In line with on-chain information, present Bitcoin SOPR development suggests the market could also be nowhere close to the value backside.

Bitcoin SOPR Nonetheless Some Distance Above The “One” Degree

As identified by an analyst in a CryptoQuant post, the BTC SOPR hints there could also be some methods to go nonetheless earlier than a backside kinds.

The “spent output profit ratio” (or SOPR briefly) is an indicator that tells us whether or not buyers are promoting at a revenue or a loss proper now.

The metric works by evaluating the historical past of every coin on the chain to see which worth it was final moved at. If this worth was lower than the present worth (that’s, the promoting worth), then the coin offered at a revenue.

Then again, the final worth being greater than the present one would suggest the investor realized a loss on this coin.

Associated Studying | On-Chain Data: Bitcoin Whales Buy The Dip As BTC Drops To $39k

When SOPR has a worth a couple of, it means the general market is making a revenue in the intervening time. Whereas ratio values under the brink suggest a realization of losses.

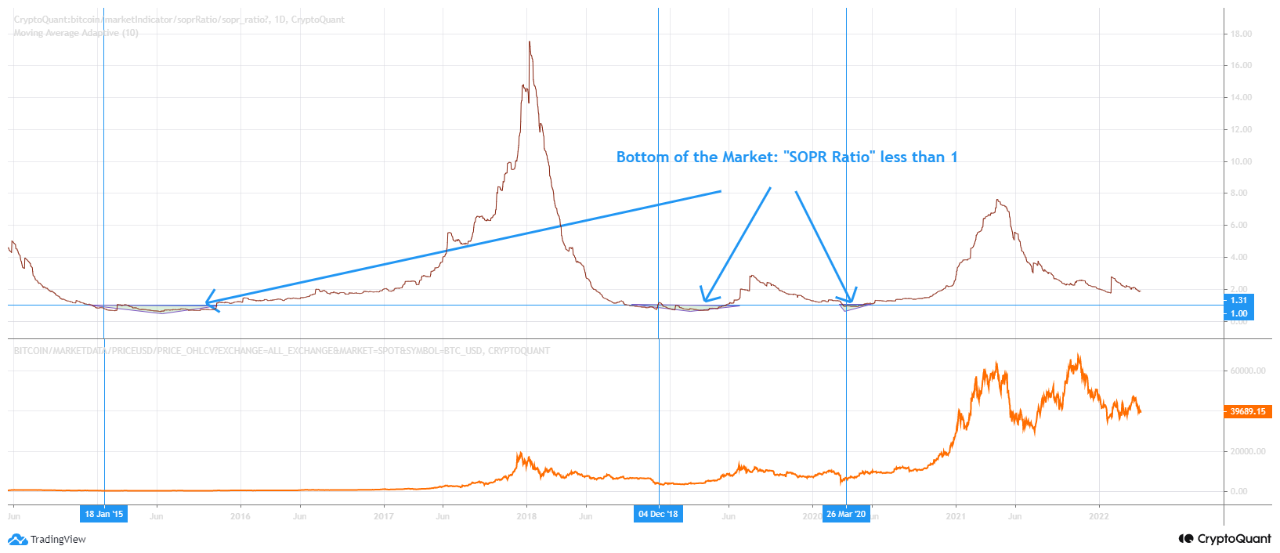

Now, here’s a chart that reveals the development within the Bitcoin SOPR over the previous few years:

Seems just like the indicator's worth is above 1 proper now | Supply: CryptoQuant

Within the above graph, the quant has marked the details of development. It looks as if bottoms have traditionally fashioned every time the Bitcoin SOPR has dipped under the worth = 1 mark.

The importance of this “one” stage is that buyers are simply breaking even at this level. The worth drops any additional and they’re promoting at a loss.

Relate Studying | TA: Bitcoin Recovers Losses But Here’s Why $41.5K Could Prevent Gains

After capitulation, there aren’t many sellers left available in the market usually, therefore why a backside kinds throughout such intervals.

Now, trying on the present development, it looks as if the worth of the Bitcoin SOPR is round 1.31 proper now. That is nonetheless a bit above the 1 stage, which may recommend there could also be extra draw back within the retailer for the crypto earlier than a brand new backside formation takes place.

Nonetheless, it’s additionally doable the value may even see a short lived rebound right here, because it already did as soon as earlier within the yr round an identical SOPR worth.

BTC Worth

On the time of writing, Bitcoin’s price floats round $40.7k, up 1% within the final seven days. Over the previous month, the crypto has misplaced 3% in worth.

The under chart reveals the development within the worth of the coin during the last 5 days.

BTC's worth seems to be to have surged up over the previous twenty-four hours | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com