Bitcoin value trades beneath the present short-term common BTC realized price of $62.6k, a key assist degree throughout the bull market. Merchants expect huge volatility amid the US PCE inflation knowledge and quarterly choices expiry setting the stage for market path within the coming days. Will BTC value drop to $55k or get better to $65k within the subsequent few days?

Bitcoin Merchants Search for Cues

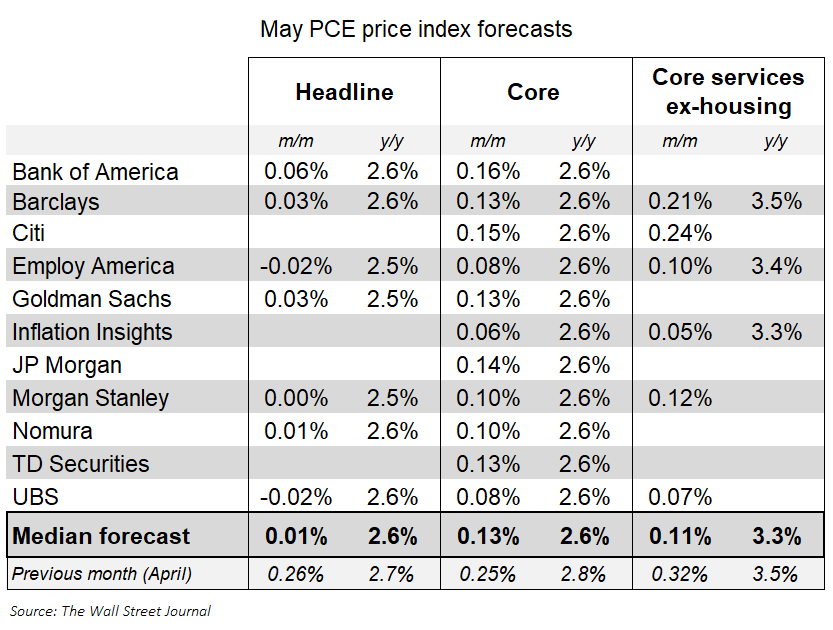

The Federal Reserve’s most popular gauge to measure inflation PCE and core PCE got here in line final month, however Wall Road giants resembling JPMorgan, Goldman Sachs, and Morgan Stanley anticipate inflation to chill, with the Fed price lower beginning in September.

Within the new estimates, all banks see headline PCE inflation slowing to 2.5% from 2.7%. Additionally, core PCE inflation to additional cool to 2.6% from 2.8%. Markets are already shifting larger because of excessive hypothesis on Fed price cuts as inflation globally cools and the Fed probably follows different central banks in price cuts quickly.

Nonetheless, IMF Managing Director Kristalina Georgieva on Thursday mentioned “The Fed ought to hold coverage charges at present ranges till no less than late 2024.” She added that there are ongoing upside dangers to inflation because of strong US financial development. The sturdy US labor market is the important thing issue behind the delay in price cuts. The IMF is extra optimistic than the Fed about hitting the two% goal price by mid-2025, which is forward of the Fed’s personal projection for 2026.

Analyst Says BTC Value Danger Falling to $55k

Markus Thielen, CEO of crypto market analysis agency 10x Research, predicts a drop in BTC value to $55k. He cited 10 components together with the double prime sample in BTC value which will push Bitcoin crashing to $55k.

Different causes that threat an enormous downfall in BTC value are weekly RSI declining regardless of buy-the-dip by traders, lack of institutional shopping for as seen in spot Bitcoin ETFs, and rising promoting strain because of macro.

In the meantime, the US greenback index (DXY) is dropping from 106.12 forward PCE, with the present studying at 105.91. The US 10-year Treasury yield jumped above 4.3% as US president Joe Biden and his predecessor Donald Trump clashed of their first presidential debate. Bitcoin strikes reverse to DXY and Treasury yields, and the present knowledge indicated volatility and uncertainty.

Additionally Learn: Will Solana And Ether Outperform Bitcoin In Near Term Amid ETF Hype?

Bitcoin Choices Information Exhibits Shopping for Exercise

The Lengthy-Time period Holders (LTH) on-chain knowledge and whales promoting their BTC holding additionally at present pointing to a excessive strain available in the market, as reported by CoinGape.

Nonetheless, Bitcoin options knowledge point out a transition towards restoration amid a rising name open pursuits, as per Deribit. Regardless of the massive market fluctuations, the IV of Bitcoin has not witnessed a major improve. The IV of BTC for every main time period is beneath 50%. CoinGlass knowledge additionally point out a complete improve in choices open curiosity.

Spot Ethereum ETF launch subsequent can avert an enormous dropdown in BTC value as sentiment improves slowly. Buyers should search for a rise in buying and selling volumes, however a sudden restoration to $65k is difficult.

BTC price jumped 1% prior to now 24 hours, with the worth at present buying and selling at 61,291. The 24-hour high and low are $60,561 and $62,292, respectively. Moreover, the buying and selling quantity has elevated by 3% within the final 24 hours.

Additionally Learn: Bitcoin Miner Capitulation Ended? On-Chain Data Signals Market Recovery

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: