Bitcoin has been capable of make a resurgence in latest weeks. The 25,000 USD barrier was recaptured by Bitcoin costs simply two days in the past, marking the primary time since June thirteenth.

Bitcoin Poised For New Rally

In June, Bitcoin had its largest month-to-month decline since 2011, falling over 37.3% to a remaining worth of $19,925. Since then, it has partially recovered its worth and as we speak noticed its first check of $25,000.

Bitcoin continues to rule the charts regardless of being down 46.5% from its earlier excessive, however its dominance has decreased to slightly below 40% versus greater than 50% just a few months in the past.

BTC/USD trades barely beneath $24k. Supply: TradingView

Nonetheless, Bitcoin has been comparatively peacefully fluctuating horizontally over the previous two weeks between $22,500 and $24,500. On the similar time, latest weeks have seen a major restoration in each commodities costs and inventory markets. Consequently, the general monetary markets are experiencing the anticipated summer season rally.

Since perspective had reached a extreme panic state in the midst of June because of the monetary markets’ steep, month-long decline, notion amongst contributors has drastically improved in the course of the course of the latest rebound. This in and of itself is a widely known bear market sample. Nonetheless, it gained’t be identified whether or not and the way the bears will return till round mid-September.

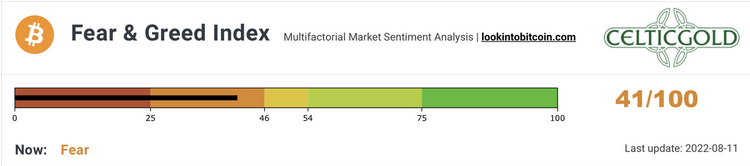

Over the earlier 4 weeks, the Crypto Concern & Greed Index has made exceptional progress. The sentiment continues to be largely scared, although. Concern nonetheless permeates the cryptocurrency business seven months after the devastating sell-off.

Crypto Concern & Greed Index, as of August eleventh, 2022. Supply: Lookintobitcoin

The sensation of being defeated permeates the broader image as effectively. There are a number of wonderful contrarian alternatives on this setting.

Total, there’s nonetheless a contrarian purchase sign as a result of scared mindset.

Sharp declines within the monetary markets can be extraordinarily detrimental to retain the present administration in workplace given the midterm elections on November eighth within the US. Consequently, solely a slight decline within the monetary markets in September can be extra probably. The markets might then rise from these lows till the American election.

Since November 2021, the fairness and cryptocurrency markets have been below intense strain for months, however a broad rebound has now been occurring for little over 4 weeks. The Nasdaq Composite, which is closely weighted towards expertise, has elevated by over 20% from its low on June sixteenth because of this process, including over $420 billion to its market worth. This is able to suggest that the bear market is formally over.

Associated Studying: Bitcoin Price Trades A Little Over $24,000, Can It Target $27,000?

Featured picture from Getty Pictures, chart from TradingView, and Lookintobitcoin