Bitcoin value current plunge beneath $67,000 has sparked discussions amongst buyers, with fears of additional declines looming. Notably, famend analyst and veteran dealer Peter Brandt, who precisely forecasted Bitcoin’s drop to $16,000 in 2022, now cautions that the cryptocurrency may plummet to $48,000.

Nonetheless, he cited the dip may occur if it fails to maintain vital help ranges. In the meantime, amid the daring forecast and important choices expiry, all eyes are on Bitcoin’s subsequent transfer.

Analyst Predicts Bitcoin Value Dip To $48K

The current Bitcoin drop has despatched ripples by the crypto group. The flagship crypto’s failure to carry above the $67,000 mark has sparked intense hypothesis about its future trajectory.

Amid this, crypto market professional Peter Brandt, who can also be a seasoned dealer with a historical past of correct predictions, has issued a stark warning. In a current submit on the X platform, he outlined a possible path for Bitcoin’s decline.

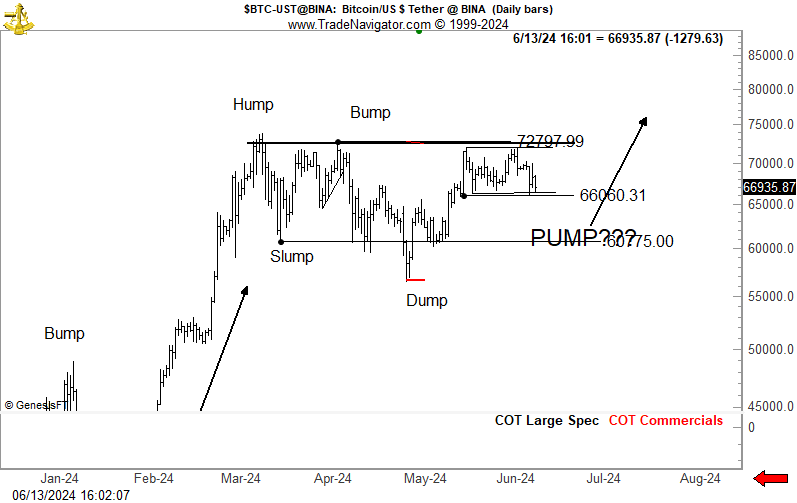

In a current X submit, Peter Brandt shared a value chart of Bitcoin, whereas noting $65,000 and $60,000 as essential ranges for Bitcoin’s close to future. In keeping with Brandt, a drop beneath $65,000 may pull the value in direction of $60,000. Conversely, a plunge beneath the $60,000 stage may see Bitcoin fall to $48,000.

Nonetheless, Brandt says that whereas these are essentially the most easy interpretations, the market may be unpredictable. On this context, he said:

Typically the obvious interpretations of a chart work out, more often than not the charts morph.

Additionally Learn: Bitcoin ETF Outflows Hit $228 Million Amid BTC Price Dip, What’s Happening?

Macroeconomic Elements & Choices Expiry In Focus

The most recent inflation knowledge from the U.S. Labor Division has proven indicators of cooling. For context, Might’s Consumer Price Index (CPI) and Producer Value Index (PPI) studies counsel cooling inflationary pressures within the nation.

Notably, this growth may affect the U.S. Federal Reserve’s strategy to rates of interest. Having stated that, if the Fed adopts a extra dovish stance, it would supply some reduction to the crypto market. A possible coverage shift may mitigate additional declines in Bitcoin’s value, offering a potential lifeline for buyers.

In the meantime, one other vital issue affecting Bitcoin’s value is the current expiry of 20,000 Bitcoin options on June 14, 2024. Choices expiry occasions typically introduce important volatility as merchants modify their positions. Notably, the utmost ache level for this expiry was set at $68,500, indicating the value stage at which most choices would expire.

As of writing, Bitcoin price stayed within the crimson whereas crossing the transient $67,000 mark. Over the past 24 hours, its value noticed a excessive of $68,337.23 and a low of $66,304.57, reflecting the unstable state of affairs available in the market.

Moreover, its buying and selling quantity additionally fell 24.55% to $27.17 billion. Nonetheless, regardless of a drop in its value, Bitcoin Futures Open Curiosity rose 0.98% within the final 4 hours to 522.67K BTC or $35.14 billion.

Additionally Learn:

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: