Key Notes

- Bitcoin consolidates above $115,000 on Saturday, September 20, erasing weekly timeframe losses as BlackRock’s IBIT ETF absorbs $3,1 billion in 10-day inflows.

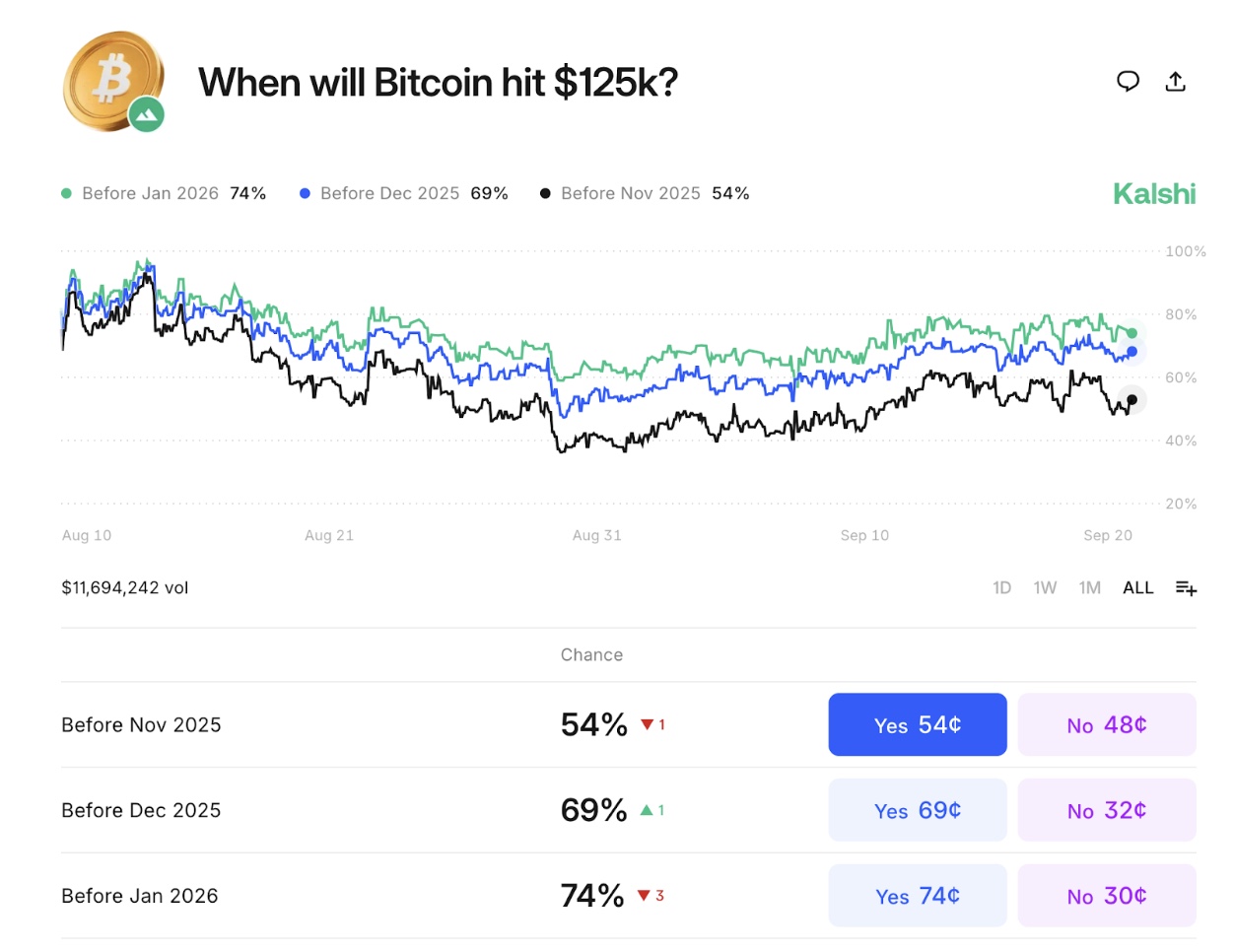

- Kalshi bettors value a 69% probability of BTC hitting $125,000 in November 2025.

- $3,1 billion inflows spotlight BlackRock’s sustained demand for BTC amid Fed-driven market turbulence.

Bitcoin (BTC) value consolidated close to $115,000 on Saturday, Sept. 20, erasing losses from Fed-induced turbulence through the previous week. BlackRock’s IBIT ETF absorbed $246 million on Friday, the one US-listed ETF to file optimistic flows.

-

Blackrock’s Bitcoin ETF recorded $3.1 billion in inflows within the final 10 days | Supply: FarsideUK

FarsideUK data exhibits that, excluding Thursday’s stalemate, BlackRock’s IBIT ETF has now averted detrimental flows since September 5, accumulating $3.1 billion during the last 10 days of buying and selling. BlackRock’s optimistic outlook on BTC additionally reverberates throughout crypto prediction markets.

-

Kalshi bettors predict a 69% probability of Bitcoin value reaching $125,000 in 2025. | Supply: Kalshi.com

When Will Bitcoin Hit $125K

Actual-time knowledge from Kalshi exhibits 69% of bettors anticipate BTC to hit $125,000 by November 2025, a one p.c enhance up to now 24 hours, with over $11.9 million wagered.

Throughout market consolidation, strategic new entrants usually look to prediction markets for clues on the subsequent directional value transfer. This uptick in BTC all-time excessive bets on Kalshi may encourage contemporary capital inflows because the turbulence from the US Fed’s current financial coverage tweaks subside.

Bitcoin Worth Forecast: $125K Breakout In-Play if Golden Cross Holds at $114K

Regardless of elevated volatility after the Fed price minimize on Wednesday, Bitcoin maintains crucial resilience indicators. The day by day chart exhibits BTC buying and selling above a Golden cross at $114,395, the place the 7-day shifting common has cleared the 50-day shifting common.

The present MACD readings are additionally optimistic. The MACD line at 915 stays above the sign line at 492, whereas the histogram bars stay in optimistic territory.

-

Bitcoin (BTC) Technical Worth Evaluation For September 20, 2025 | Supply: TradingView

With the Golden cross nonetheless in play, bears nonetheless want a decisive shut beneath $114,000 to determine dominance.

On the upside, fast resistance lies on the 7-day SMA close to $116,000, adopted by the important thing psychological goal of $120,000. A confirmed break above $120,000, backed by ETF inflows, may propel BTC instantly towards $125,000, aligning with Kalshi bettors’ expectations.

In abstract, ETF demand mixed with the energetic golden cross on the BTCUSD 24-hour chart strengthens the likelihood of BTC value extending positive aspects towards a brand new all-time excessive within the coming weeks.

Greatest Pockets Presale Positive factors Momentum Alongside Bitcoin’s ETF Rally

Bitcoin’s ETF-driven resilience over the previous week has additionally fueled optimism round early-stage initiatives like Greatest Pockets (BEST). Past multi-chain crypto storage, Greatest Pockets affords institutional-grade safety that appeals to buyers in search of diversification past large-cap cash.

-

Greatest Pockets Presale

- At press time, Greatest Pockets’s presale has raised over $15.9 million, reflecting demand from merchants positioning for potential upside outdoors BTC. With simply over 4 hours till the subsequent presale tier, contributors can nonetheless purchase BEST tokens at $0.0256 every through the official website.

As Bitcoin consolidates above $115K and ETF flows maintain bullish sentiment, initiatives like Greatest Pockets seize spillover demand from merchants in search of increased upside alternatives in rising markets.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.