The Bitcoin (BTC) worth has suffered large promoting strain dropping all the best way to $53,500 on Monday amid the huge sell-off by the German authorities in addition to the Mt. Gox’s creditors’ repayment. After yesterday’s crash, the Bitcoin price has recovered to $57,500 as of press time with a few of the on-chain metrics displaying energy for Bitcoin going forward.

Bitcoin Peull A number of Flashes Bull Run Forward

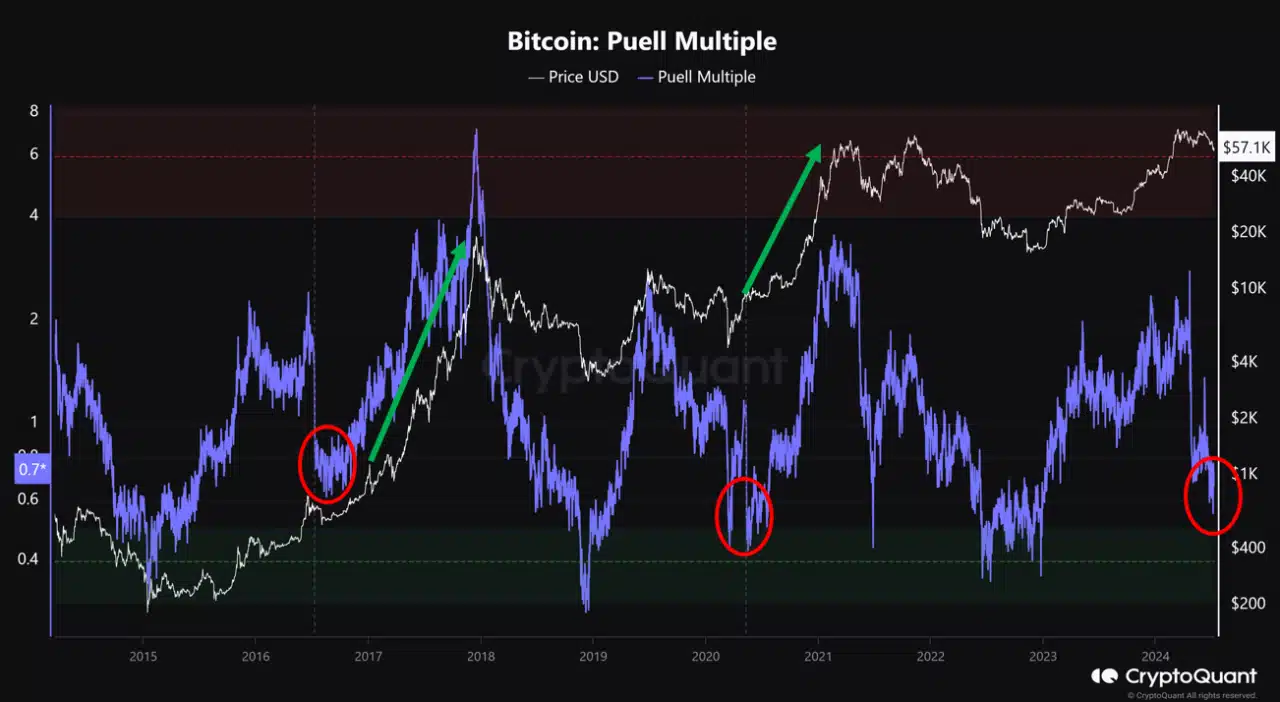

Onc-hain knowledge supplier CryptoQuant leverages the Bitcoin Peull A number of to determine the underside of the bear market in addition to sign the tip of the correction interval within the bull market.

Traditionally, the Puell A number of has fallen considerably throughout bull cycles, akin to in 2016 and 2020, adopted by robust rises in Bitcoin’s worth. Crimson-circled areas on the chart spotlight cases the place miners’ profitability dropped quickly, resulting in a plummet on this indicator.

This time in 2024, related patterns have been rising suggesting that the tip of the correction on this bull market may very well be close to. Consequently, CryptoQuant expects the beginning of the bull run on this third quarter.

The final month of June noticed large Bitcoin miner capitulation because the profitability for the miners dropped by a staggering 7.8%, at ranges not seen for the reason that April halving occasion. The BTC miners’ each day income has plummeted all the best way to $26 million, from a staggering $78 million earlier than the halving occasion.

Additionally Learn: Bitcoin Miner Bitfarms Appoints New CEO Amid Riot Takeover Bid

BTC Holding Wallets Drop Amid Market Volatility

On-chain knowledge supplier Santiment reported that there’s a drop within the non-empty Bitcoin wallets, presently standing at 54.09 million. Since June 15, the online lower in these wallets is 566,000.

Santiment reported that the discount is a constructive signal for affected person buyers. this drop in wallets is mainly because of the liquidation by impatient holders aka weak arms. As per Santiment, this usually displays market bottoms brought on by worry, uncertainty, and doubt (FUD). related patterns have been noticed earlier in January, suggesting potential shopping for alternatives.

Santiment additional experiences that the 30-day and 365-day Bitcoin MVRV indicators are each in destructive territory.

This case signifies a shopping for alternative, because it exhibits that present purchases are being made when different merchants are experiencing losses.

Santiment highlights that the final time each MVRV ratios have been destructive, buyers who purchased Bitcoin then would have seen a 132% return.

Additionally Learn: German Govt Bags 3673 Bitcoin After Massive Dump

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: