Following the occasions of the previous week, it’s extra of a matter of “when” reasonably than of “if” the Bitcoin worth will hit a historic six-figure worth. The crypto commentary channels and waves have been largely occupied with the premier cryptocurrency doubtlessly reaching $100,000 over the previous few weeks.

A six-figure worth for BTC isn’t solely a powerful milestone for all the crypto business but in addition one which comes with “unfavorable” occasions resembling liquidations for brief merchants. Right here is an on-chain perception into “what subsequent” if the Bitcoin worth climbs above $100,000.

What’s Subsequent For BTC’s Value After $100,000?

In a latest report, blockchain analytics agency Glassnode shared an perception into the on-chain efficiency of the premier cryptocurrency since beginning its newest rally. Whereas the $100,000 worth mark appears inevitable, the blockchain agency expects Bitcoin worth to lose a few of its momentum after crossing the goal.

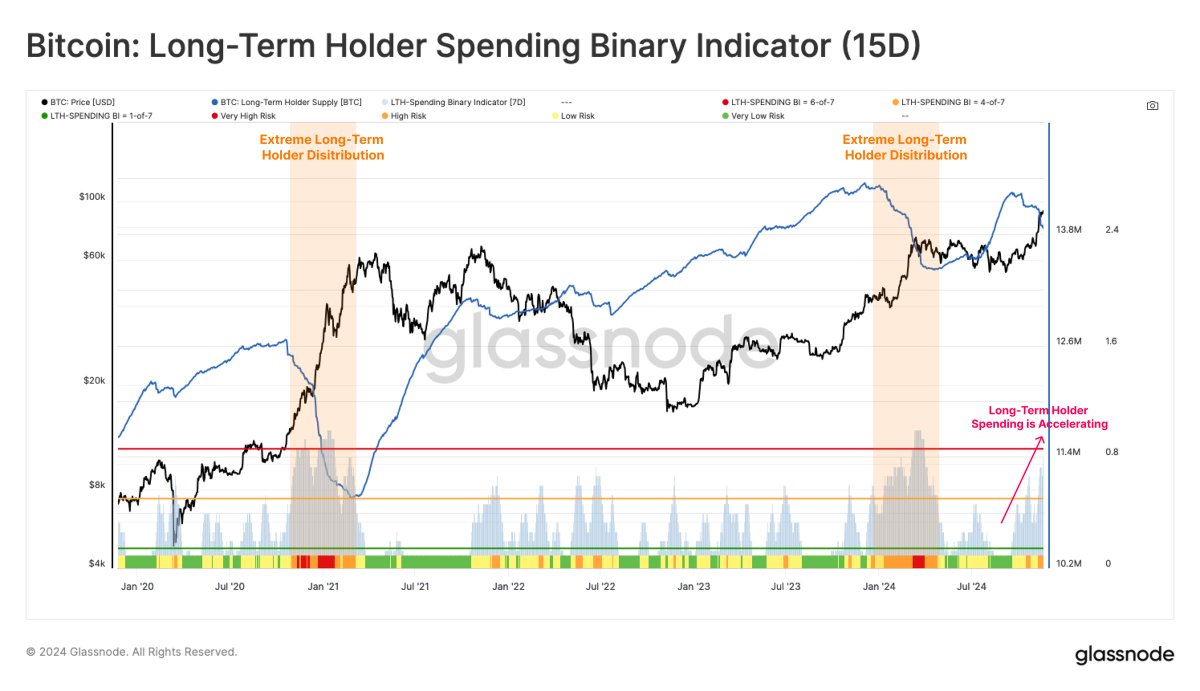

One of many rationales behind this projection lies within the latest conduct of an investor cohort referred to as the Lengthy-term holders (LTH). In accordance with Glassnode, the long-term holders are starting to dump their belongings for earnings and could also be ready to promote extra cash as the worth motion continues to develop robust.

Supply: Glassnode/X

Primarily based on information from the LTH Spending Binary Indicator, which tracks the depth of the sell-side stress of the long-term holders, these main buyers have been more and more distributing their belongings. This Spending Binary metric reveals that the LTH steadiness has declined on 11 of the final 15 days.

Whereas the demand from institutional investors, particularly by way of the US spot exchange-traded funds (ETFs), has absorbed 90% of the sell-side stress from long-term buyers, Glassnode famous that the spending stress of this investor cohort has begun to outpace ETF web inflows in latest days. This sample was additionally observed earlier in February 2024.

In accordance with Glassnode, if the sell-side stress continues to outpace the ETF demand, it might end in short-term worth volatility or result in worth consolidation. The on-chain agency mentioned:

Nevertheless, since 13 November, LTH sell-side stress has begun to outpace ETF web inflows, echoing a sample noticed in late February 2024, the place the imbalance between provide and demand led to elevated market volatility, and consolidation.

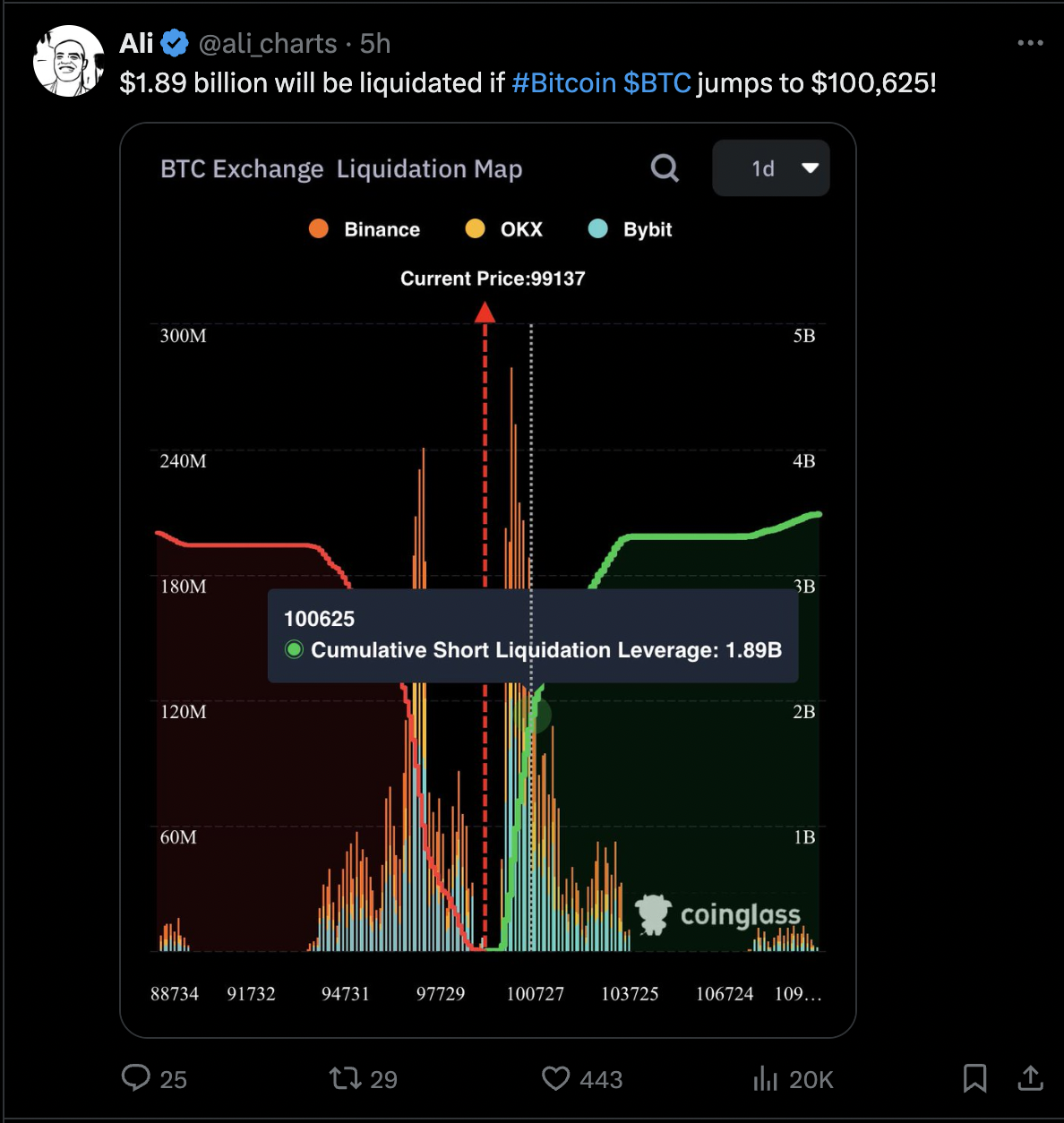

$1.89 Billion To Be Liquidated If Bitcoin Value Crosses This Stage

In a November 22 publish on X, distinguished crypto analyst Ali Martinez sounded a warning to the Bitcoin bears. In accordance with information from CoinGlass, a large $1.89 billion seems set for liquidation if the Bitcoin worth hits $100,625.

Supply: Ali_charts/X

As of this writing, the premier cryptocurrency is valued at $99,424, reflecting a 1.4% worth improve prior to now day. Information from CoinGecko reveals that the Bitcoin worth has been on a way more spectacular run on the weekly timeframe, surging by almost 10% prior to now seven days.

The value of Bitcoin on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView