Bitcoin value continues to point out exemplary stability above $30,000. The pioneer cryptocurrency hit a 12-month excessive late final week at $31,468 however stalled to permit for consolidation.

Many market watchers anticipated BTC to retrace and retest help at $28,000, however the enhanced market construction bolstered by a sudden rise in curiosity from institutional traders has ensured Bitcoin price upholds its position above $30,000.

The most important cryptocurrency is buying and selling at $30,230 on Thursday, with $10.5 billion in buying and selling quantity recorded in 24 hours. Regardless of the soundness exhibited, BTC is down 0.7%.

MicroStrategy Buys 12,333 BTC

The crypto market has been extraordinarily eventful this June, beginning with an intensified crackdown by the US Securities and Change Fee (SEC).

Main crypto exchanges Coinbase and Binance have been sued by the regulator, with 64 cryptocurrencies, together with Cardano (ADA), Polygon (MATIC), and Solana (SOL), implicated as safety tokens.

Nonetheless, the face of the crypto business began to vary with Blackrock’s debut out there, aspiring to function a spot Bitcoin ETF. And since then, more institutional investors have both been expressing curiosity within the area as stakeholders or holders of the most important crypto BTC.

Though MicroStrategy is a veteran investor in Bitcoin, its most recent purchase of 12,333 BTC value round $347 million is an indication that its time for Wall Avenue to enter the market.

MicroStrategy has acquired an extra 12,333 BTC for ~$347.0 million at a median value of $28,136 per #bitcoin. As of 6/27/23 @MicroStrategy hodls 152,333 $BTC acquired for ~$4.52 billion at a median value of $29,668 per bitcoin. $MSTR https://t.co/joHo1gEnR0

— Michael Saylor⚡️ (@saylor) June 28, 2023

Institutional traders shunned the crypto marketplace for the final one and a half years amid regulatory uncertainty and different inside forces just like the implosion of Terra (LUNA) in Could and FTX in November 2022.

MicroStrategy’s newest buy brings the overall quantity of BTC on its stability sheet to 152,333 – value round $4.5 billion.

Will Bitcoin Value Rally On Institutional Traders Surge?

Except for MicroStrategy and Blackrock, firms like Constancy Investments and Ledger have began working crypto-based platforms.

Constancy backs EDX Markets, a crypto change designed for brokers and particular person traders. Ledger, however, has simply introduced the launch of Ledger Enterprise TRADELINK, a crypto service devoted to catering to the wants of institutional traders.

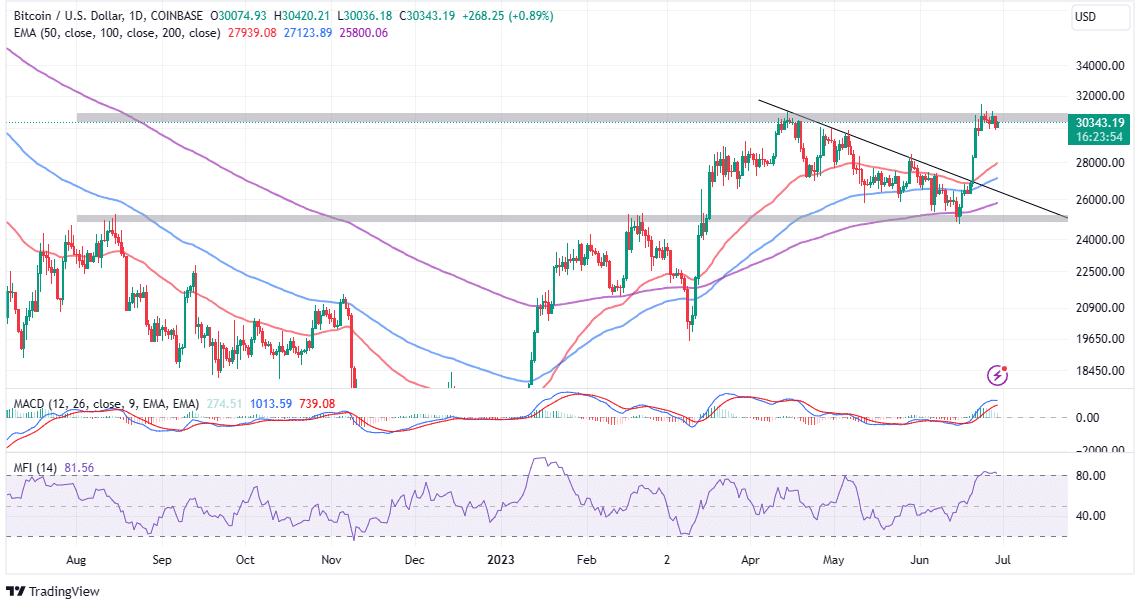

In the meantime, Bitcoin price holds firmly above $30,000. This help is essential for the resumption of the uptrend focusing on $38,000. The Cash Circulate Index (MFI) reinforces the soundness out there, holding inside the overbought area.

This suggests that the cash streaming into BTC markets is considerably increased than the outflow quantity. If these circumstances keep the identical or enhance, bulls may have a better time pushing for a breakout to $38,000.

Merchants should tread cautiously, conscious of the promoting stress emanating from the current rejection from the 12-month excessive stage. If overhead stress continues to construct, they’ll anticipate a promote sign from the Transferring Common Convergence Divergence (MACD) indicator.

In that case, it’s important to attend till Bitcoin value confirms a rebound from $30,000 and probably breaks and holds above $30,000 to make certain of a brand new uptrend. Nonetheless, it’s untimely to rule out one other rollback to $28,000.

Associated Articles

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.