Bitcoin worth has continued to remain within the purple right this moment, hovering across the $96K mark following a short-term pump after the US job knowledge gave some aid yesterday. Notably, the newest US job knowledge signifies a cooling labor market, which may give more room to the Federal Reserve to maneuver with their charge reduce plans. Nonetheless, amid this, prime specialists predict a possible BTC dip to $90k, whereas sustaining their bullish outlook on the long-term trajectory of the coin.

Bitcoin Worth Probably To Hit $90K Earlier than Focusing on New ATH

Bitcoin worth has hovered between $90K and $100K for a while as macroeconomic woes and different considerations have dampened market sentiments. Amid this, prime market specialists anticipate additional BTC decline, which might give extra shopping for alternatives for traders. In different phrases, regardless of the short-term woes, analysts remained bullish on the long-term trajectory of the coin.

For context, in a latest X publish, prime crypto analyst Michael van de Poppe recognized $90,000 as a really perfect shopping for zone for Bitcoin. In keeping with his latest market evaluation, BTC is at present in a “place of boredom,” with worth motion stagnating. He believes {that a} dip to the decrease boundary could possibly be a primary entry alternative for traders.

As well as, his evaluation highlights $104K as an important resistance degree. If Bitcoin breaks previous this barrier, it may sign the beginning of a rally towards a brand new all-time excessive. “Check the highs once more = probably new ATH on the horizon.” van de Poppe defined.

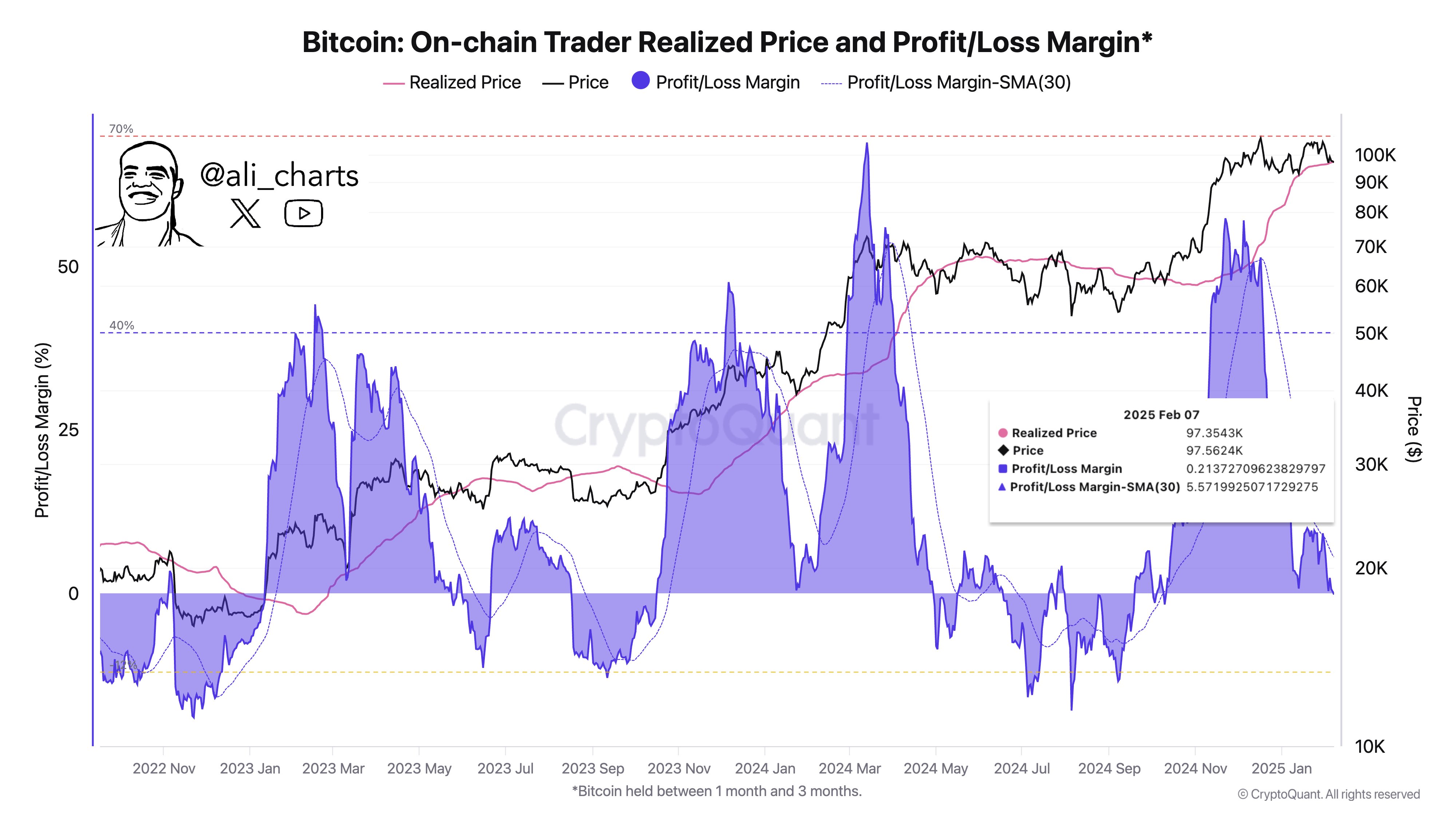

Echoing related sentiments, market professional Ali Martinez pointed out that traditionally, the very best shopping for alternatives for Bitcoin happen when merchants face a 12% loss. At current, merchants are nonetheless in revenue by 0.21%, suggesting that BTC would possibly nonetheless have room to drop earlier than a big uptrend.

Prime Causes Why Bitcoin Worth Is Poised To Rally

Bitcoin Change Outflows Indicators Bullish Momentum Forward

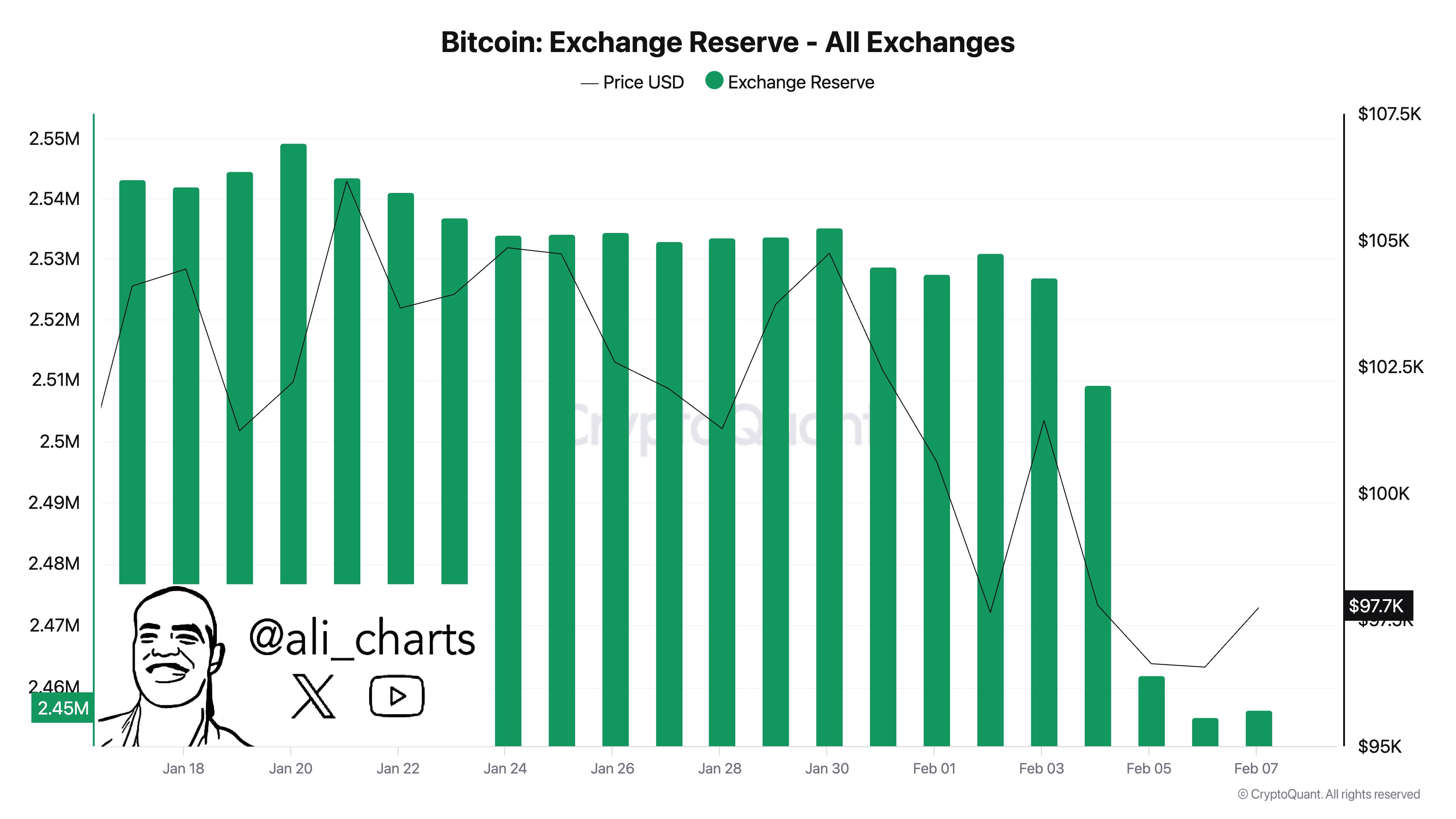

Whereas short-term worth predictions recommend a dip, on-chain knowledge signifies rising long-term confidence amongst traders. Ali Martinez just lately reported that over 70,000 BTC have been withdrawn from exchanges previously week.

Notably, such large-scale withdrawals sometimes point out that traders are shifting their holdings to non-public wallets, decreasing promoting stress out there. This development has usually preceded main Bitcoin worth rallies previously.

US Job Knowledge Fuels Sentiment

One of many key macroeconomic components influencing Bitcoin worth is the Federal Reserve’s stance on rates of interest. Nonetheless, the newest US job data suggests a cooling labor market, which may give the Fed extra flexibility to implement charge cuts. Notably, BTC has soared previous the $100K mark after the Labor market launched this significant knowledge yesterday.

In the meantime, decrease rates of interest typically increase threat belongings like Bitcoin by making conventional investments much less engaging. Having stated that, if the Fed strikes ahead with its anticipated cuts, it may set off renewed investor curiosity in BTC.

Crypto-Pleasant Regulatory Atmosphere And Bitcoin Reserve Speculations

Donald Trump’s presidency has proved to be bullish for the broader crypto market, not to mention the flagship crypto. Having stated that, specialists are eyeing in the direction of crypto-friendly regulatory setting within the US, which may assist increase traders’ confidence in the direction of digital belongings.

As well as, a flurry of US states is already shifting forward with their Bitcoin Reserve plans. In addition to, US crypto czar David Sacks just lately stated that the US administration is evaluating US Bitcoin Strategic Reserve plans. This improvement, if occurs, may additional set off the worldwide race for BTC adoption, which in flip may ship the worth to a brand new excessive.

How’s BTC Performing?

Bitcoin worth right this moment was down about 2% and traded at $95,943, and its one-day buying and selling quantity soared 11% to $50.8 billion. Notably, the crypto has touched a 24-hour excessive and low of $100,154.14 and $95,653 within the final 24 hours. In addition to, the Bitcoin Relative Energy Index stayed at 41, indicating a robust momentum forward.

Including to the bullish sentiment, a prime market analyst just lately predicted BTC price to hit $150K, sparking additional optimism. It’s value noting that this analyst is broadly adopted by crypto market fans, given his repute for precisely predicting the BTC backside in 2022. Having stated that, it seems that regardless of short-term volatility, Bitcoin worth is poised to hit a brand new ATH quickly.

Disclaimer: The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: