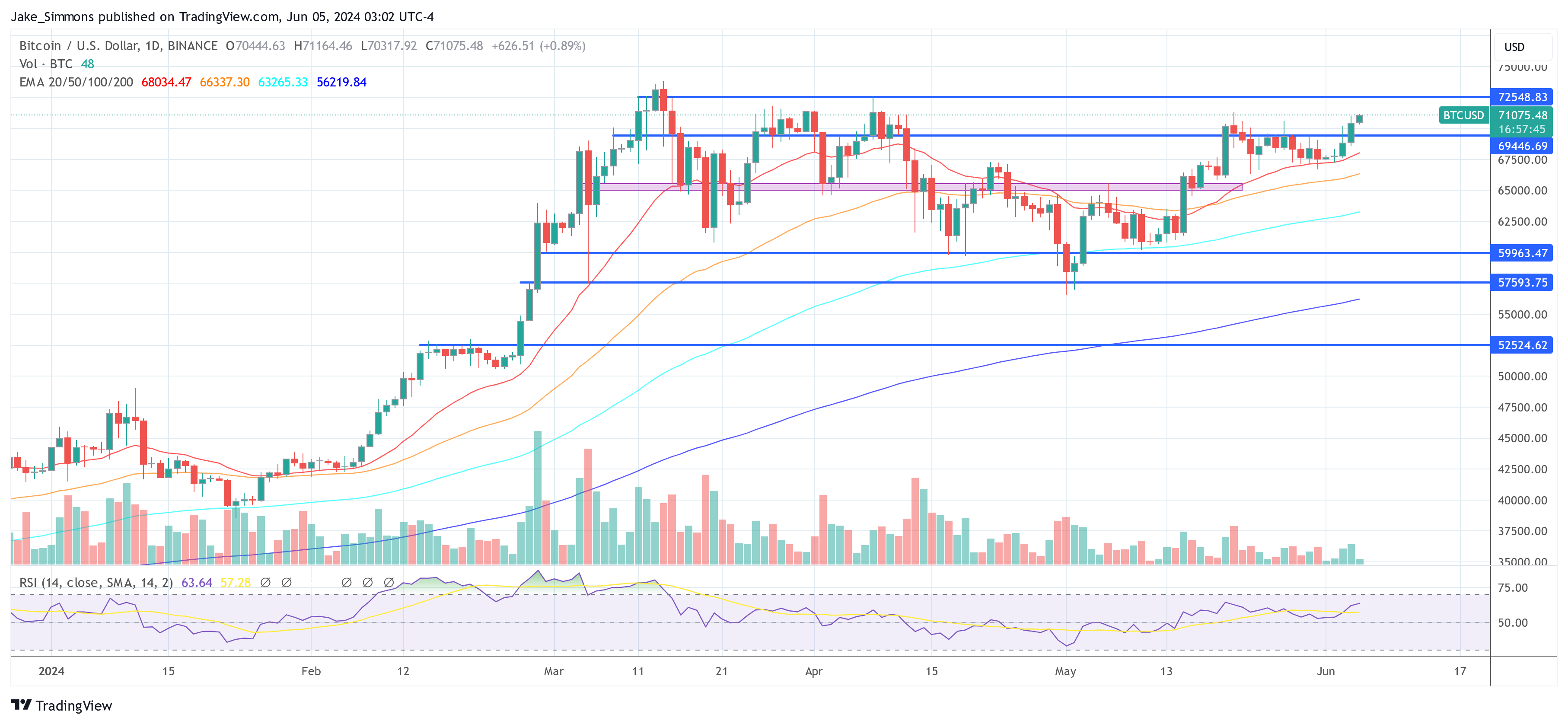

Bitcoin has surged 2.9% within the final 24 hours, reaching a excessive of $71,166 on Binance at this time, marking the best worth since Could 21. This rally seems to be primarily fueled by strong inflows into US spot Bitcoin ETFs, with the sector experiencing its sixteenth consecutive day of internet inflows.

Why Is The Bitcoin Value Up At this time?

Yesterday alone, these ETFs noticed an influx of $886.6 million, with Constancy main at $378.7 million—setting a brand new report for the fund. BlackRock wasn’t far behind, with substantial inflows totaling $274.4 million. Different important contributions included Ark with $138.7 million, Bitwise at $61 million, and the Grayscale Bitcoin and VanEck Bitcoin Belief recording $28.2 million and $4 million respectively.

Good morning fellow hodlers,

We had an absolute insane day of inflows yesterday with $886.6 million of inflows (that’s ~12 500 BTC)

Constancy did $378.7 million, Blackrock did $274.4 million, Ark did $138.7 million and Bitwise 61 million.

Even $GBTC had inflows price of $28.2… pic.twitter.com/KaDdmTrq9p

— WhalePanda (@WhalePanda) June 5, 2024

The sustained curiosity is additional evidenced as BlackRock’s iShares Bitcoin ETF surpassed $20 billion in belongings, turning into the quickest ETF to succeed in this milestone, reflecting important momentum and investor enthusiasm.

Associated Studying

Eric Balchunas, a Bloomberg ETF analyst, emphasised the dimensions of those inflows, stating, “Constancy not messing round, big-time flows throughout at this time for The Ten, practically $1b in complete. Second finest day ever, since Mid-March. $3.3b in previous 4wks, internet YTD at $15b (which was prime finish of our 12mo est). The ‘third wave’ is popping right into a tidal wave.”

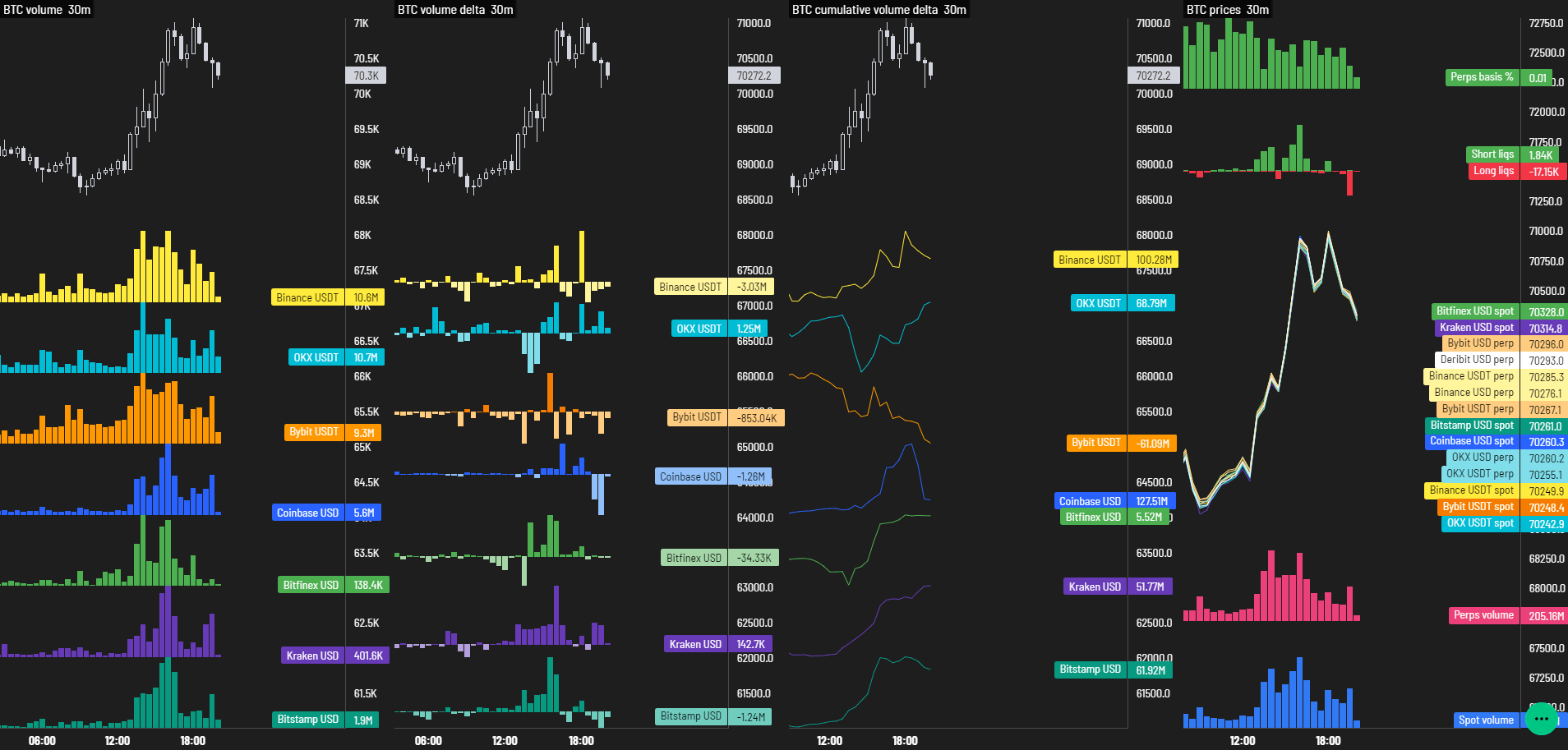

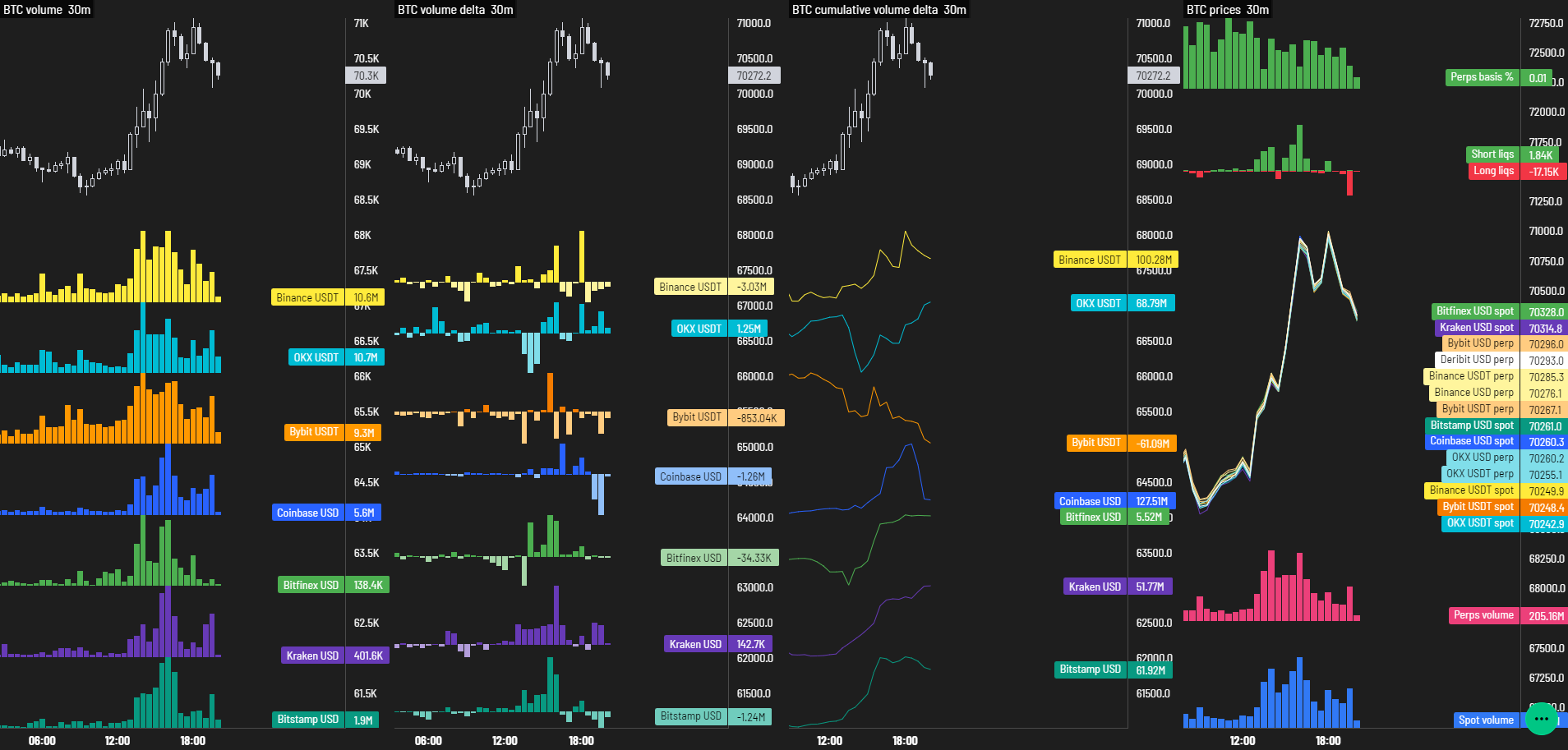

Regardless of the optimistic influx dynamics, Byzantine Basic (@ByzGeneral), a distinguished crypto analyst, noticed that the value surge might have been extra pronounced. He highlighted the presence of considerable passive supply on spot exchanges, which could have tempered the value improve.

Associated Studying

He famous yesterday, “Excessive quantity at this time, and the perps foundation really went down a bit. I feel that we received good ETF flows at this time, however… They’re shopping for into quite a lot of passive provide on spot exchanges.” He additional commented at this time, “What did I say, large ETF inflows. However due to all the passive provide it’s like an unstoppable pressure colliding with an immovable object.”

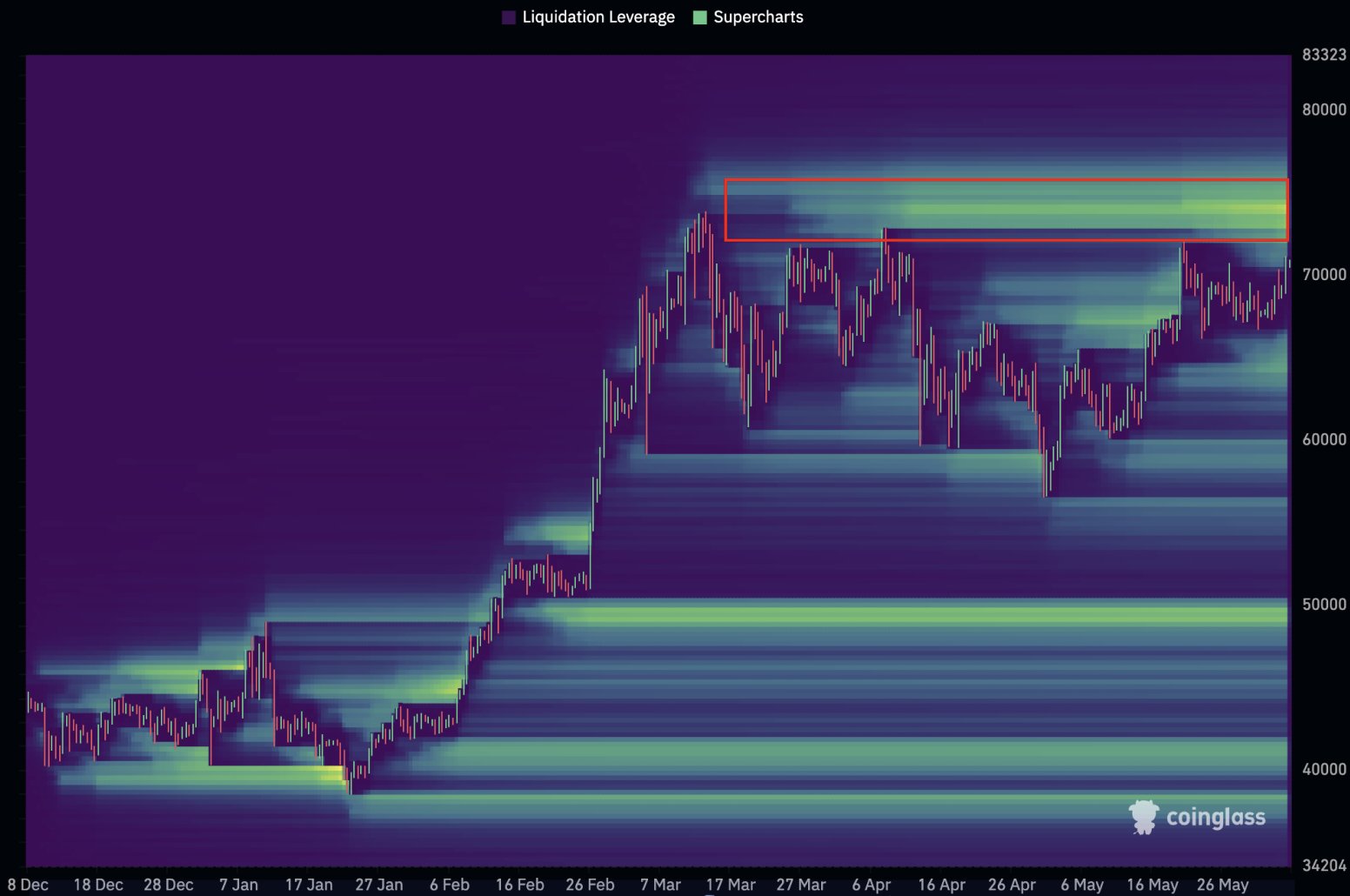

Furthermore, it’s necessary to notice that the value improve was not pushed by the liquidation of short positions within the BTC futures market, which noticed solely $27.58 million in shorts liquidated within the final 24 hours, in keeping with Coinglass information.

Nevertheless, Willy Woo, a famend on-chain analyst, warned {that a} continued rise might set off a big quick squeeze. Woo said through X, “Tapping 72k is the fuse that’s set to start out a liquidation cascade. $1.5b of quick positions able to be liquidated all the way in which as much as $75k and a brand new all time excessive.”

At press time, BTC traded at $71,075.

Featured picture created with DALL·E, chart from TradingView.com