Bitcoin worth has been shifting decrease throughout the slender vary between $29,000 and $30,000 since final week, with analysts beginning to acclimatize to declines stretching to $28,000.

Probably the most distinguished crypto’s commendable stability will be attributed to low volatility, decoupling from the inventory market which suggests restricted response to financial elements like Thursday’s Client Worth Index (CPI).

Bitcoin Worth Secure However Prepared To Transfer

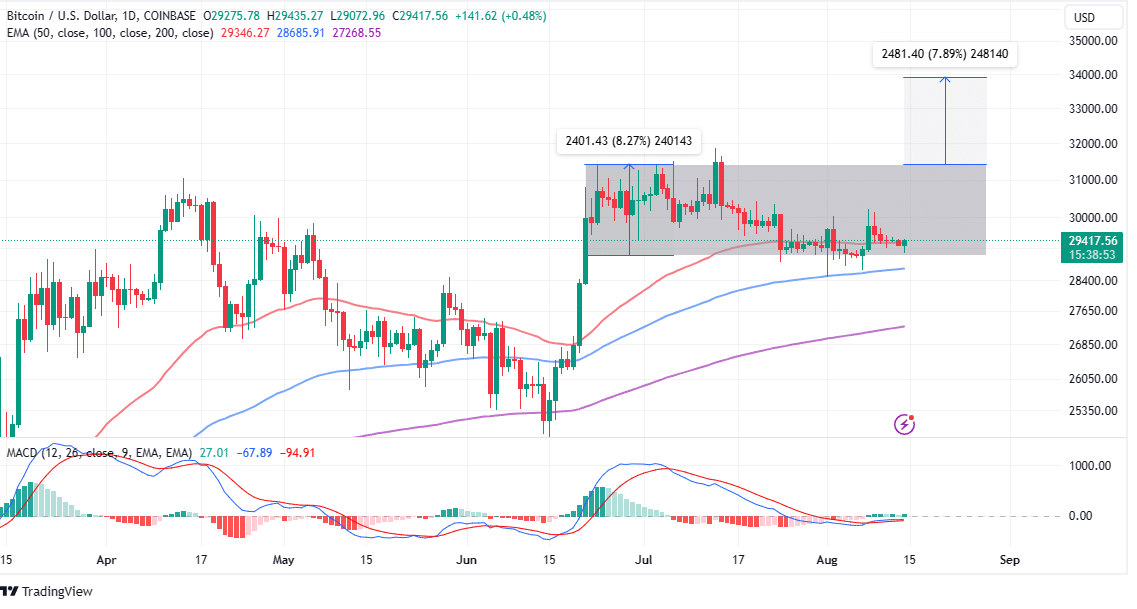

Bitcoin price is buying and selling at $29,404 after testing and rebounding from help at $29,000. After efficiently coping with resistance on the 50-day Exponential Transferring Common (EMA), the trail with the least resistance appears to be to the upside, bringing the psychological vendor congestion at $30,000 inside attain.

Regardless of the flat motion of the Transferring Common Convergence Divergence (MACD), a purchase sign is extremely probably. Merchants looking for new publicity to lengthy positions in BTC must be looking for the MACD line in blue crossing above the sign line in pink.

A bullish rectangle, as noticed on the chart implies that Bitcoin price is in the process of breaking out to higher levels.

The bullish rectangle sample signifies a powerful uptrend that pauses earlier than resuming its upward motion. It varieties when the value strikes sideways between two parallel horizontal traces, making a box-like form.

Merchants can capitalize on this sample by shopping for when the value breaks above the higher line, indicating a continuation of the bullish development.

Notice that, merchants use the peak of the rectangle to estimate the goal worth after the breakout. On this case, purchase when Bitcoin has damaged above $resistance at $31,450 and take into account cashing out at $33,911.

Forward of the rectangle breakout, buyers might journey the wave to $31,430 by shopping for BTC because it recovers above the 50-day EMA (pink) at $29,346.

If vary help at $29,000 weakens, the MACD may verify a promote sign as an alternative, thus forcing Bitcoin to abandon the breakout above $30,000.

Miner Accumulation To Precedes Bitcoin Worth Rally

Discussions round main institutional buyers like Blackrock getting into the crypto market have continued to warmth, particularly with the Securities and Change Fee (SEC) deliberating approving the primary exchange-traded product (SEC).

In keeping with on-chain insights from CryptoQuant “… if ‘Token Transferred’ and ‘Velocity velocity’ improve together with the value improve, that is probably a precursor to an upward rally.”

In the meantime, miner exercise implies that Bitcoin is consolidating forward of the following bullish breakout. Previous bullish cycles have proven that miners are inclined to accumulate forward of the halving.

“Miners had been sellers beginning in Aug 2022 and at last beginning on Might 27 this 12 months they began accumulating. Technically talking, it’s of their finest curiosity economically talking to begin accumulating earlier than the halving which is scheduled for April 2024.”

Nonetheless, there was a noticeable improve in BTC inflows into spot exchanges prone to have dampened the potential momentum from “muted outflows as worth hovered in a good vary of 29k-$31k.

Associated Articles

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.