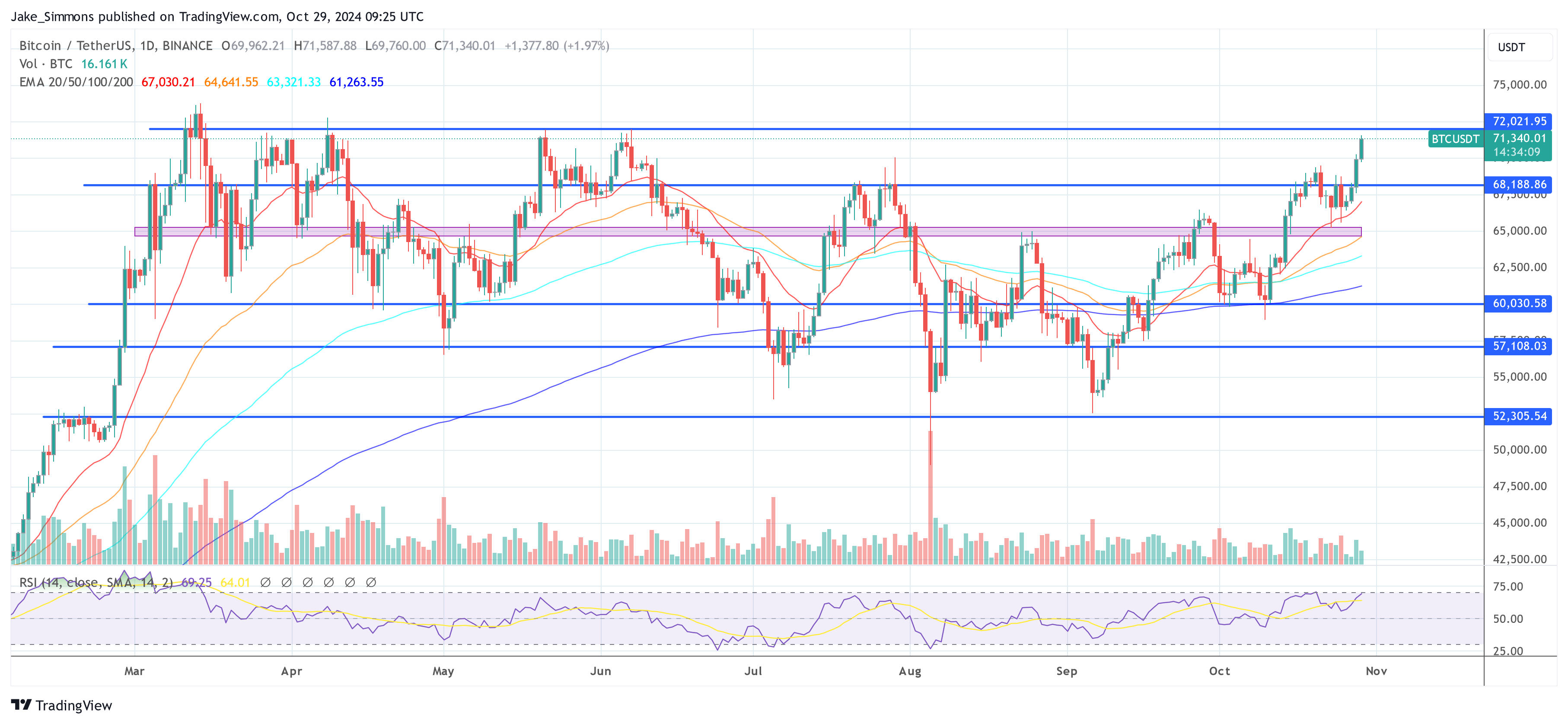

The Bitcoin value has surged previous the $71,000 mark at present. Over the previous 5 days, Bitcoin’s value has rallied by greater than 8.5%, climbing from $65,600 to as excessive as $71,118 on October 29. Within the final 24 hours alone, the BTC value has elevated by 3.8%. This upward momentum may be attributed to 4 key components:

#1 Bitcoin ETFs Entice Large Inflows

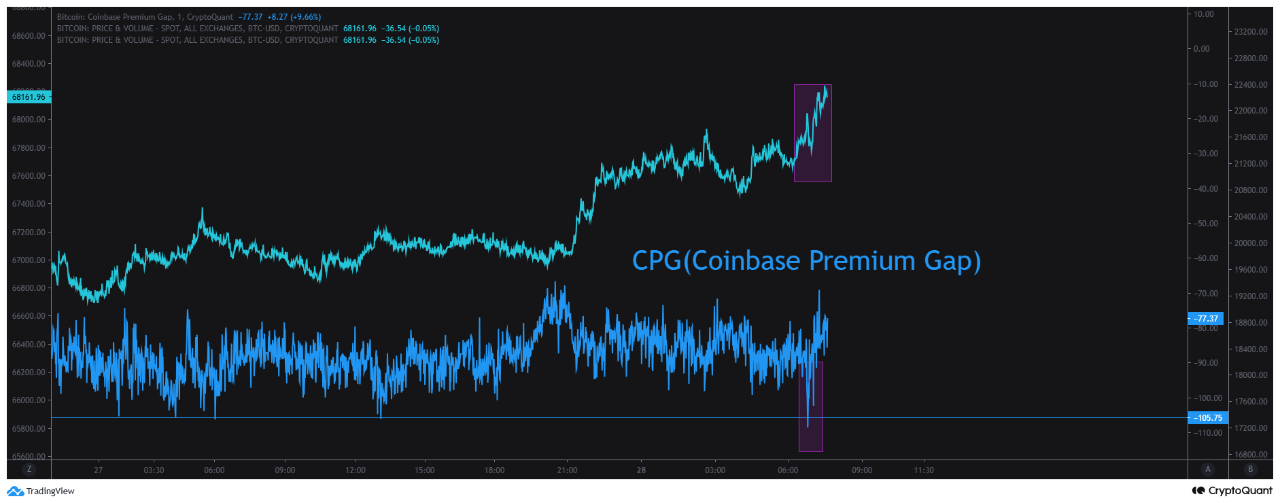

The surge in Bitcoin’s value is carefully linked to substantial inflows into Bitcoin Alternate-Traded Funds (ETFs). Yesterday witnessed large ETF flows totaling $479.4 million. BlackRock led the inflows with $315.2 million, adopted by Constancy at $44.1 million, Ark with $59.8 million, and Bitwise at $38.7 million. These vital investments coincided with Bitcoin’s value motion from $68,000 to over $71,000.

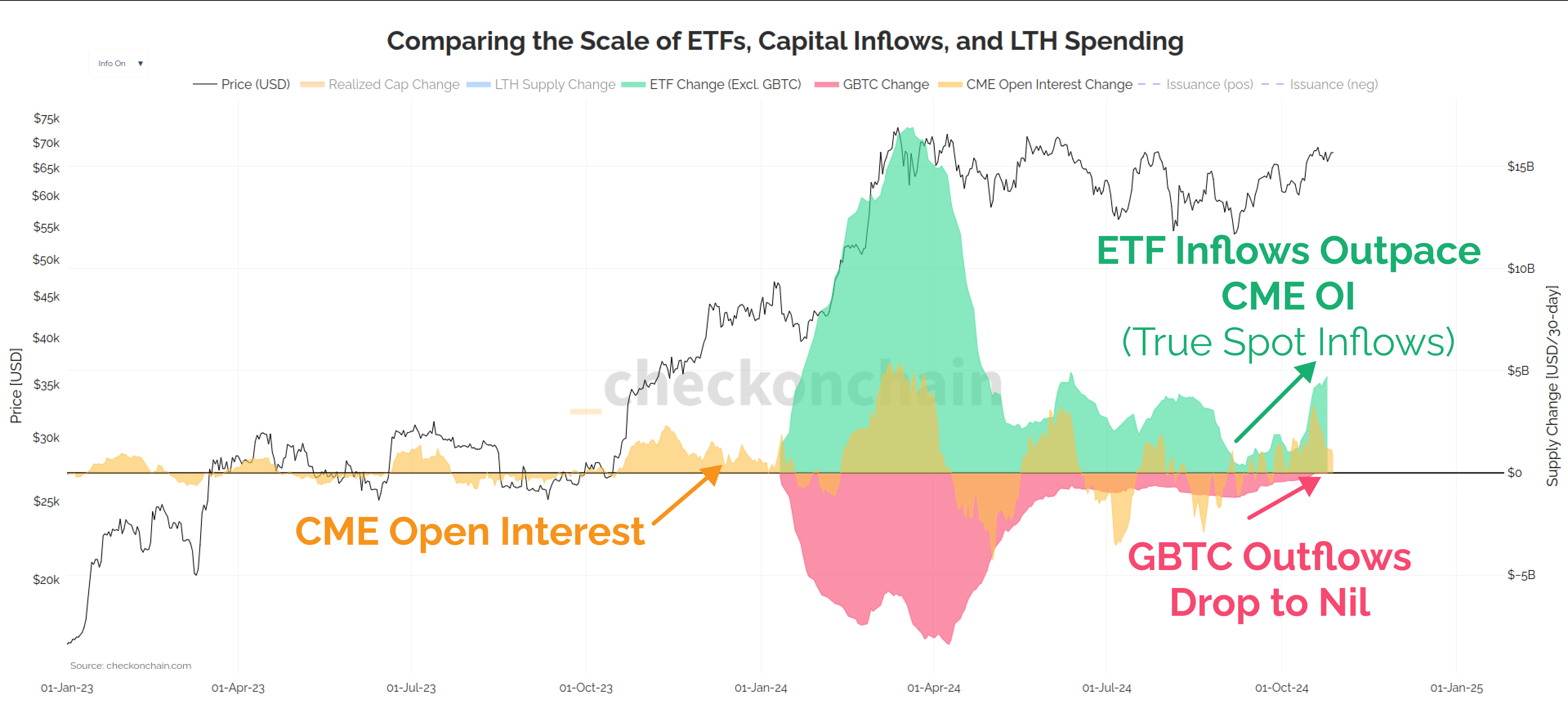

Main on-chain analyst James “Checkmate” Test highlighted a divergence between Bitcoin ETF inflows and CME Open Curiosity. He noted “We now have a divergence between Bitcoin ETF Inflows and CME Open Interest. ETF Inflows are ticking meaningfully greater, CME Open Curiosity is up, however not as a lot GBTC outflows are additionally minimal. We’re seeing true directional ETF inflows, and fewer so money and carry trades.”

The divergence means that traders are favoring direct publicity to Bitcoin via ETFs quite than partaking in money and carry trades involving futures contracts. The carry commerce technique within the context of US spot Bitcoin ETFs and CME futures includes shopping for the ETF (monitoring the spot value of Bitcoin) and concurrently shorting Bitcoin futures on the CME.

This strategy goals to capitalize on value variations when futures commerce at a premium to the spot value (contango). The notable shift towards ETFs signifies a bullish sentiment amongst traders, anticipating additional value appreciation.

#2 The “Trump Commerce”

Political developments are additionally influencing Bitcoin’s current rally. Singapore-based QCP Capital commented on the influence of former President Donald Trump’s interview on the Joe Rogan Expertise podcast, which has gained over 32 million views and pushed his Polymarket odds above 66%. Regardless of “crypto” being touted because the “Trump Trade,” Bitcoin’s correlation with Trump’s potential election victory appears to gas the Bitcoin value rally.

QCP Capital additionally famous that Bitcoin is up solely 8% this “Uptober,” in comparison with a mean of 21% in earlier Octobers. They said, “If spot holds at these ranges, this October would mark Bitcoin’s fourth-worst efficiency previously decade.” With complete BTC perpetual futures open curiosity throughout exchanges standing at $27 billion—approaching this 12 months’s peak—a breakout above $70,000 may set off new all-time highs, particularly with extra leveraged longs becoming a member of in.

#3 Shorts Squeeze Amplifies Worth Surge

Market information signifies a big shorts squeeze contributing to Bitcoin’s value spike. In response to Coinglass, previously 24 hours, 65,622 merchants had been liquidated, with complete liquidations throughout your entire crypto market amounting to $228.51 million. Of this, $169.47 million had been quick liquidations. Particularly for Bitcoin, $83.61 million in shorts had been liquidated. The most important single liquidation order occurred on Binance’s BTCUSDT pair, valued at $18 million.

The substantial liquidation of quick positions means that many merchants had been betting on a value decline and had been pressured to shut their positions because the market moved towards them. This mass unwinding of shorts can speed up upward value actions as merchants purchase again into the market to cowl their positions.

#4 Whales Improve Shopping for Exercise

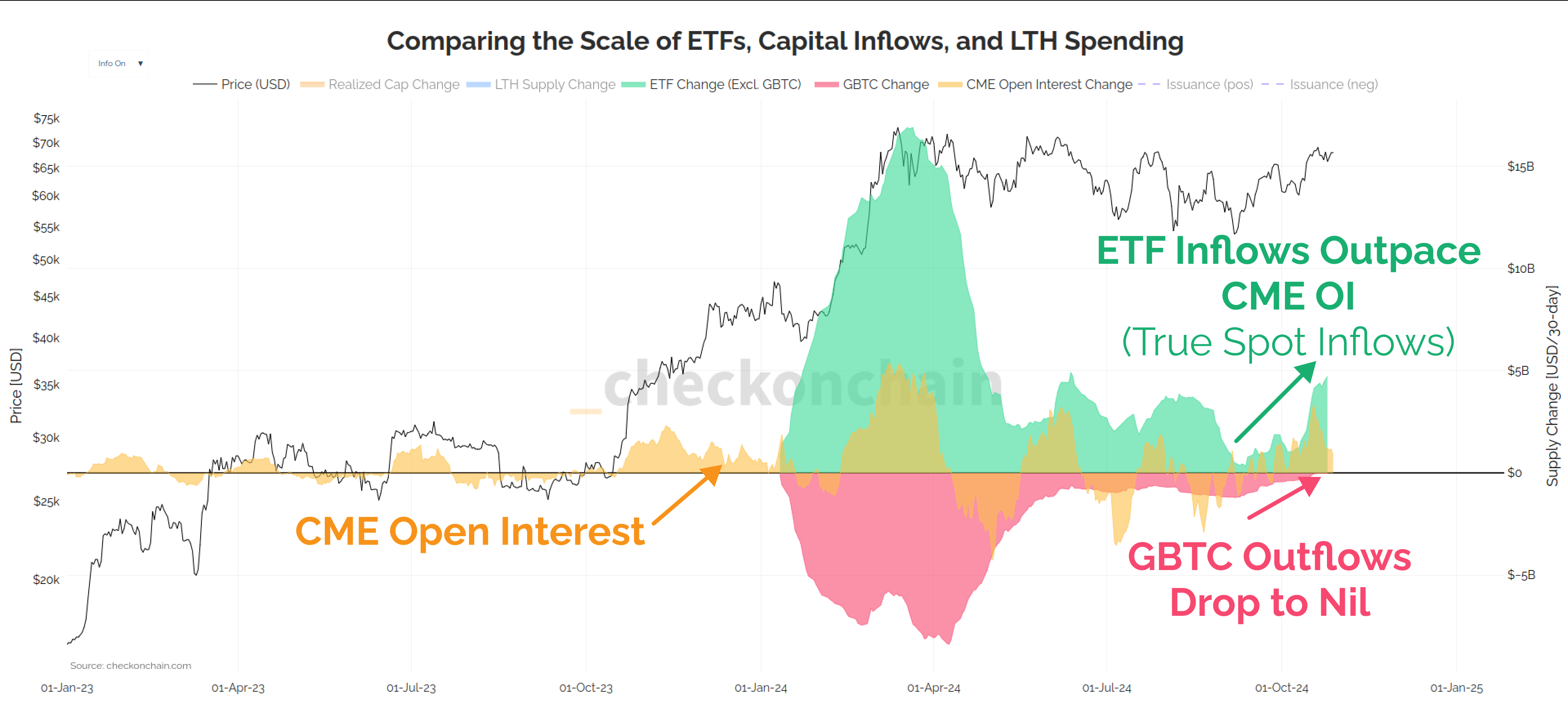

Giant-scale traders, sometimes called “whales,” are enjoying a pivotal position within the present rally. CryptoQuant analyst Mignolet observed that Bitcoin’s rally continues, led by exercise on the Binance alternate. He identified that Binance whales started vital involvement out there two weeks in the past throughout Asian buying and selling hours, and up to date declines within the Coinbase Premium Hole (CPG) alongside value will increase are “a transparent signal of Binance whales’ intervention.

Mignolet emphasised that this shouldn’t be interpreted as a decline in US demand, however a good stronger shopping for stress from Binance. Over the previous two weeks, demand for US Bitcoin spot ETFs has surged, with a web influx of roughly 47,000 Bitcoin. Since most ETF merchandise use Coinbase, actions in CPG information are carefully tied to ETF demand. He concluded, “The present Bitcoin value is being pushed by Binance whales, with sustained inflows of US capital.”

At press time, BTC traded at $71,340.

Featured picture created with DALL.E, chart from TradingView.com