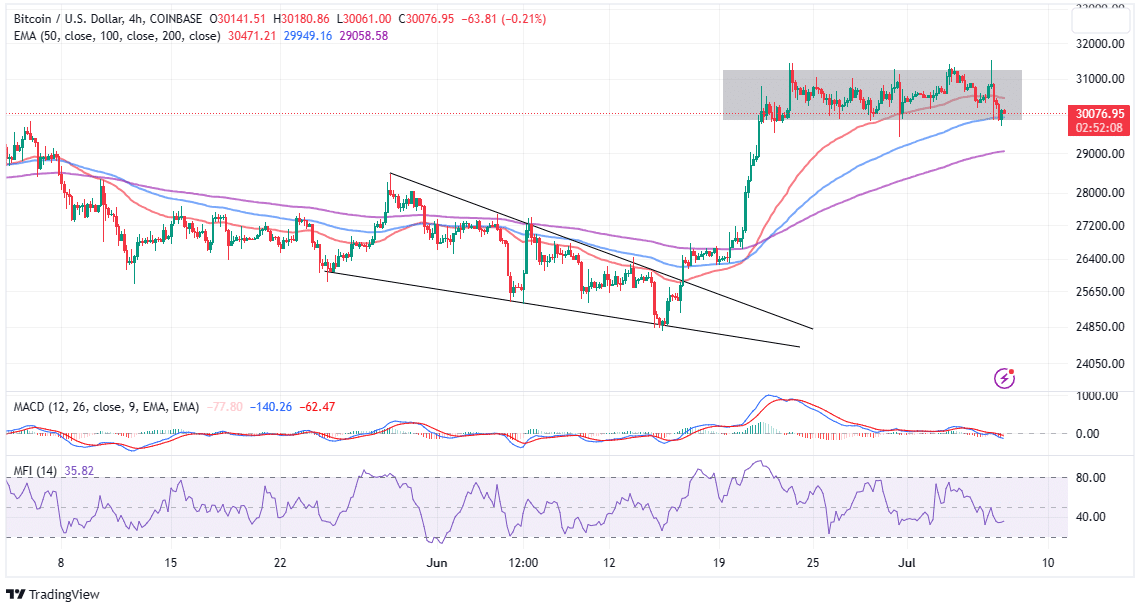

Bitcoin value has delivered a 12.2% upside within the final 30 days after factoring within the correction from its 12-month excessive milestone of barely above $31,500. Nevertheless, the identical upside is beginning to come below growing strain, particularly if the fast assist at $30,000 crumbles, letting bears via.

The Paradox of Growing Whales and a Struggling Bitcoin Worth

Glassnode, a blockchain knowledge analytics agency, has revealed that enormous Bitcoin holders, colloquially referred to as ‘whales,’ are growing their holdings regardless of Bitcoin’s struggle to resume its upward trend.

Furthermore, the identical whales are hesitant about shifting their belongings to exchanges, with chilly pockets storage standing out as probably the most most well-liked choice. CoinDesk believes that traders are cautious of the danger related to leaving digital belongings on exchanges, along with regulatory hindrances or each.

If the development continues and we see much less and fewer of the Bitcoin provide making it to exchanges as whales improve, this might be a bullish gesture.

What’s Holding Bitcoin Worth Again?

Regardless of the rising curiosity amongst whales, the biggest cryptocurrency has been bombarded with a number of financial knowledge studies: The Federal Open Market Committee (FOMC) minutes on Wednesday and the Jobs and Providers studies on Thursday.

The FOMC minutes reaffirmed the Fed Chair, Jerome Powell June’s remarks on why traders ought to anticipate extra price hikes within the second half of 2023.

Bitcoin and Ethereum didn’t take the ADP report nicely, which confirmed that the non-public sector added 497,00 jobs. On high of this, the ISM sector Index climbed to 53.9 in June, dwarfing market estimates of 51.2 and 50.3 in Could.

The report serves as a brand new catalyst for the U.S. Federal Reserve to justify additional price cuts because it grapples with the duty of reining in inflation.

This hawkish stance sometimes exerts substantial strain on cryptocurrency and different danger asset markets, as there’s widespread concern that the Fed’s actions may plunge the economic system right into a extreme recession.

Can Bitcoin Worth Beat The Odds?

Bitcoin value is especially grounded in its place above $30,000, due to enhanced investor curiosity, bolstered by multiple spot BTC ETF applications, together with one from the biggest asset supervisor, Blackrock.

Traders consider this time; the SEC will break the norm of rejecting proposals, particularly with Larry Fink, Blackrock’s CEO, promising to work hand in hand with regulators.

In the meantime, BTC is combating growing overhead strain, with increasingly more traders giving up on the look forward to Bitcoin to weaken resistance at $31,000 and resume the uptrend certain for $35,000 and $38,000 within the brief time period.

Though Bitcoin price slipped to $29,745 on Thursday, it has since regained floor above $30,000 and is buying and selling at $30,088 towards the top of the Asian session on Friday. Help at $30,000 has been bolstered by the presence of the 100-day Exponential Transferring Common (EMA) (line in blue).

Based on Captain Faibik, a rising crypto analyst with 62k followers on Twitter, Bitcoin value is forming a rectangle on the day by day timeframe chart. Though a bullish sample, bulls should, in keeping with Faibik, clear the hurdle at $31,125 to substantiate a breakout.

$BTC forming Bullish Rectangle on the Day by day timeframe Chart..!!

Bulls must Clear the 31,125 Resistance to Affirm the Breakout.#Crypto #Bitcoin #BTC pic.twitter.com/8TezfsJWGi

— Captain Faibik (@CryptoFaibik) July 7, 2023

A confirmed bullish breakout would imply Bitcoin value rises and holds above the rectangle resistance. A sudden spike in quantity would additional validate the bullish transfer, with merchants betting on BTC to shut the hole to $35,000.

Associated Articles

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.