Bitcoin worth continues to be trying a breakout that may see it resume the anticipated bullish wave above $30,000. Nevertheless, with the crypto market disadvantaged of ample liquidity to rally, consolidation between $29,000 and $30,000 is taking priority.

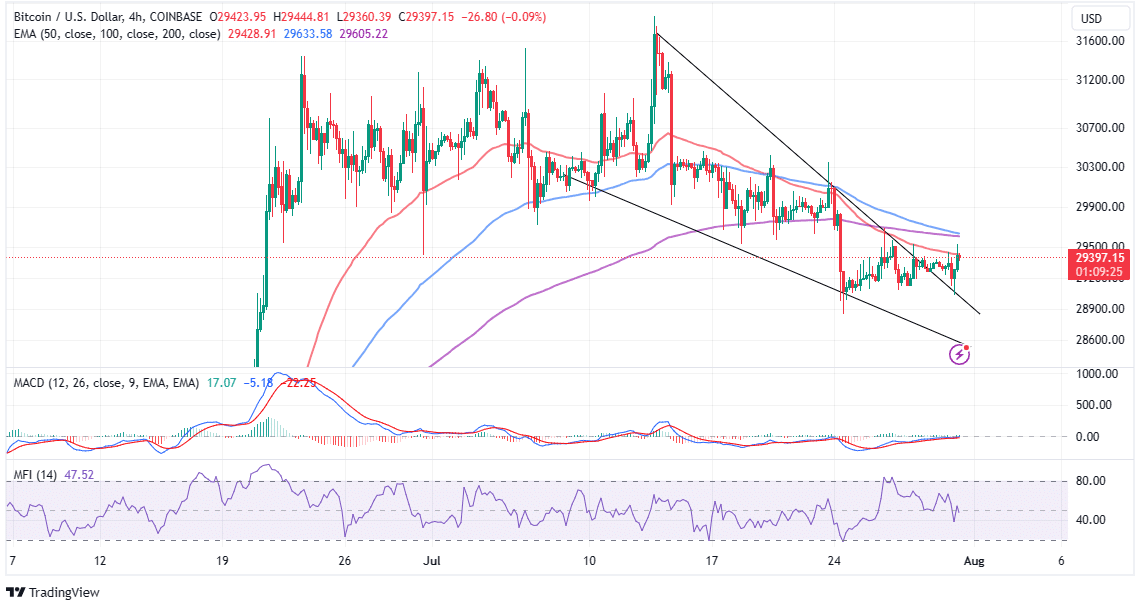

This evaluation will consider the potential state of affairs in BTC and what forces are more likely to invalidate it. Whereas Bitcoin price broke out the falling wedge pattern mentioned on Friday, it solely made it barely above $29,500 such that it’s exchanging palms at $29,408 on Monday – as buyers put together to usher within the European session.

Bitcoin Worth Regular Regardless of Curve Exploit

Bitcoin worth managed to remain calm because the crypto market struggled to digest the exploit on the stablecoin alternate Curve, which has risked as a lot as $100 million. In keeping with a report by CoinDesk, the hack took benefit of a “re-entrancy” bug within the platform’s programming language known as Vyper.

In the meantime, Bitcoin is trading at $29,393 after facing another rejection from highs barely above $29,500. The resistance highlighted by the 50-day Exponential Transferring Common (EMA) (crimson) at $29,428 limits worth motion on the upside, making the climb above $30,000 an uphill job.

It’s believable for Bitcoin price may roll back to support at $29,000, and sweep contemporary liquidity earlier than resuming the uptrend.

Buyers might wish to maintain onto their lengthy positions in BTC realizing that the Transferring Common Convergence Divergence (MACD) dons a purchase sign. Motion above the imply line (0.00) would reinforce the purchase sign, introduced when the blue MACD line crossed above the crimson sign line.

Because the falling wedge sample breakout is lagging under $30,000, a retest of the descending trendline, or $29,000 would go a protracted approach to hold investor curiosity intact.

Standard crypto analyst Captain Faibik highlights a broadening formation on the 12-hour chart, which revealed the opportunity of a “doubtlessly substantial as much as 10% bullish wave.”

$BTC Broadening Formation (12h) 📈

I firmly anticipate a Doubtlessly Substantial As much as 10% Bullish Wave .#Crypto #Bitcoin #BTC pic.twitter.com/nPij72KegM

— Captain Faibik (@CryptoFaibik) July 31, 2023

Nevertheless, merchants should be cautious, retaining in thoughts the 100-day EMA (in blue) might flip beneath the 200-day EMA (purple) thus confirming a demise cross sample. Not like a golden cross, this can be a bearish sample, which suggests that the trail with the least resistance is to the draw back.

So long as Bitcoin holds above $29,000, buyers ought to stay assured {that a} breakout is coming quickly and should propel BTC to $35,000. Nevertheless, prolonged declines to $28,000 whereas they might provide a chance for buyers to purchase lower-priced BTC cash, they may trigger panic, culminating in additional losses to $25,000.

Associated Articles

The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.