On-chain knowledge exhibits the Bitcoin short-term holder conduct has continued to show divergence from the value in current weeks.

Bitcoin Brief-Time period Holder SOPR Continues To Transfer Principally Sideways

As identified by an analyst in a CryptoQuant post, whereas the value has gone down lately, short-term holders have as an alternative made extra income.

The related indicator right here is the “Spent Output Profit Ratio” (SOPR), which tells us whether or not the common Bitcoin investor is at the moment promoting at a revenue or at a loss.

When the worth of this metric is larger than 1, it means the holders as an entire are shifting cash at some revenue proper now. Then again, the SOPR being under the edge suggests the general market is realizing an quantity of loss in the intervening time.

Naturally, the indicator having values precisely equal to 1 implies the market members are simply breaking-even on their promoting at the moment.

Now, there’s a cohort within the BTC market referred to as the “short-term holders” (STHs), which incorporates all buyers who’ve been holding their cash since lower than 155 days in the past.

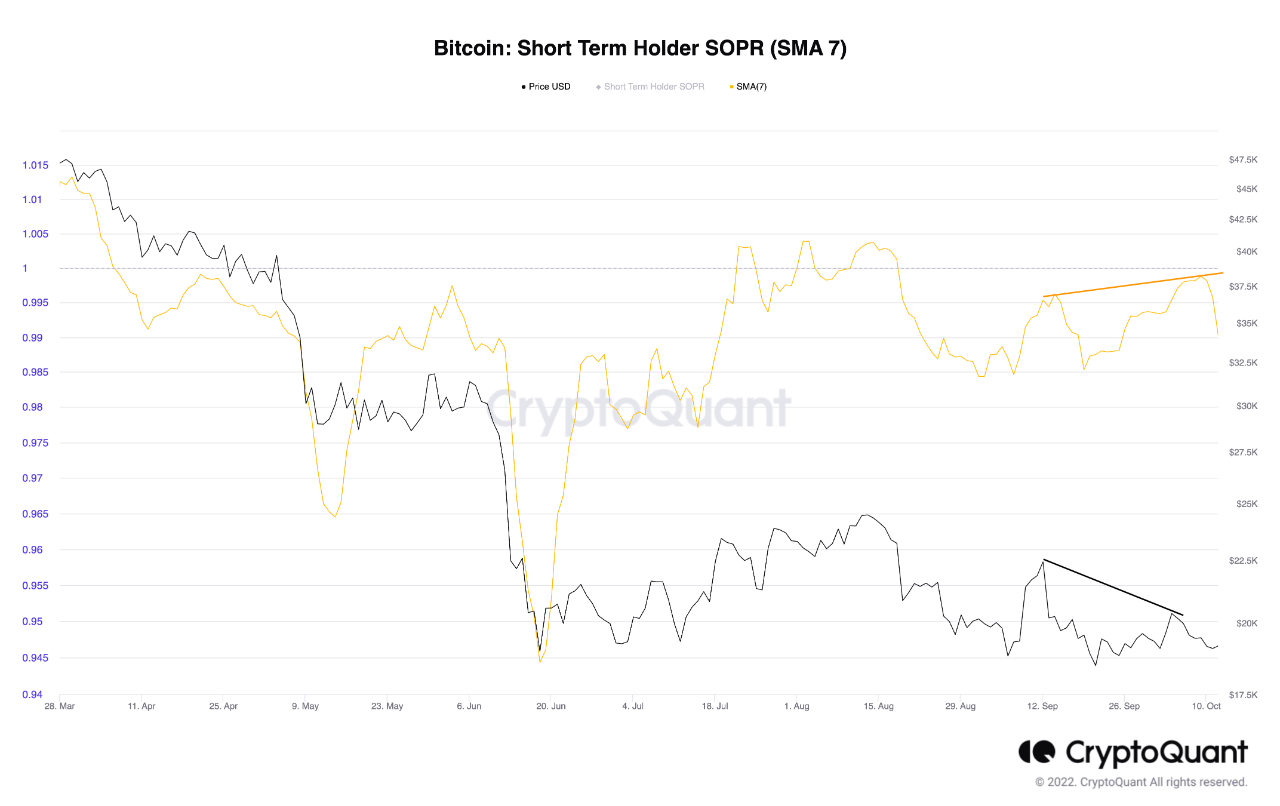

Here’s a chart that exhibits the pattern within the 7-day shifting common SOPR particularly for this Bitcoin holder group:

Seems like the worth of the metric bounced off the 1 mark lately | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin short-term holder SOPR is within the area under 1 proper now, which means that these buyers have been promoting at a loss lately.

The metric has in actual fact been trapped on this zone for a number of months now, because the 1 stage has been offering resistance to it on this interval.

Throughout the Could and June crashes, the indicator’s worth spiked down as STHs capitulated and offered at heavy losses. Nonetheless, in current months, whereas the value has gone down (albeit steadily), the STH SOPR hasn’t proven any indicators of comparable capitulation.

The quant has marked this divergence within the chart. Relatively than STHs going into deeper losses on account of the value declining, they’ve really been promoting at fewer losses in current weeks as their SOPR has been climbing as much as values near 1.

BTC Value

On the time of writing, Bitcoin’s price floats round $19.1k, up 1% within the final week. Over the previous month, the crypto has gained 4% in worth.

The under chart exhibits the pattern within the worth of the coin over the past 5 days.

The worth of the crypto appears to have been persevering with its limitless consolidation in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, charts from TradingView.com, CryptoQuant.com