Key Notes

- Bitcoin value hits new all-time excessive above $125,500 as ETF inflows exceed $3.2 billion in a single week.

- CryptoQuant’s Coinbase Premium Index stays optimistic for 30 consecutive days, signaling persistent institutional accumulation.

- Analysts predict that BTC might take a look at $150,000 if bullish momentum holds after 9 consecutive inexperienced days.

Bitcoin value superior to contemporary all-time highs of $125,580 on Sunday, October 5, propelled by a five-day buying frenzy that drew $3.2 billion in inflows from Bitcoin ETFs final week.

On-chain information exhibits the Coinbase Premium Index has trended optimistic for 30 consecutive days since September 7, highlighting sustained US institutional demand regardless of volatility. In keeping with Cryptoquant, index measures value variations between Coinbase’s company and controlled US traders and different international exchanges.

Bitcoin Coinbase Premium Index | Supply: CryptoQuant

As of this report, the Coinbase Premium Index stands at +0.06, after final printing destructive at -0.007 on September 7.

This constant premium displays aggressive accumulation amongst institutional consumers all through the late September dip, when BTC briefly corrected from $124,500 to $108,683 earlier than getting into its present rebound part.

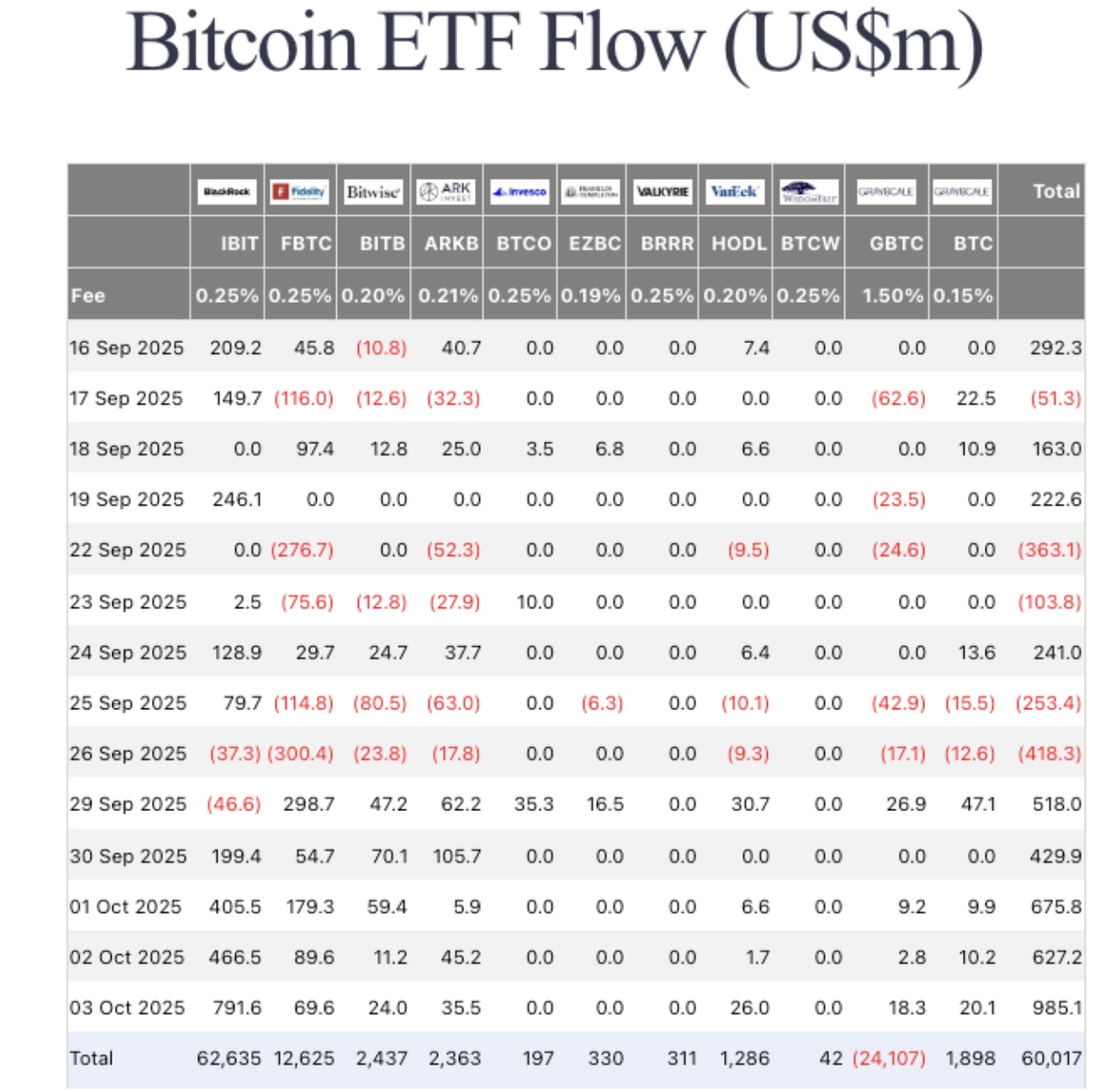

Bitcoin ETFs internet $3.64 billion in second-highest weekly inflows | Supply: FarsideInvestors

Throughout that correction, ETF inflows remained resilient. In keeping with Farside Traders, spot Bitcoin ETFs closed buying and selling on Friday with inflows of $986 million. ETFs recorded complete inflows of $3.24 billion to hit a second-highest weekly inflows since inception in January 2024.

The regular rise in ETF inflows and dominant on-chain exercise validates robust institutional demand whilst short-term traders and day merchants locked in income on the mid-September peaks.

Bitcoin Worth Forecast: Can Bulls Push Towards $150K?

Bitcoin value has closed inexperienced in 9 of its final ten buying and selling days, boosted by robust institutional demand. The present breakout above $125,000 positions BTC firmly above all essential short-term resistance factors.

Bitcoin (BTC) Technical Worth Evaluation | Supply: TradingView

After clearing a demise cross at $118,461 through the late-September retreat, BTC has now entered value discovery, consolidating above the 5-day, 8-day, and 13-day shifting averages.

The Parabolic SAR under $113,000 additionally suggests consumers are prone to muster robust assist at key resistance ranges if a short-term correction happens.

On the upside, Bitcoin value might advance towards the subsequent goal $130,000, adopted by a psychological push towards $150,000 earlier than year-end. Nevertheless, an RSI nearing 70 hints that short-term overbought situations might set off delicate retracements earlier than the subsequent leg up.

Pepe Node Presale Features Momentum as Bitcoin Units New Highs

As Bitcoin’s record-breaking rally reignites bullish sentiment, early-stage tasks like Pepe Node are additionally drawing investor curiosity.

The meme-inspired platform presents as much as 864% staking rewards, permitting customers to construct digital meme coin mining rigs, merge nodes for enhanced yields, and earn tokenized bonuses.

At present priced at $0.0010, the Pepe Node presale has raised $1.16 million of its $1.3 million goal. With Bitcoin getting into a brand new value discovery part, traders are more and more exploring tasks like Pepe Node that supply larger upside potential.

Members can nonetheless be a part of by means of Pepe Node’s official website earlier than the subsequent presale value tier unlocks.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.