Bitcoin price is again within the inexperienced and rising above assist at $30,000 towards the tip of the Asian session on Tuesday. The pioneer cryptocurrency had slipped barely beneath $30,000 and traded a July low at $29,705 over the weekend, however bulls swept by means of recent liquidity, including credence to the bullish momentum.

After 24 hours of an intense tug-of-war between the bulls and bears for dominance at $30,000, BTC is up 1.1% to $30,500. Bitcoin boasts $592 billion in market capitalization and $15 billion in buying and selling quantity, in line with worth knowledge by CoinGecko.

Bitcoin Worth Bulls Get up head of Wednesday CPI Information Launch

Varied jobs experiences during the last week stored Bitcoin and crypto generally depressed. Market individuals at the moment are ready to see how the bellwether crypto will react to Wednesday’s launch of the US June Client Worth Index (CPI) together with the Producer Worth Index (PPI) popping out on Thursday.

Traders are anticipating declines within the inflation knowledge, which has sustained a downtrend since Could. The identical declines will validate the Federal Reserve’s resolution to pause rate of interest hikes, briefly making use of brakes on its intent to hike rates of interest by 25 foundation factors (bps).

Whereas the tight financial coverage has helped cut back the CPI from 9% posted in August to 4%, in line with Could’s report, economists concern that a bit an excessive amount of stress may topple the US right into a extreme recession.

Market watchers are wanting ahead to a CPI drop to the three% vary in June, with some, just like the senior market analyst at Oanda, a foreign exchange market maker, Edward Moya, popping out overly bullish with a projection of two.8%.

Crypto traders, alternatively, could be routing for a major drop within the CPI index, as it can justify the Fed’s resolution to maintain halting rate of interest hikes. Threat markets like Bitcoin and shares depend upon inflation happening to maintain traders’ danger urge for food increased.

Bitcoin Worth Battles Each Micro and Macro Forces

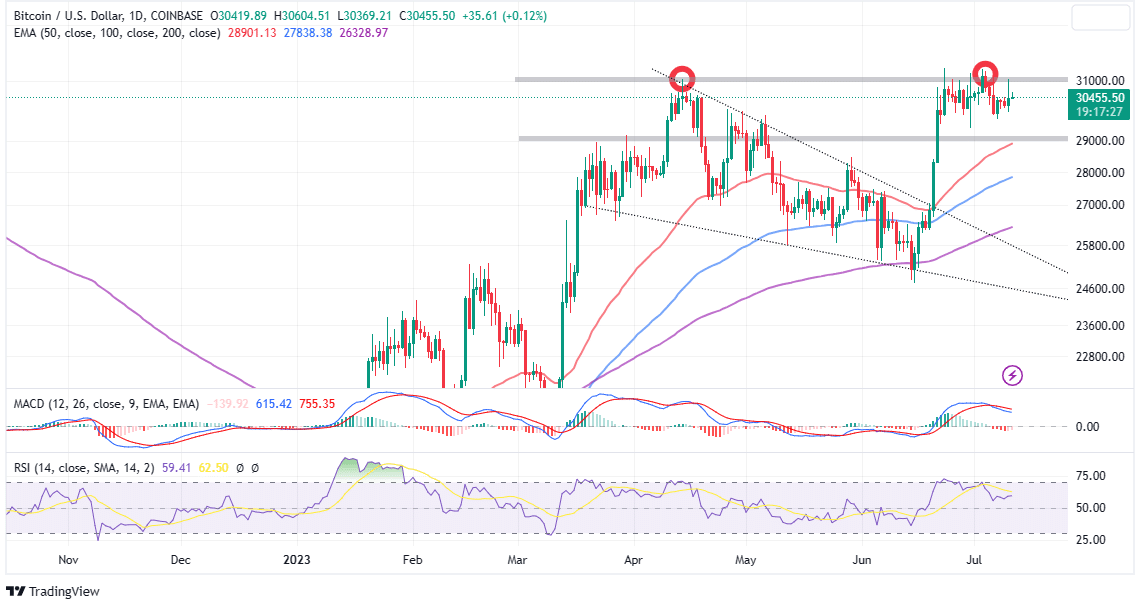

A raft of jobs experiences from final week restricted worth actions within the crypto market, with Bitcoin worth consolidating between $30,000 and $31,000. This sluggish worth motion introduced into the image a double-top sample, which bulls should battle in any respect prices to maintain the uptrend intact. In any other case, BTC dangers plunging to $25,000 with the opportunity of sweeping by means of a lot decrease liquidity at $20,000.

A double-top sample reveals a doable reversal of an uptrend. It kinds when Bitcoin price reaches a high point, falls again, after which rises once more to the identical or practically the identical stage, forming two peaks.

Merchants could be searching for affirmation when the worth breaks beneath the assist stage that connects the lows between the peaks ($30,000), signaling that the patrons have misplaced momentum and the sellers have taken over.

The double-top sample helps to establish potential exit factors for his or her lengthy positions or entry factors for brief positions. Merchants can also use indicators comparable to quantity, transferring averages, or oscillators to substantiate the sample and gauge the power of the reversal.

That stated, the Transferring Common Convergence Divergence (MACD) indicator dons a promote sign on the identical day by day chart. Subsequently, the Relative Energy Index (RSI) reveals that bears could have a major affect on Bitcoin worth, particularly if the U.S. CPI knowledge doesn’t drop as anticipated.

If bulls push by means of the double-top sample resistance at $32,000, bolstered by constructive inflation knowledge, investor danger urge for food for Bitcoin and crypto could soar, with BTC triggering a rally to $35,000 and $38,000.

Associated Articles

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.