Bitcoin outflows have proven a spike amounting to 30k BTC in the present day, resulting in a plunge within the all exchanges reserve.

Bitcoin Netflow Exhibits Deep Adverse Spike As 30k BTC Exits Exchanges

As identified by an analyst in a CryptoQuant post, the BTC alternate netflow confirmed a big adverse spike earlier in the present day.

The “outflow” is a measure of the entire quantity of Bitcoin exiting wallets of all exchanges. Equally, the variety of cash being deposited to exchanges is the “influx.”

The distinction between the influx and the outflow is named the netflow. This indicator tells us the online quantity of cash shifting into or out of exchanges.

When the worth of this indicator is adverse, it means outflows are presently overwhelming the inflows and a web quantity of Bitcoin is exiting exchanges. Such a development, when extended, may be bullish for the worth of the crypto as it could be an indication of accumulation.

Associated Studying | USDC Inflow Spikes Up, Will It Act As Dry Powder For New Bitcoin Rally?

Then again, a constructive netflow exhibits {that a} web quantity of cash are coming into alternate wallets in the mean time. Since buyers normally deposit to exchanges for promoting functions, this development may be bearish for the coin.

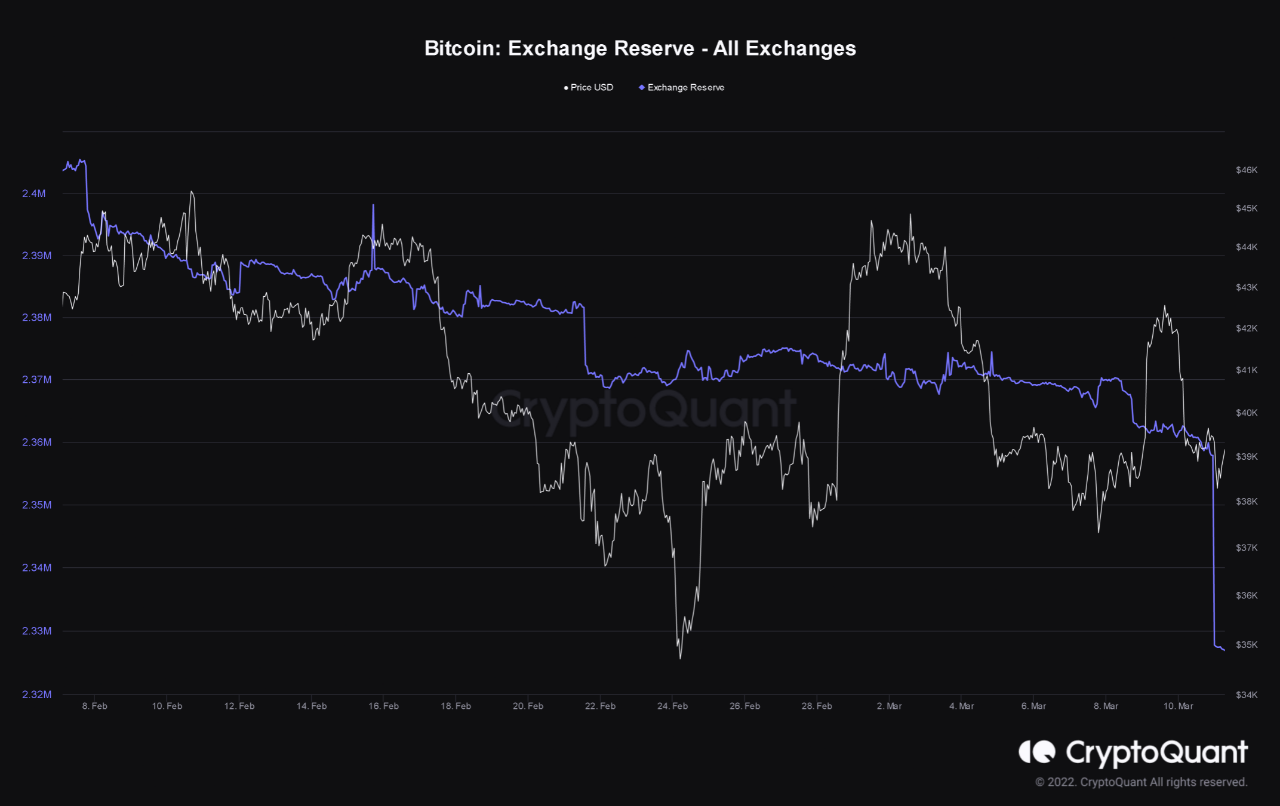

Now, here’s a chart that exhibits the development within the Bitcoin netflow over the previous couple of weeks:

Seems to be just like the indicator confirmed a big downward spike just lately | Supply: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin netflow had an enormous adverse spike earlier in the present day. This amounted to an outflow of greater than 30k BTC, or over $1.2 billion.

Such a lot of cash exiting exchanges has made the exchange reserve (a metric that measures the entire variety of BTC current on exchanges) plunge down:

The indicator's worth appears to have plummeted in the present day | Supply: CryptoQuant

If this outflow belongs to a number of whale entities withdrawing their Bitcoin for hodling in chilly wallets, then it may be fairly bullish for the worth of the crypto because it has considerably decreased its promote provide (that’s, the reserve).

Associated Studying | Bitcoin On Course To Hit $100K Nine Months From Now, Bitbull CEO Predicts

Nonetheless, because the quant notes, it’s but unclear in the mean time what this adverse netflow could signify. It’s potential it might be simply an inner switch throughout the alternate wallets. And if that’s the case, it shouldn’t have any constructive impact on the worth.

BTC Value

On the time of writing, Bitcoin’s price floats round $40k, down 3% within the final seven days. Over the previous month, the crypto has misplaced 6% in worth.

The under chart exhibits the development within the value of the coin during the last 5 days.

BTC's value plunged down yesterday | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com