Bitcoin slipped on Friday after a short run increased, and a few market watchers say the transfer may drive a policymaker response. Primarily based on experiences, Bitcoin was buying and selling at about $113,240, down 3.4%, on August 22, 2025.

Associated Studying

Crypto Analyst Flags Inflation Danger

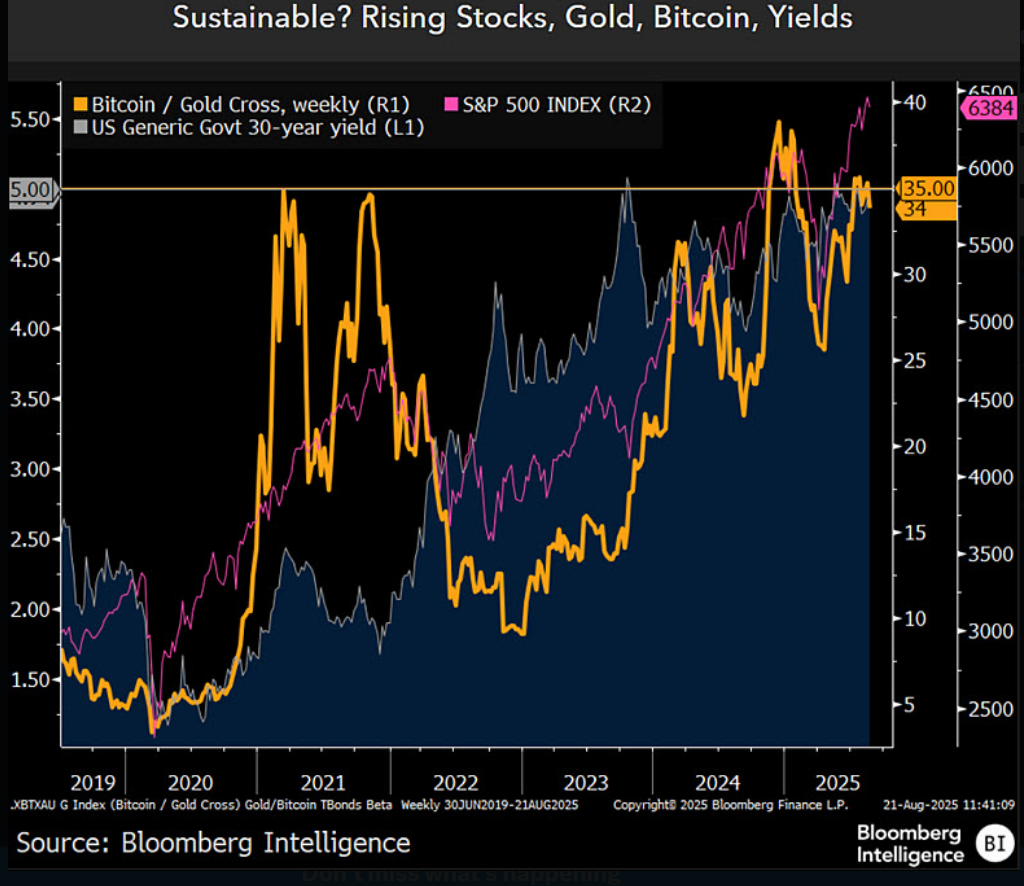

In line with Bloomberg Intelligence strategist Mike McGlone, the simultaneous rise in equities, Treasury yields, gold and Bitcoin appears to be like unstable and will push inflation increased if it continues.

He warned that stronger risk-asset good points would possibly nudge the Federal Reserve towards tighter coverage, not easing, which might be the alternative of calls from US President Donald Trump to loosen coverage this 12 months.

Stories have famous that Bitcoin fell from a neighborhood excessive of $120,050 to roughly $112,990, a decline of about 6% since final Friday, and that the crypto misplaced simply over $1,000 in just a few hours throughout the transfer.

A Lot Could Be Driving on Bitcoin/Gold Going Up –

The simultaneous rise in equities, Treasury bond yields, Bitcoin and gold seems unsustainable, and at a minimal due for some volatility post-summer doldrums. A state of affairs my graphic highlights is that if threat belongings hold rising,… pic.twitter.com/7xCLbw7DXy— Mike McGlone (@mikemcglone11) August 22, 2025

Worth Motion And Market Strikes

Markets reacted shortly. Some merchants booked earnings after the spike, and others trimmed positions forward of key Fed commentary at Jackson Gap.

The pullback was not excessive by historic requirements, but it surely reveals how shortly sentiment can change. Markets have been watching Treasury yields and Powell’s feedback intently, since these alerts assist resolve whether or not threat belongings will hold drawing contemporary cash.

What The Numbers Imply For Buyers

Primarily based on experiences, the latest fall understates how a lot volatility persists in crypto. A 6% transfer in just a few days is regular for Bitcoin’s historical past, but it nonetheless issues for large holders and funds that transfer cash out and in shortly.

Some assist ranges round $112,000 had been being watched by crypto tacticians, whereas merchants mentioned draw back safety would possible be examined if yields proceed increased.

Associated Studying

Analysts’ Worth Targets

Analysts are break up on the place Bitcoin goes from right here. Bernstein strategists, for instance, have floated a state of affairs the place Bitcoin may climb as excessive as $200,000 inside months if sure on-chain flows and institutional demand persist.

Different market gamers see a extra modest path, with some guessing at a peak close to $140,000 to $150,000 as probably the most life like upside within the close to time period.

On the similar time, veteran voices like McGlone warn that draw back situations stay attainable if the Fed tightens.

Featured picture from Meta, chart from TradingView