The Bitcoin open curiosity has been a topic of debate over the previous week, with varied on-chain platforms revealing its current record-breaking surge. Nonetheless, funding analytics agency Alphractal disputed that the open curiosity in BTC had reached a brand new all-time excessive.

Curiously, a outstanding crypto analytics platform has put ahead new knowledge on the Bitcoin open curiosity, disclosing that this indicator certainly cast a file excessive over the previous week. Right here is its potential implication on the worth of BTC.

Are Bitcoin Merchants Taking Extra Danger?

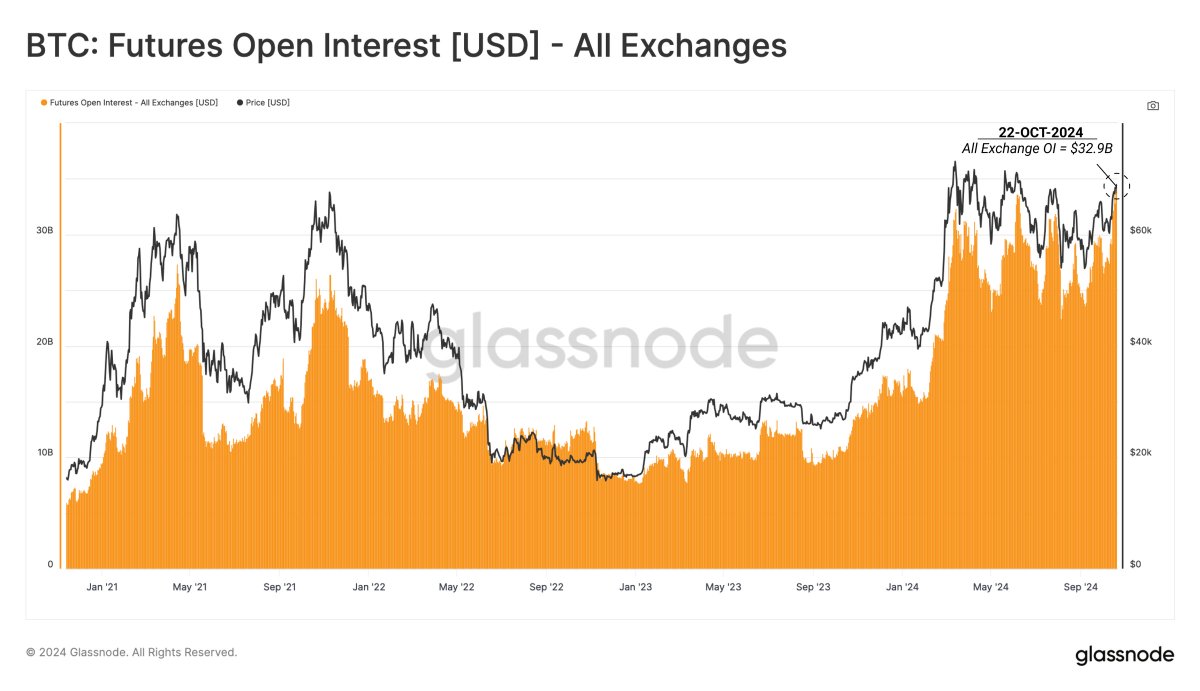

In a brand new publish on the X platform, Glassnode revealed that open curiosity in Bitcoin throughout all exchanges reached a brand new all-time excessive.

Glassnode wrote on X:

Open Curiosity throughout each perpetual and fixed-term futures contracts has recorded a brand new ATH of $32.9B this week, suggesting a marked enhance in mixture leverage getting into the system.

For context, open curiosity is an indicator that measures the whole quantity of futures or derivatives contracts of a specific cryptocurrency (BTC, on this state of affairs) out there at a given time. It usually provides perception into the quantity of funds being invested into Bitcoin futures for the time being. Rising open curiosity additionally suggests a shift in investor sentiment and a rise in market speculations, with many merchants gearing up for market motion.

Supply: Glassnode/X

With the Bitcoin open interest surging to a brand new all-time excessive of $32.9 billion prior to now week, it reveals that contemporary capital is flowing into essentially the most beneficial market within the cryptocurrency business. Though the metric doesn’t present data on whether or not these new futures positions are bearish or bullish, it does point out the probability of upper volatility out there.

As Glassnode highlighted on X, there’s a important enhance in mixture leverage getting into the Bitcoin derivatives market. From a historic standpoint, the market tends to witness important and spontaneous worth swings at any time when there may be heightened risk-taking conduct from merchants.

This market outlook units up an fascinating subsequent few weeks for the worth of Bitcoin, which has not significantly impressed within the month of October. After forming a strong bullish momentum within the earlier week, the premier cryptocurrency has did not capitalize prior to now few days.

BTC Value At A Look

As of this writing, the price of Bitcoin lies simply beneath the $67,000 stage, reflecting a 2.1% decline prior to now 24 hours. In the meantime, the premier cryptocurrency is down by about the identical determine on the weekly timeframe, in line with knowledge from CoinGecko.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView