A sudden transfer by a big holder and deep-pocketed early homeowners are being linked to a pointy wobble in Bitcoin costs this week.

Associated Studying

Outdated Whales Maintain Deep Revenue

In response to Willy Woo, provide is tightly held by OG (“original gangster”) whales who constructed large positions round 2011 when Bitcoin traded at about $10.

He warned that the hole in price foundation makes a distinction: it now takes roughly $110,000 of contemporary capital to soak up every Bitcoin these holders select to promote.

That math, he says, helps clarify why worth motion has been sluggish whilst general market curiosity grows.

In response to market observers, a single whale’s rotation from Bitcoin into Ether helped set off a speedy sell-off that briefly knocked roughly $45 billion off Bitcoin’s market cap.

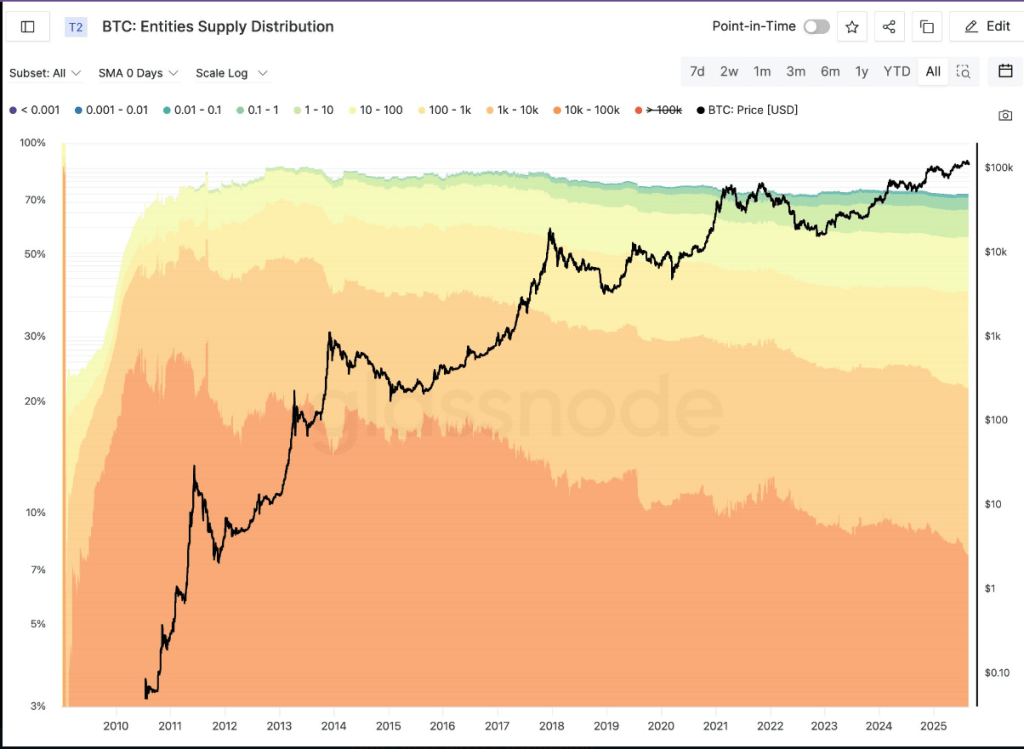

Why is BTC transferring up so slowly this cycle?

BTC provide is concentrated round OG whales who peaked their holdings in 2011 (orange and darkish orange).

They purchased their BTC at $10 or decrease. It takes $110k+ of recent capital to soak up every BTC they promote. pic.twitter.com/7CbWXsvX2l

— Willy Woo (@woonomic) August 24, 2025

Flash Crash Unfolded Rapidly

Based mostly on reviews, Bitcoin slid from $114,500to $112,980 in 9 minutes, briefly touching $112,050, CoinMarketCap data exhibits.

Ether fell 3.8% in the identical window, dropping from $4,925 to $4,680. Costs later recovered about half of these losses. Merchants level to a series of transfers that set the transfer off.

Whale Rotations And Giant Transfers

Blockchain.com information present that roughly 24,000 BTC — about $2.7 billion on the time — was despatched to the decentralized perpetuals platform Hyperliquid throughout six transfers starting Aug. 16.

Of that sum, 18,142 BTC has been bought and far of the proceeds have been rotated into 416,590 ETH, an analyst often known as MLM reported. A bit of these ETH — 275,500 — was staked, price about $1.3 billion.

Strategic Positioning And Large Positive factors

It was additionally reported that the whale took on massive leveraged positions, longing 135,260 ETH on Hyperliquid for a complete publicity close to 551,861 ETH, valued at greater than $2.6 billion.

That arrange a commerce that netted round $185 million, in response to the identical analyst. The longs boosted ETH prices as different merchants adopted the flows, and when the whale started closing positions, speedy reversals led to cascading promote orders.

Associated Studying

Forces At Work

Experiences have disclosed the whale nonetheless controls 152,874 BTC throughout a number of addresses, and people funds initially moved off an trade about six years in the past.

Market watchers say there are two forces at work: long-dormant holders sitting on large unrealized good points, and energetic merchants utilizing massive rotations to seize short-term strikes.

If extra of the 152,874 BTC strikes to market, sellers might check demand once more. Then again, the quantity of ETH being staked factors to a minimum of some longer-term intent from large gamers.

Featured picture from Meta, chart from TradingView