The crypto market stays on edge regardless of Bitcoin value noting a powerful rally immediately. Notably, the latest transfers of greater than 2500 BTC by Mt. Gox have sparked discussions amongst buyers about the way it may hinder the present rally of the coin. As well as, latest reviews additionally point out that BTC may witness a pullback forward, citing historic and different market tendencies.

Bitcoin Value Faces Pullback Danger Amid Mt. Gox Switch

In accordance with a latest report by Arkham Intelligence, Mt. Gox has moved 2570 BTC immediately, valued at round $228.48 million. The switch was made to a pockets “1PQZw…DDJtK”, sparking discussions about the way it can influence the present rally of the Bitcoin value.

Apart from, the bankrupt crypto exchange has also moved greater than 32,300 BTC to 2 separate wallets just lately. Regardless of that, the BTC nonetheless maintains its place within the inexperienced, indicating that buyers are lauding the latest constructive market tendencies in response to those short-term considerations.

Nevertheless, if an analogous selloff continues, it may considerably influence crypto’s efficiency within the coming days. Notably, the distribution of funds by Mt. Gox to its collectors has beforehand weighed on the buyers’ sentiment. A flurry of merchants fears the transfer will set off promoting strain on the crypto if the collectors determine to liquidate their holdings.

Alternatively, different consultants have remained assured. For context, given the rising attraction of crypto, particularly Bitcoin, after Donald Trump’s win, many anticipate the collectors to carry on to their portfolio because the crypto continues to see new heights now.

Is BTC On the Verge Of A Pullback?

Amid the latest Mt. Gox switch, many consultants have warned a couple of potential pullback within the Bitcoin value forward. Nevertheless, as of writing, BTC value was up practically 11% to $89,502.06, its new ATH, with its buying and selling quantity rocketing 77% to $136.35 billion. Moreover, BTC Futures Open Curiosity rose 11%, reflecting the market’s robust confidence in the direction of the crypto.

Notably, in a latest report, QCP Capital warns of potential pullbacks because of elevated perpetual funding charges and 7-month excessive foundation yields. Regardless of structural bullishness, leveraged washouts might set off corrections, the report famous. Apart from, Veteran dealer Peter Brandt echoes warning, citing Bitcoin’s inherent volatility.

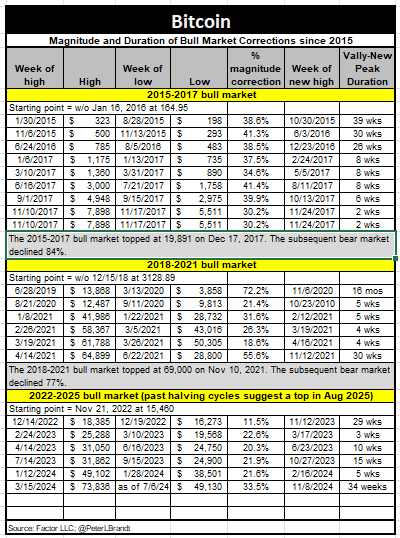

Brandt predicts Bitcoin will grow to be the worldwide customary of worth, rendering different belongings’ costs unstable. Traditionally, Bitcoin’s corrections have moderated since 2015. The newest bull cycle, beginning November 2022, skilled delicate corrections, together with a 34-week, 33.5% downturn.

Nevertheless, it’s additionally value noting that regardless of short-term correction considerations, many have remained bullish on BTC’s future trajectory. Just lately, Peter Brandt said that Bitcoin price is prone to hit $200K within the coming days, echoing an analogous outlook shared by the highest funding agency Bernstein.

Disclaimer: The offered content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: