Key Notes

- Lawmakers face midnight deadline on $1.7 trillion spending invoice with prediction markets exhibiting 87% shutdown chance.

- Bitcoin brief merchants deployed $1.4 billion in leverage at $115k as markets brace for potential US authorities funding disaster.

- BTC trades in rising wedge sample close to $113,871 with vital resistance at $115k figuring out subsequent directional transfer.

US VP J.D Vance hints at first US Authorities Shutdown in 7 years at an Oval workplace press-briefing on Sept. 30, sparking contemporary danger indicators throughout world markets.

According to Reuters, the lawmakers stay deadlocked on a $1.7 trillion “discretionary” spending for key company operations.

The shutdown might lower off US authorities funding to key federal initiatives beginning on Oct. 1, if Republican Occasion and Democrats lawmakers fail to succeed in a well timed settlement on the spending invoice, or an extension earlier than midnight. That is anticipated to have appreciable financial impression, with vital bureaucratic companies positioned on maintain as authorities places of work shut down, whereas non-essential employees could endure redundancy.

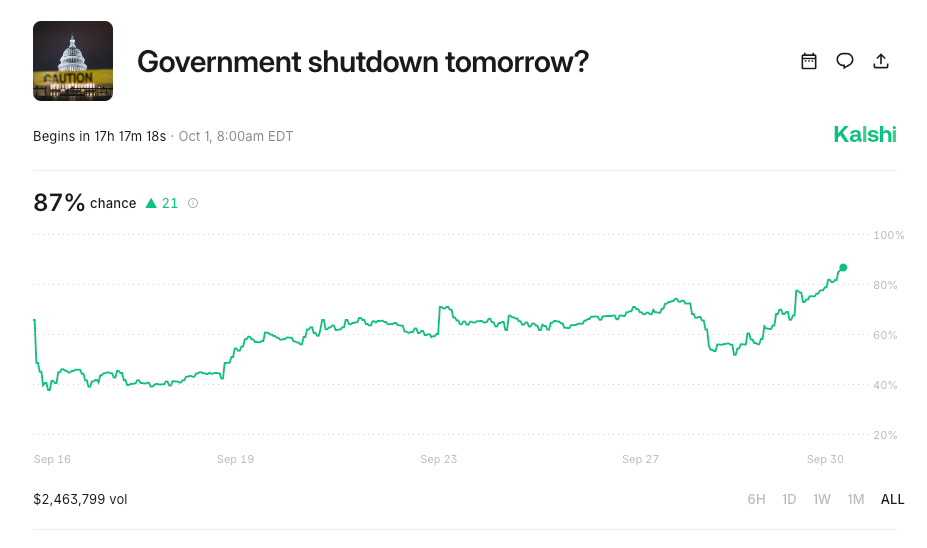

Prediction markets present 87% Likelihood of US Authorities Shutdown | Supply: Kalshi, Sept 30

Real-time data from predictions market platform Kalshi exhibits 87% expectations of a shutdown, with complete wager approaching $2.5 million as of this report.

Immediate impression was seen in key markets with Gold (XAU) value shifting up 0.6% to $3,843 and the tech-heavy S&P 500 rising 0.1%. In the meantime with the Dow Jones Industrial Common (DJI) down 0.022% reflecting energetic capital rotations as buyers react.

President Donald Trump has threatened irreversible job cuts for federal employees according to BBC News, amplifying uncertainty throughout key markets. Whereas Bitcoin

BTC

$114 415

24h volatility:

0.1%

Market cap:

$2.28 T

Vol. 24h:

$57.43 B

value consolidates close to weekly-time body peaks round $114,000, publicity to the US monetary markets might see merchants preserve a cautious stance.

How Will Bitcoin Value React to the US Authorities Shut Down?

Earlier than rebounding to $114,200 on Sept. 30, Bitcoin value initially retraced below $113,500 with bears promptly deploying $1.4 billion as markets braced for impression of the approaching US authorities shutdown talks.

BTC has usually rallied on safe-haven bets in periods of testy political disaster. Nonetheless Bitcoin’s risky value motion and derivatives buying and selling metrics seen on Sept. 30 indicators bearish expectations from cross-exposure to US markets.

For the reason that final Authorities shutdown on Dec. 22, 2018, cryptocurrencies have grow to be more and more entangled with US monetary markets and political panorama.

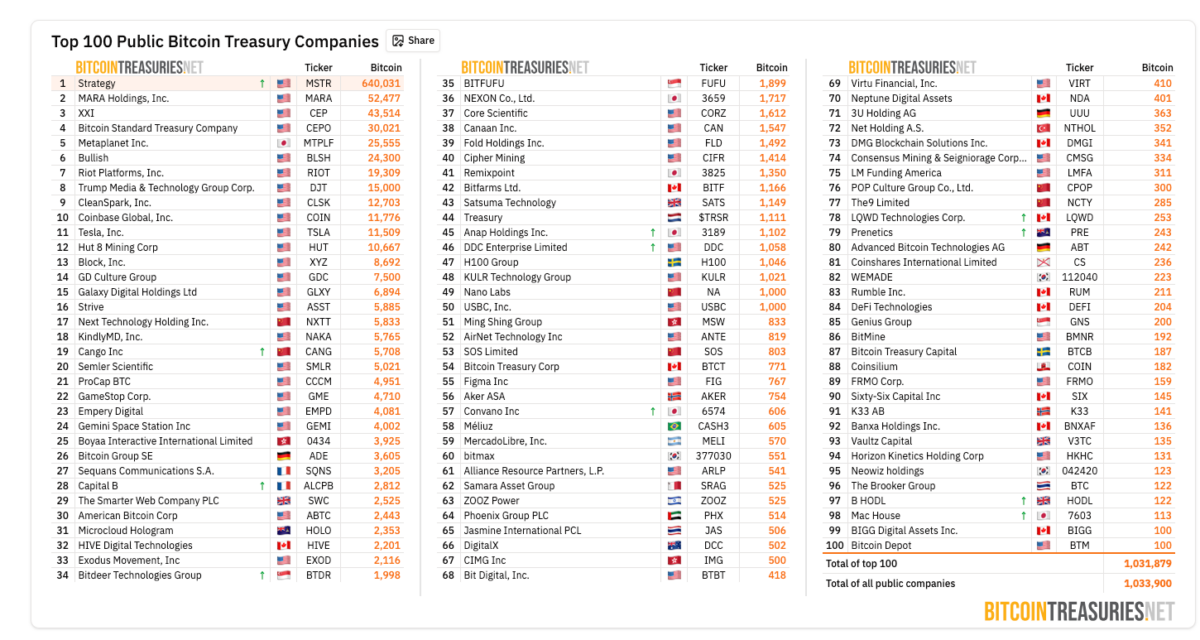

High 100 Publicly US-listed Companies Holding Bitcoin, as of Sept. 30, 2025 | Supply: BitcoinTreasuries

Crypto-native corporations like Coinbase and Robinhood have been included within the S&P 500 boosted by a optimistic shift in US crypto laws below the present Trump regime that took over in January 2025.

Extra so, BitcoinTreasuries lists over 100 public companies within the US carrying a cumulative 1,031,879 BTC on the steadiness sheet, together with world largest asset supervisor Blackrock which at present holds almost $100 billion throughout its energetic ETF choices for BTC and ETH.

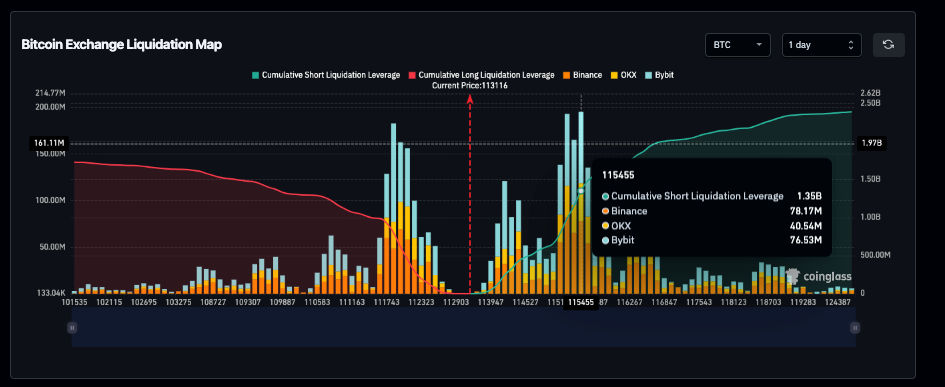

Bitcoin brief merchants deploy $1.4 billion of $2.4 billion complete leverage at $115.3k | Supply: Coinglass

Coinglass liquidation map data captures the BTC brief merchants’ response to the US authorities shutdown studies. As depicted beneath, energetic BTC SHORT positions rose to $2.4 billion with longs restricted to $1.73 billion during the last 24 hours, reflecting dominant bearish expectations.

A more in-depth take a look at the chart exhibits the BTC brief merchants clustered $1.4 billion in leverage across the $115,000 value stage, accounting for 58% of the whole energetic positions.

Because the US Authorities shutdown stays unconfirmed, the looming brief leverage cluster at $115,000 might restrict Bitcoin rebound prospects as merchants weigh their choices.

Bitcoin Value Forecast: Will BTC Reclaim $115K or Succumb to Correction Alerts Forward?

Bitcoin value trades inside a rising wedge formation on the weekly chart, a construction usually previous sharp directional strikes. At present ranges close to $113,871, BTC is urgent the mid-range, with bulls and bears evenly matched.

On the upside, rising Value-to-Quantity ratio (PVT) ranges round 725,550 BTC assist an optimistic Bitcoin value outlook, suggesting long-term capital inflows nonetheless stay intact. If shutdown fears gasoline safe-haven demand as seen in Gold getting into overbought territories, Bitcoin bulls might capitalize to set off a breakout above the Rising wedge’s higher boundary close to $120,000.

Bitcoin (BTC) Technical Value Evaluation | Supply: TradingView

Conversely, the MACD line at 4,861 trending beneath the sign at 5,859 indicators fading momentum, whereas histogram weak point displays constructing draw back strain. A breakdown beneath wedge assist at $105,000 would verify bearish divergence, probably accelerating losses towards $95,000.

With the most important leverage cluster at present at $115,000, this stage stays vital to Bitcoin’s subsequent transfer. A rejection there might verify bearish dominance, whereas a decisive shut above it within the coming days, could set off a brief overlaying frenzy, probably driving BTC value to $120,000.

Greatest Pockets Presale Nears $16.2M With BTC Value Caught in Limbo

With Bitcoin merchants weighing headwinds from the approaching US authorities shutdown, buyers are turning to early-stage initiatives like Greatest Pockets (BEST), for upside momentum.

Greatest Pockets (BEST) is a multi-chain storage resolution constructed with institutional-grade safety to disrupt the $11 billion non-custodial pockets sector.

Greatest Pockets (BEST) Presale

At press time, the Greatest Pockets presale has surpassed $16.1 million raised. With lower than 24 hours till the following value tier, buyers can nonetheless purchase tokens at $0.0257 by way of the Best Wallet website, to unlock early-entrant advantages forward of its official launch.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.