Bitcoin edged increased at present, breaching the important thing $119,000 mark, after a string of regular periods, lifting costs above latest ranges and drawing recent consideration from huge buyers.

Associated Studying

Based on Coinglass knowledge, BTC rose about 2.50% within the final 24 hours, and is up 8% during the last seven days. Buying and selling exercise and inflows are being watched carefully as merchants dimension up the following transfer.

Institutional Flows Drive Momentum

Knowledge exhibits the highest crypto asset registered a second straight day of robust inflows, placing $430 million into Bitcoin spot ETFs. That type of demand helps clarify why Bitcoin’s market worth has jumped from $870 billion to $2.34 trillion this yr.

Analysts say that regular institutional shopping for has been a key engine behind the rally, and continued flows might hold momentum alive.

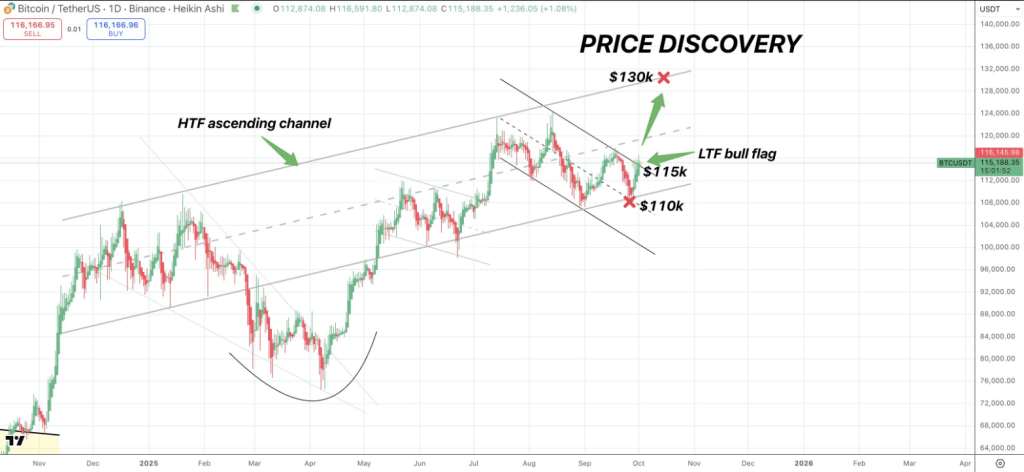

$BTC/usdt DAILY$BTC breaking out of LTF consolidation @ $115k throughout the HTF ascending channel we’ve been in all of 2025

$130k is the last word breakout level and will result in the cycle blow off prime 🎯 pic.twitter.com/1J9rSc7BJO

— Satoshi Flipper (@SatoshiFlipper) October 1, 2025

Value Ranges And Targets In Focus

Resistance zones are being examined. Close to-term hurdles sit at $118,500 and $119,800, with a detailed goal at $120k if patrons keep in management.

Analyst Satoshi Flipper identified that BTC seems to have constructed a base above the $115,000 space and is holding a better time-frame construction, including {that a} long-term breakout goal sits close to $130,000.

Consumers prolonged the climb previous $118k, and that transfer is being cited as an indication that demand stays current above present ranges.

On-Chain Alerts And Volatility

Based on Coinglass, buying and selling quantity rose 12% to just about $95 billion for the day, whereas Open Curiosity elevated 4.46% to $84 billion.

The OI weighted funding charge got here in at 0.0050%. Liquidations present the market can nonetheless transfer shortly: $157.08 million in positions had been wiped prior to now day, with shorts accounting for $136 million and longs $20 million.

A bullish MACD crossover has been confirmed on some timeframes, and the RSI sits at 58% — ranges that recommend extra room to climb however not runaway overheated circumstances.

Seasonal Patterns Add To The Optimism

Based mostly on reviews and previous knowledge, October has a historical past of robust efficiency — “Uptober” exhibits a mean achieve of 20%. September registered a 5% rise, and the third quarter closed with 6% in keeping with Coinglass.

The fourth quarter’s common return has traditionally been giant, at 78%, which is why some market contributors are optimistic heading into the ultimate months of the yr.

Consumers stay energetic, however the path up will not be easy. A transparent push above $120,000 can be a helpful sign that new highs may observe, whereas a stumble into the liquidity clusters might pressure a fast pullback.

Associated Studying

Market contributors are balancing on-chain flows, seen technical ranges, and recognized seasonal patterns as they determine their subsequent steps.

Featured picture from Unsplash, chart from TradingView