In a current statement through X (previously Twitter), Alex Thorn, head of agency huge analysis at digital asset agency Galaxy, highlighted the potential for an additional Bitcoin gamma squeeze much like the one witnessed final week. BTC gained 15% final week. He remarked, “The Bitcoin gamma squeeze from final week might occur once more. If BTCUSD strikes larger to $35,750-36k, choices sellers might want to purchase $20m in spot BTC for each 1% upside transfer, which might trigger explosiveness if we start to maneuver up in the direction of these ranges.”

Elaborating on the mechanics, Thorn defined the conduct of sellers in relation to gamma and delta. “When sellers are quick gamma and worth strikes up, or when they’re lengthy gamma and worth strikes down, they should purchase spot to remain delta impartial. Final week’s expiries will dampen potential explosiveness, but it surely’s nonetheless in play.” This basically implies that the actions of choices sellers, pushed by the necessity to keep a impartial place, can amplify worth actions.

Will Bitcoin Value Rally Like Final Week?

Thorn additionally emphasised the significance of on-chain information in understanding these dynamics. He talked about a continued divergence between the availability held by long-term holders and the availability that has moved in lower than 24 hours. This divergence, which has been rising over the previous 12 months, signifies a decline in on-chain liquidity, suggesting that long-term holders should not promoting their holdings, doubtlessly resulting in a provide squeeze.

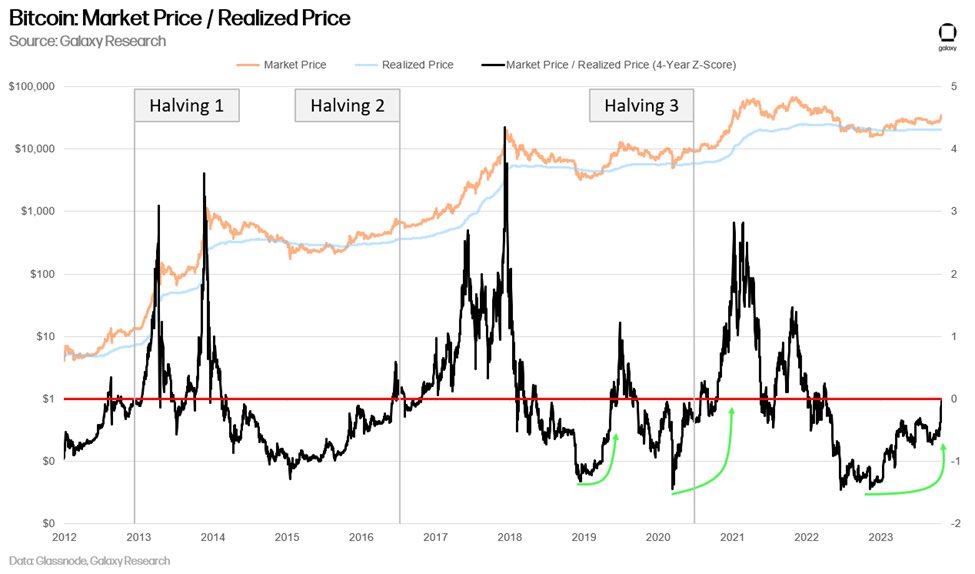

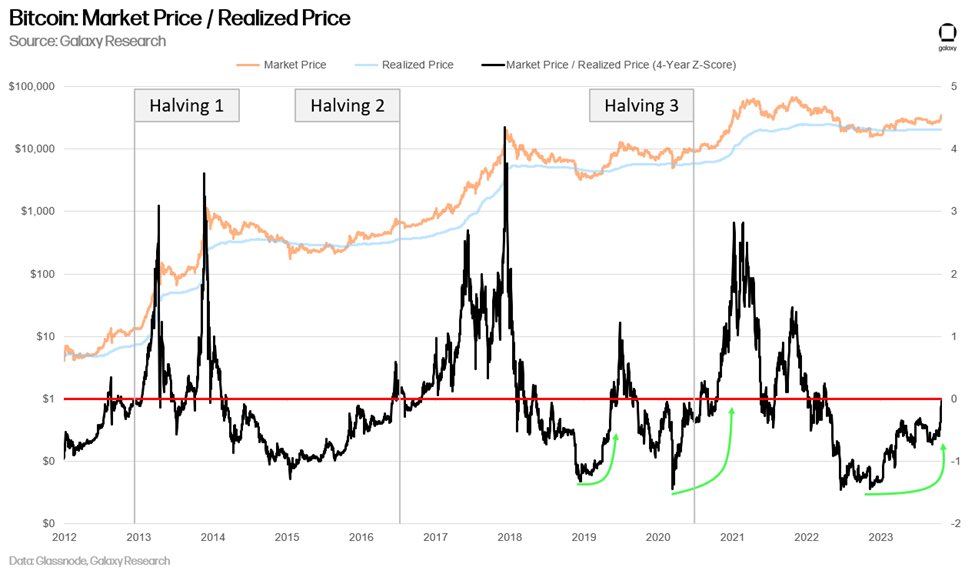

Moreover, Thorn pointed to the 4-year rolling Z-score of the ratio of market worth to realized worth, a variation of the MVRV ratio. This metric supplies insights into Bitcoin’s valuation relative to its historic common. A excessive constructive Z-score signifies potential overvaluation, whereas a detrimental Z-score may counsel undervaluation. Thorn’s remark that the sample is starting to resemble these seen earlier than earlier bull runs is especially noteworthy.

One other essential remark made by Thorn pertains to the compression of relative price bases. He famous a tightening sample that has traditionally been noticed throughout bear or accumulation intervals that precede bull markets. This compression suggests that there’s a consensus amongst various kinds of holders concerning the worth of Bitcoin.

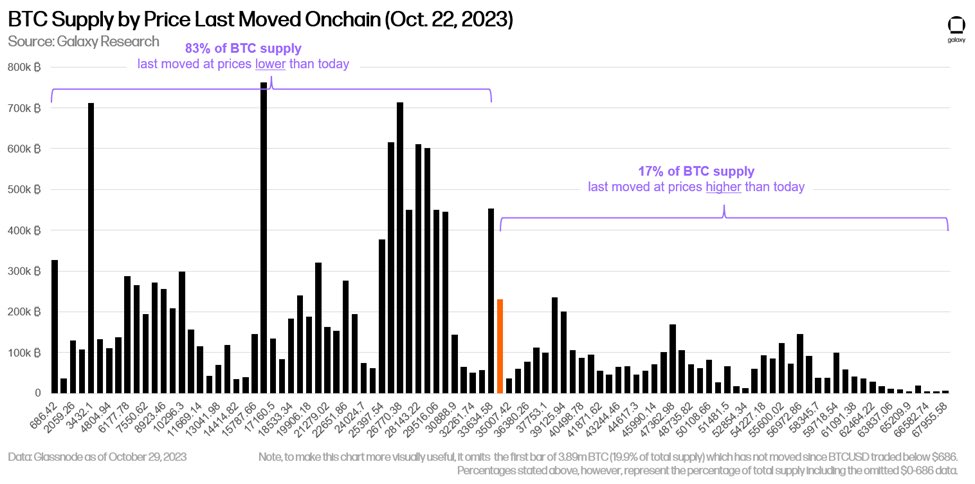

Thorn’s evaluation of the Bitcoin provide by the worth at which every coin final moved is especially illuminating. He noticed a sparse price foundation between the present worth of $34,591 and the $38,400-39,100 vary. Furthermore, with 83% of the availability not having moved since costs had been decrease than at this time and almost 70% of the availability stagnant for over a 12 months, it’s evident that long-term holders are in revenue and are doubtless ready for even larger costs earlier than promoting.

Final week, as reported by NewsBTC, Thorn had precisely predicted a gamma squeeze. He had emphasised the numerous function the choices market performed in influencing Bitcoin’s worth trajectory. Thorn warned, “We’re approaching max ache for gamma shorts.”

In abstract, whereas Thorn doesn’t make a direct prediction about Bitcoin’s near-term worth, his evaluation on X supplies a complete overview of the present market dynamics. The mix of potential gamma squeezes, declining on-chain liquidity, and historic patterns all level in the direction of a good surroundings for Bitcoin bulls.

At press time, BTC traded at $34,249.

Featured picture from Shutterstock, chart from TradingView.com