On-chain information reveals the Bitcoin alternate whale ratio has spiked not too long ago, one thing that might result in additional draw back within the asset’s worth.

Bitcoin Change Whale Ratio Has Sharply Surged Lately

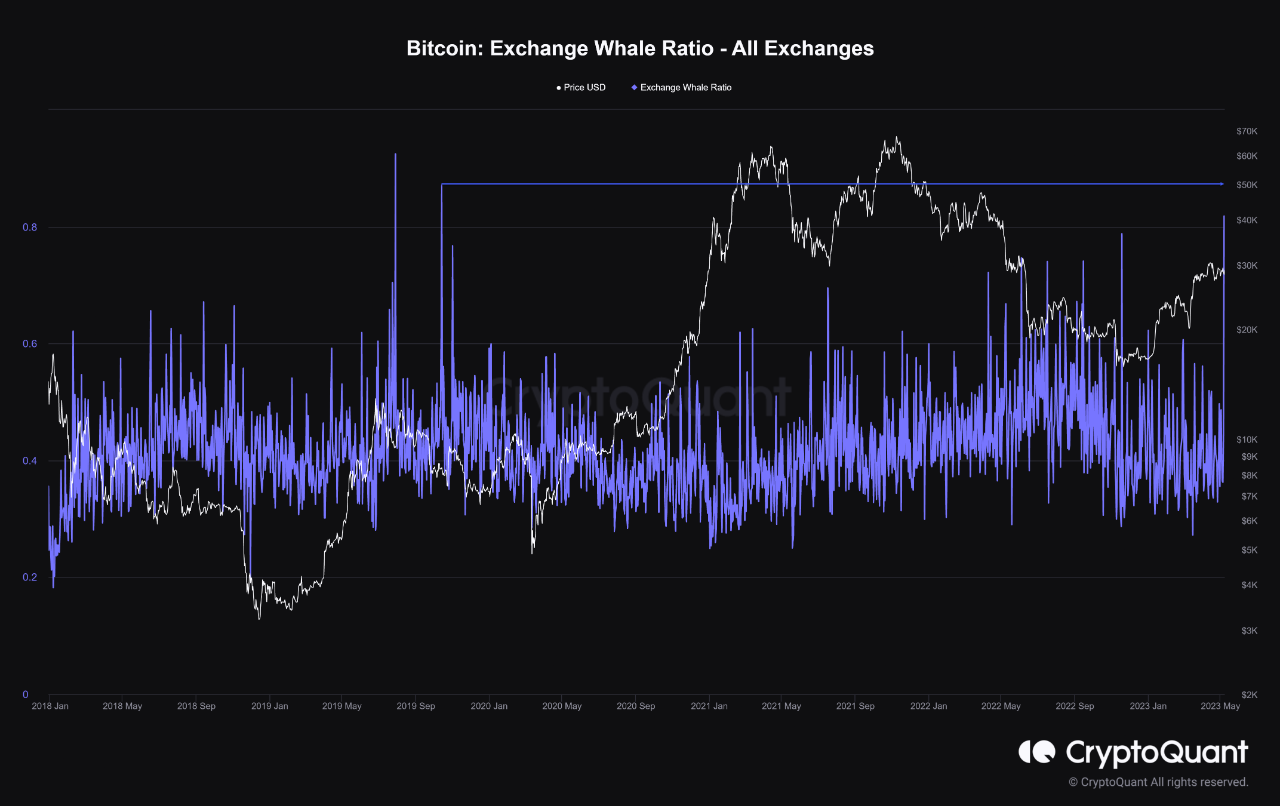

As identified by an analyst in a CryptoQuant post, the alternate whale ratio is presently at its highest degree since September 2019. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the highest 10 inflows to exchanges and the full alternate inflows.

An “exchange inflow” is any motion of Bitcoin in direction of the wallets of centralized exchanges from addresses exterior such platforms (like self-custodial wallets).

The highest 10 inflows right here discuss with the ten largest influx transactions going in direction of these platforms. Usually, these largest transfers are coming from the whales, so the alternate whale ratio can inform us how the influx exercise of the whales presently compares with that of all the market (the full inflows).

When this indicator has a excessive worth, it means these humongous holders are making up a big a part of the full inflows presently. As one of many primary the explanation why traders transfer their cash to exchanges is for selling-related functions, this type of development generally is a signal that whales are promoting proper now.

Then again, low values of the metric indicate this cohort isn’t making too many inflows relative to the remainder of the market. Such a development will be both impartial or bullish for the cryptocurrency’s value, relying on another market circumstances.

Now, here’s a chart that reveals the development within the Bitcoin alternate whale ratio over the previous few years:

Seems like the worth of the metric has been fairly excessive in latest days | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin alternate whale ratio has noticed a fairly large spike not too long ago. This means that whales are making up a moderately giant a part of the full alternate inflows presently.

The metric has crossed the worth of 0.8 on this spike, implying that greater than 80% of the inflows are coming from these humongous traders proper now. This degree of ratio hasn’t been seen out there since manner again in 2019.

This earlier spike of comparable scale occurred as the value was winding down from the April 2019 rally, and shortly after it passed off, Bitcoin registered an extension in its drawdown.

A fair bigger spike within the ratio was additionally noticed earlier in the identical yr, round when the aforementioned April 2019 rally topped out. The timings of those two spikes might recommend that it was the dumping from the whales that influenced the market and brought on the value to go down.

If these earlier cases of whale influx exercise of comparable ranges are something to go by, then the Bitcoin value might face a bearish decline within the close to time period because of the present potential promoting strain from this cohort.

The drawdown might have probably additionally already began, because the cryptocurrency’s value has taken a dive beneath the $28,000 mark immediately.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $27,900, down 2% within the final week.

BTC has plunged prior to now day | Supply: BTCUSD on TradingView

Featured picture from Thomas Lipke on Unsplash.com, charts from TradingView.com, CryptoQuant.com