The price of Bitcoin has considerably cooled off, struggling to succeed in the highly-coveted $100,000 mark, after an intense bullish run all week lengthy. Nonetheless, traders look like undeterred by the sluggish worth motion of the premier cryptocurrency previously few days.

Bitcoin Taker Purchase/Promote Ratio Is Rising — Impression On Worth

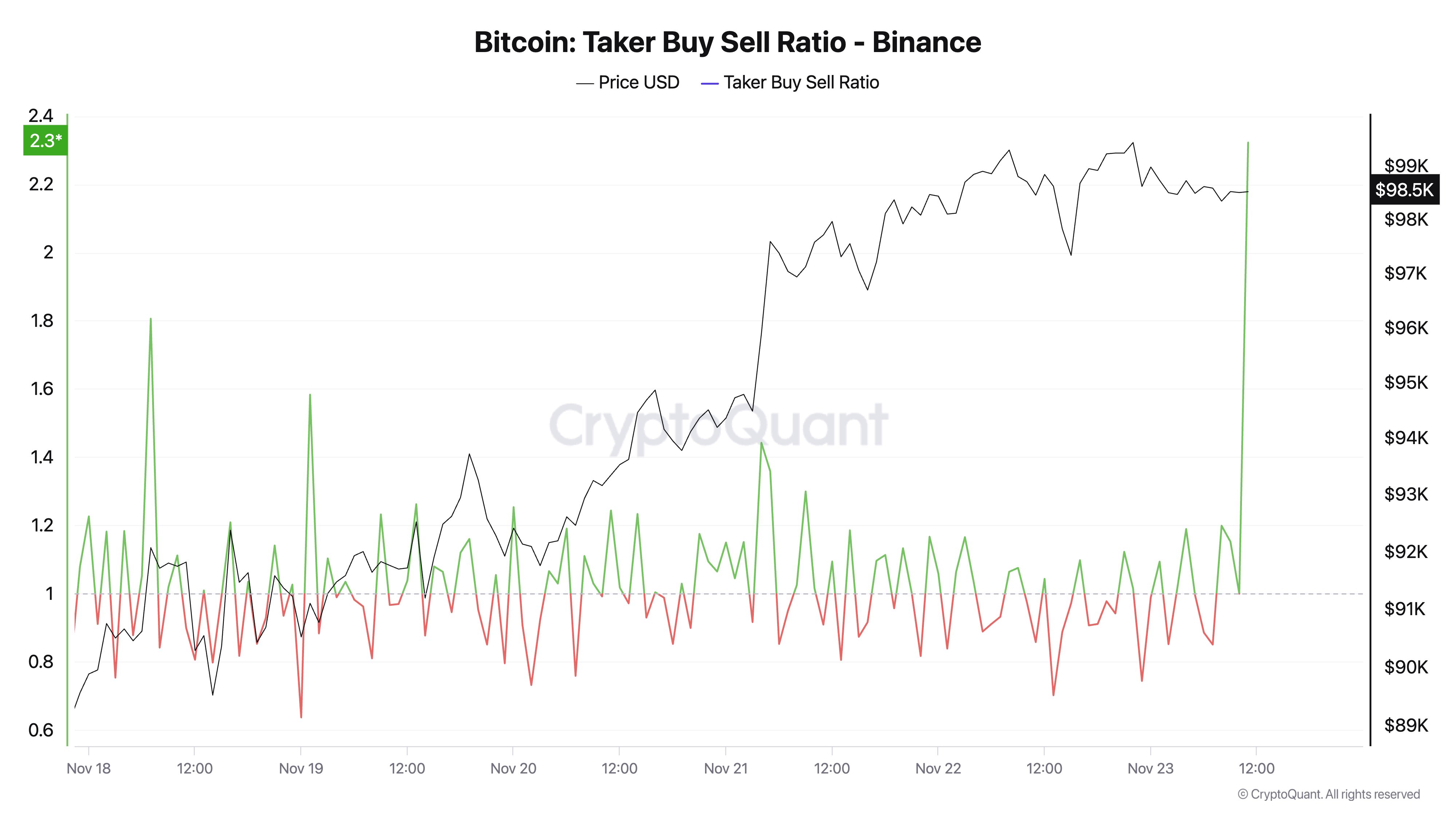

In a November 23 publish on the X platform, outstanding crypto analyst Ali Martinez shared that merchants have taken to loading their luggage with Bitcoin in current days. This on-chain statement is predicated on the “taker purchase/promote ratio,” which tracks the taker purchase and taker promote volumes for a selected cryptocurrency.

A greater-than-one worth of the taker purchase/promote ratio means that the taker purchase quantity is increased than the taker promote quantity. That is normally thought of a bullish sign, which suggests the willingness of traders to pay a better worth for a selected cryptocurrency (Bitcoin, on this case).

Associated Studying

In distinction, when the metric’s worth is lower than 1, it implies that extra sellers are keen to promote their belongings at a lower cost. Sometimes, this means a bearish sentiment amongst traders, because the promoting strain is overshadowing the shopping for strain within the particular market.

Martinez highlighted in his publish on X that the Bitcoin taker buy/sell ratio throughout main buying and selling platforms, together with Binance, OKX, HTX, and Bybit, has witnessed a big surge previously day. As proven within the chart beneath, the metric spiked to a worth of over 28 on Binance, the world’s largest alternate.

Equally, the Bitcoin taker purchase/promote ratio climbed nicely above the 1 threshold, exhibiting the mounting shopping for strain within the open market. This degree of intense shopping for exercise may make sure that the premier cryptocurrency continues its rally towards the $100,000 milestone.

As of this writing, the value of BTC stands round $97,800, reflecting a 1.1% decline within the final 24 hours. However, the flagship cryptocurrency’s performance on the weekly timeframe remains to be spectacular. In keeping with CoinGecko knowledge, BTC is up by almost 8% previously week.

Who Is Shopping for?

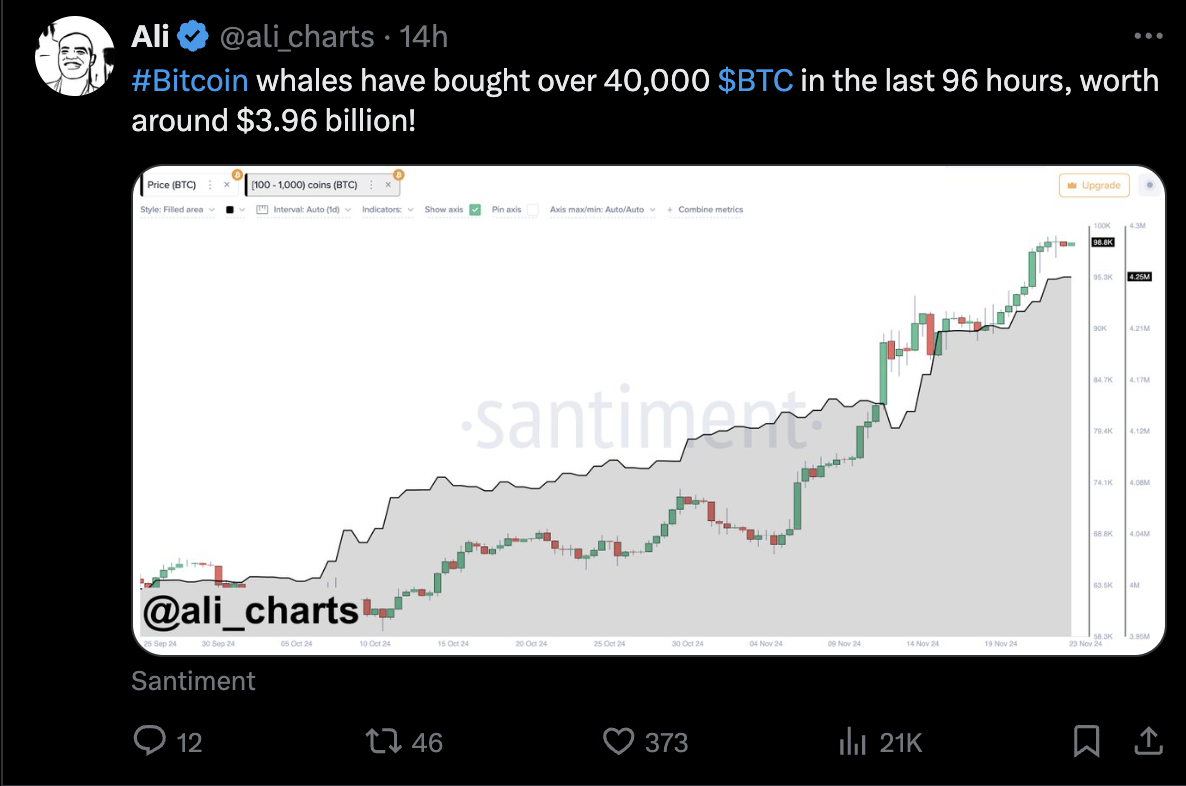

In one other publish on the X platform, Martinez revealed {that a} notable cohort of enormous traders (also referred to as whales) have been lively within the Bitcoin market previously few days. This class of whales concerned listed here are these holding between 100 and 1,000 cash.

In keeping with knowledge from Santiment, whales have bought greater than 40,000 BTC (equal to round $3.96 billion) previously 4 days. Contemplating their affect on market dynamics, this shopping for exercise from the Bitcoin whales may very well be bullish for worth.

Associated Studying

Featured picture from iStock, chart from TradingView