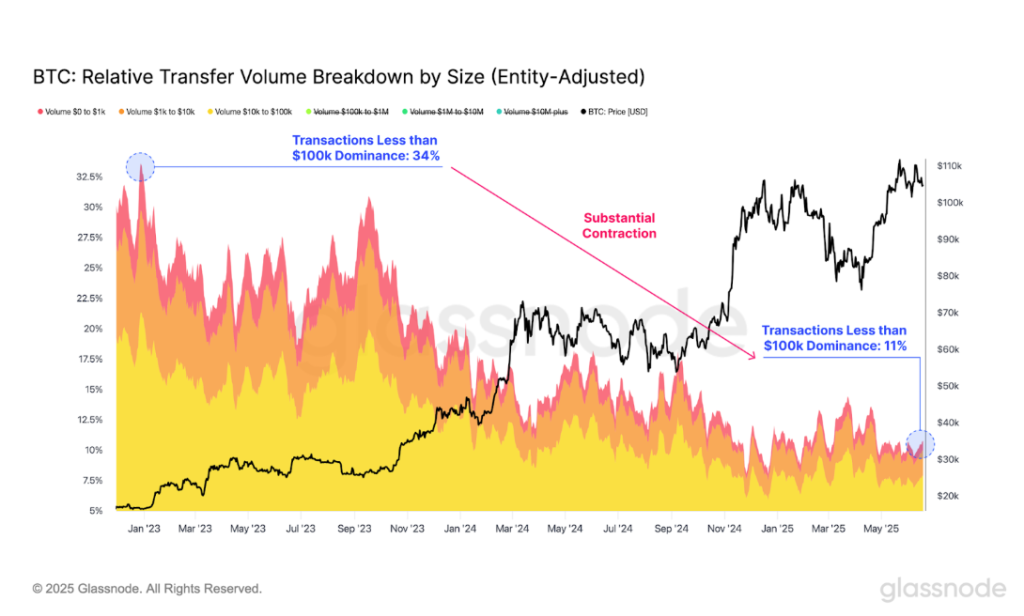

Though transaction counts are falling, the Bitcoin blockchain is settling huge amounts of transactions on-chain. The each day quantity common this cycle is round $7.5 billion and spiked as excessive as $16 billion through the preliminary rally above $100,000 in late 2024. Nevertheless, the character of those transactions has shifted from the fingers of retail merchants. The common quantity per transaction is simply above $36,000, which means that enormous institutional gamers and high-net-worth people at the moment are the first customers of the Bitcoin community.

Retail-size transactions (these below $100,000) have seen their relative share of the total volume go down massively. For instance, transactions within the $0 to $1,000 vary now symbolize lower than 1% of complete worth transferred, down from about 4% in the beginning of this cycle.

Payment Stress Drops Whereas Off-Chain Buying and selling Dominates

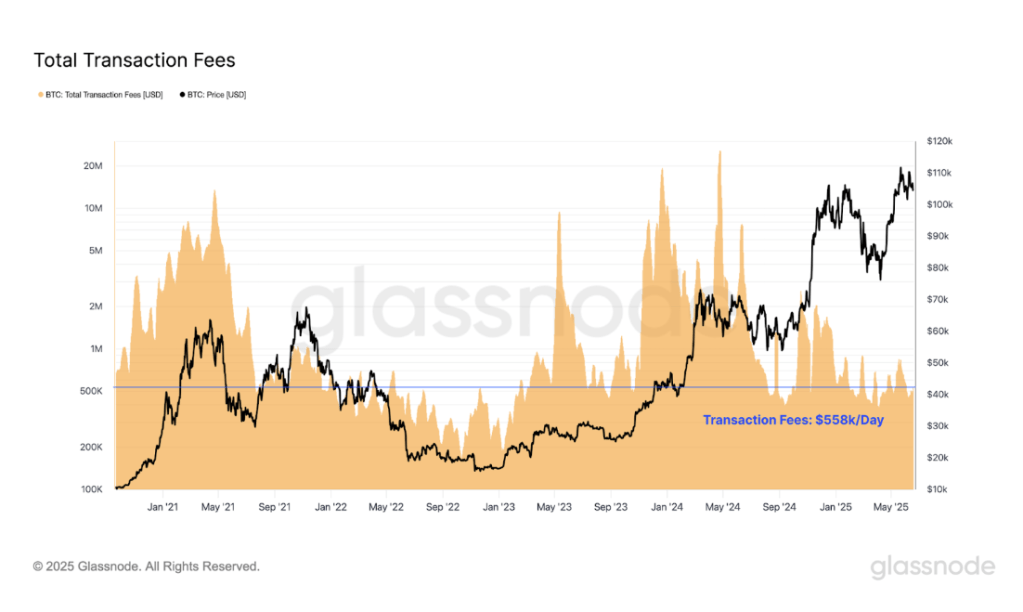

Glassnode’s report additionally highlights how subdued the charge setting has grow to be, even with Bitcoin buying and selling round all-time excessive costs. Common miner income from transaction charges has dropped to only $558,000 per day. Though the lower is partly resulting from technical enhancements like SegWit and transaction batching, the huge fall in miner income signifies a notable drop in block-space demand and the general discount within the variety of transactions.

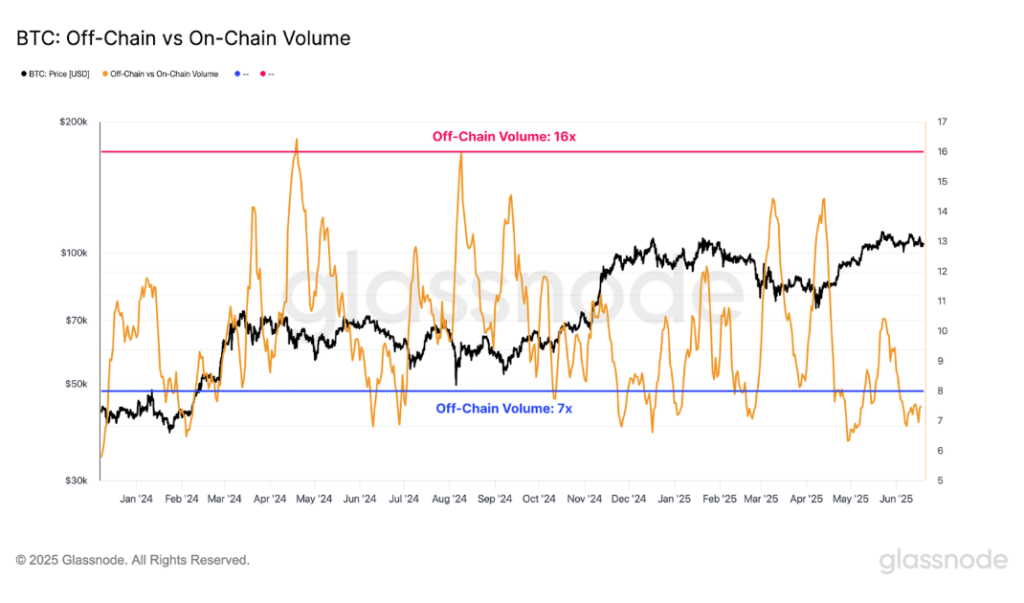

On the other hand, buying and selling exercise has shifted to off-chain venues, particularly centralized exchanges. Spot volumes typically exceed $10 billion per day, whereas futures markets dominate with common each day quantity round $57 billion and peaks surpassing $120 billion. Choices markets are additionally rising, now dealing with over $2.4 billion per day. Altogether, these off-chain platforms deal with 7 to 16 occasions extra quantity than what’s settled immediately on the Bitcoin blockchain.

In conclusion, the Glassnode report exhibits the altering dynamics of Bitcoin’s ecosystem and the way it’s slowly leaning more toward large institutions than retail merchants. On the time of writing, Bitcoin is buying and selling at $103,470, down by 2% up to now 24 hours.

Featured picture from Pexels, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.