In response to the newest on-chain knowledge, traders have been excessively betting on the Bitcoin value in current weeks, resulting in its total struggles.

Longs Vs Shorts Imbalance — How This Induced Value Crash

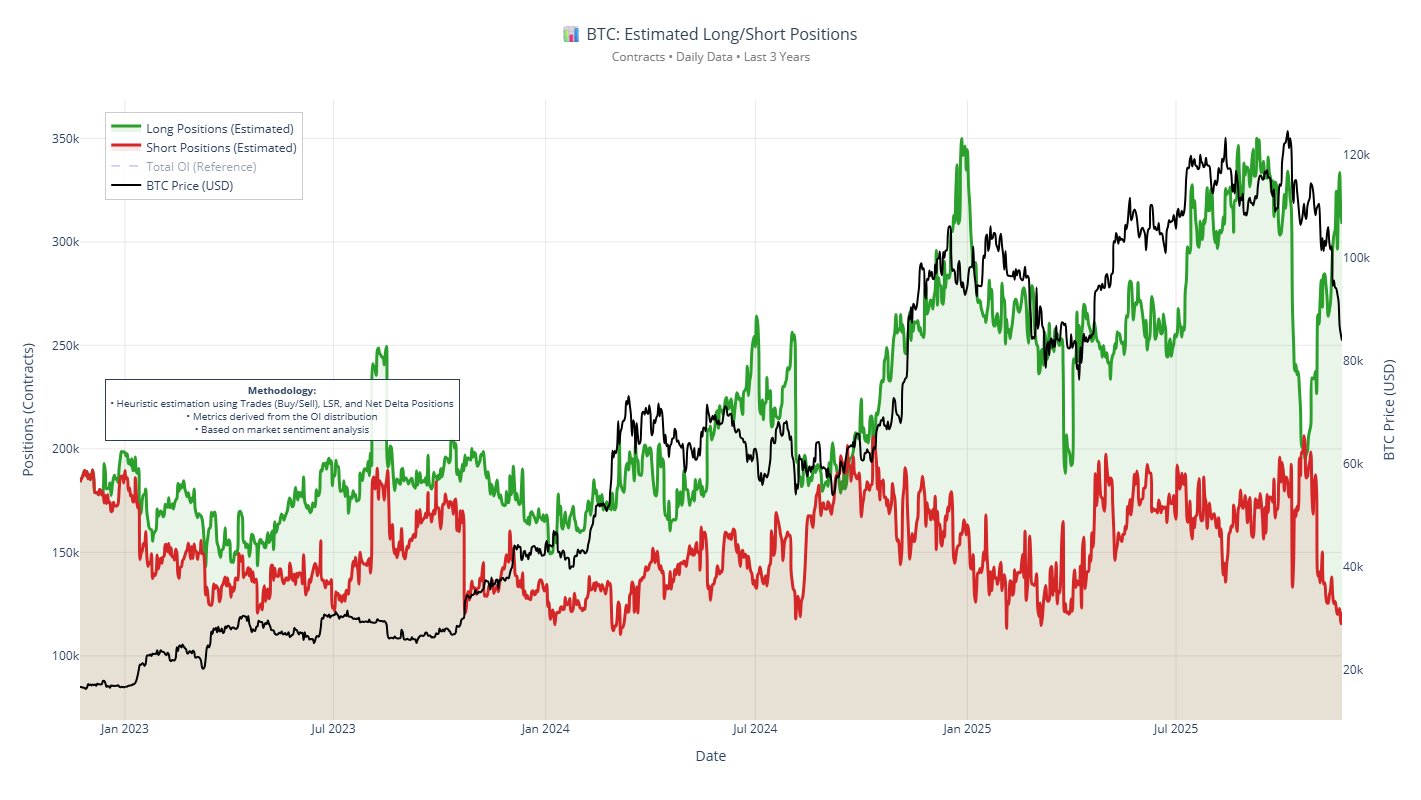

In a November 22 submit on social media platform X, Alphractal CEO and founder Joao Wedson revealed the underlying dynamics behind Bitcoin’s current unchecked fall. In deciphering this downward pattern, the crypto pundit evaluated the Estimated Lengthy/Brief Positions metric, which estimates how a lot of the Open Curiosity throughout exchanges is devoted to lengthy positions relative to brief positions.

Wedson reported that, throughout 19 exchanges, there are about 71,000 BTC positioned in longs, whereas a comparatively smaller quantity of BTC (27,900) is devoted to shorts. Whereas this commentary doesn’t embody knowledge from the Chicago Mercantile Alternate (CME), the discrepancy between longs and shorts stays unusually massive.

Associated Studying

This imbalance is critical as a result of when there are clusters of lengthy positions at related value ranges, the market tends to lean right into a extra fragile state. Average pullbacks beneath these clusters typically result in a cascade of pressured liquidations (generally known as an extended squeeze) — an occasion which may in flip push costs additional south.

Notably, Wedson identified that merchants should have been satisfied that $100,000 was Bitcoin’s value backside — a hypothesis that quickly grew to become null after its failure. Afterwards, $90,000 got here into focus, with one other collection of liquidations following swimsuit. For the time being, $84,000 seems to be the price majority of Bitcoin’s speculative merchants goal as the brand new value backside.

These liquidation occasions that came about after the $100,000 and $90,000 helps have been breached offered extra buy-side liquidity for the Bitcoin value to topple. On the identical time, most important brief positions have been closed off, making it tough for a extra outlined value restoration to happen, as there’s barely any sell-side liquidity to ship the Bitcoin value to the upside.

For Bitcoin to get well, Wedson defined that there must be a major lower in lengthy positioning, whereas brief publicity goes on the rise.

Watch Out For $81,250 — Analyst

In one other submit on X, technical analyst Ali Martinez noted that Bitcoin’s 2-year transferring common, which stands at roughly $81,250, is a crucial landmark for the long run trajectory of the flagship cryptocurrency.

The analyst defined that historic failures of the 730-day SMA have typically marked the beginnings of bear markets. Thus, within the state of affairs the place the Bitcoin value slips previous its present 2-year common value, we could possibly be witnessing the beginning of an extended bearish cycle

As of press time, Bitcoin holds a valuation of $86,251, reflecting an over 3% value soar previously 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView