Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After per week of risky worth motion, Bitcoin has as soon as once more returned to familiar territory across the $106,000 worth degree. Nonetheless, on-chain knowledge exhibits that traders are nonetheless cautious, with the crypto Worry & Greed Index now within the impartial zone.

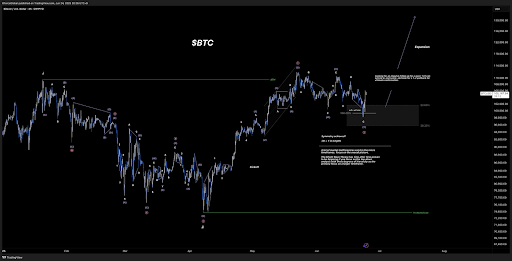

However, technical evaluation of Bitcoin’s worth motion on the 4-hour candlestick timeframe chart exhibits that its worth habits has accomplished a major correction, one that’s paving the way for a significant rally to $130,000.

Bitcoin’s Wave 2 Correction Would possibly Be Full

Based on XForceGlobal, a crypto analyst who posted a detailed Elliott Wave chart on the social platform X, Bitcoin’s latest correction matches neatly inside a accomplished WXY sample. The second wave, which began following the all-time excessive of $111,814 on Could 22 and shaped the corrective construction, has now retraced into the anticipated Fibonacci vary between the 23.6% and 38.2% ranges. Notably, the best minimal goal for this correction transfer was within the $90,000 area, and Bitcoin fulfilled that situation with the pullback to just under $98,200 over the weekend.

Associated Studying

An important factor was in preserving the macro wave construction. Instead of drawing out a deeper pullback into the 0.618 to 0.886 Fibonacci ranges, which is commonly attribute of bear market retracements, the evaluation maintains the concept this was a wave 2 correction inside a bigger bullish impulse.

This distinction is necessary. If the WXY correction is certainly full and wave 2 has concluded, the subsequent logical transfer within the Elliott Wave sequence is a 3rd wave advance. Based on Elliott Wave evaluation, the third wave is commonly essentially the most explosive when it comes to worth enlargement. Its end result may subsequently push the value of Bitcoin to new heights which are considerably larger than its most up-to-date all-time excessive.

Why $130,000 Is A Reasonable Goal For Bitcoin

The analyst’s technical projection on Bitcoin’s 4-hour candlestick timeframe chart exhibits an anticipated wave 3 trajectory extending beyond $111,800, with an enlargement arrow reaching up above $130,000. That is the enlargement transfer and relies on an identical projection of Wave 1.

Associated Studying

Within the accompanying chart, the analyst marks the important thing pivot zone between $98,000 and $102,000 because the Wave C termination space. If this zone certainly marks the completion of the second wave, the subsequent motion would require validation by way of the formation of a transparent 1-2 construction inside Wave 3.

Which means affirmation of the bullish rely additionally will depend on the value making a brand new native excessive above the present vary after which pulling again with out breaching the latest lows. If that construction performs out, then the market would probably be within the early stages of a powerful third wave.

Bitcoin has already made an 8% worth acquire after it dropped to a low of $98,200 following U.S. airstrikes on Iranian nuclear websites. Essentially the most important upward transfer got here on Tuesday, June 24, when reports of a Middle East cease-fire pushed Bitcoin up roughly 4%. On the time of writing, Bitcoin is buying and selling at $106,330.

Featured picture from Pixabay, chart from Tradingview.com