On-chain information exhibits the full variety of Bitcoin addresses has seen speedy progress lately, an indication that adoption could also be accelerating.

Bitcoin Whole Addresses Have Grown By 3.95% Throughout The Final Two Months

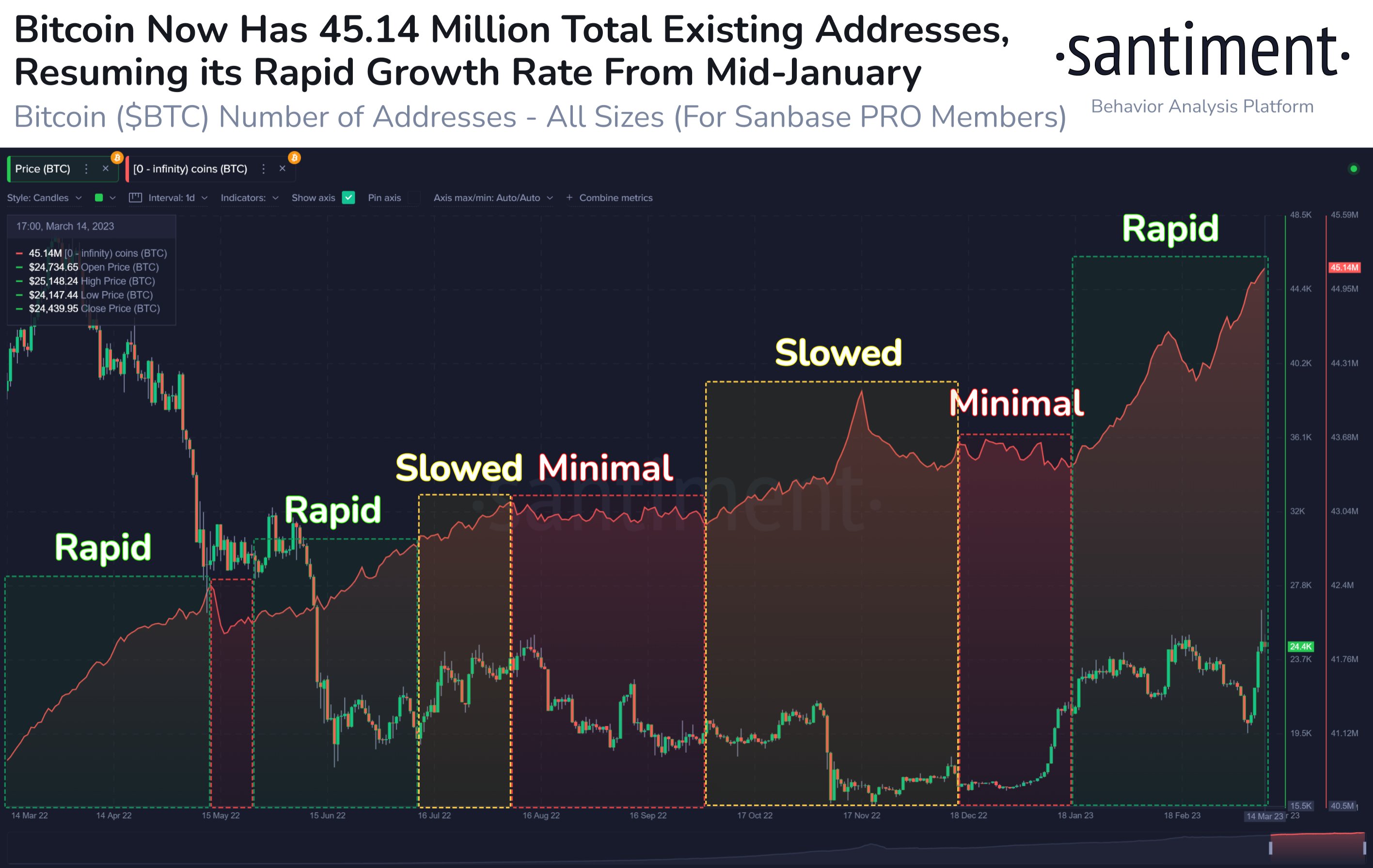

In response to information from the on-chain analytics agency Santiment, BTC now has a complete of 45.14 million addresses. The related indicator right here is the “BTC Supply Distribution,” which tells us which pockets teams out there embody what number of addresses proper now.

The pockets teams right here seek advice from cohorts divided based mostly on the full variety of cash they’re at present holding. As an example, the 1-10 cash group contains all addresses which might be carrying a steadiness between 1 and 10 BTC in the intervening time.

If the Bitcoin Provide Distribution metric is utilized to this group, then it will measure the full variety of such wallets out there which might be satisfying this situation.

Since within the present case, the amount of curiosity is the full variety of addresses throughout the complete community, no matter pockets quantity, Santiment has merely merged all the present deal with cohorts to point out their mixed Provide Distribution.

Here’s a chart that exhibits the pattern on this indicator over the previous yr:

Appears like the worth of this metric has quickly gone up in latest days | Supply: Santiment on Twitter

As displayed within the above graph, the full variety of addresses holding between 0 and infinite BTC (that’s, a variety that covers wallets of all sizes out there) had been observing some sharp progress round a yr in the past, when the bear market was solely simply setting in.

This implies that new addresses had been nonetheless being created at a speedy tempo again then. At any time when this type of pattern is seen, it implies that numerous new customers are presumably becoming a member of the community, and thus the adoption of the cryptocurrency is choosing up.

Nonetheless, when crashes like these triggered by the LUNA collapse and 3AC bankruptcy shook the market and a bearish transition occurred in full swing, the expansion slowed down and the indicator even encountered giant stretches of sideways motion.

Normally, buyers discover consolidating markets boring, so exercise slows down throughout bear markets when the value is displaying such a pattern. Naturally, the community has a tough time attracting new customers in these situations, so the rise within the whole addresses additionally plateaus.

Quite the opposite, risky strikes are thrilling to holders and thus, carry lots of consideration to the blockchain, which finally ends up pulling in new customers to the cryptocurrency. An instance of that is clearly seen in the course of the FTX crash within the chart, the place the addresses all of a sudden jumped in a interval of in any other case sluggish progress.

With the most recent Bitcoin rally over the past couple of months, the indicator’s worth has as soon as once more began displaying a pointy rise, implying that lots of new customers are being interested in the asset now.

On this interval alone, the full variety of addresses has grown by virtually 4%, a notable improve in such a brief period of time. Extra adoption is mostly a optimistic signal for any coin, because it offers a sustainable base for long-term progress.

BTC Value

On the time of writing, Bitcoin is buying and selling round $24,900, up 15% within the final week.

BTC has stumbled for the reason that rise above $26,000 | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Santiment.internet