The newest on-chain information reveals that the Bitcoin community exercise has been waning over the previous few months, with the blockchain metric reaching a brand new low just lately.

Why Is The Bitcoin Community Exercise Falling?

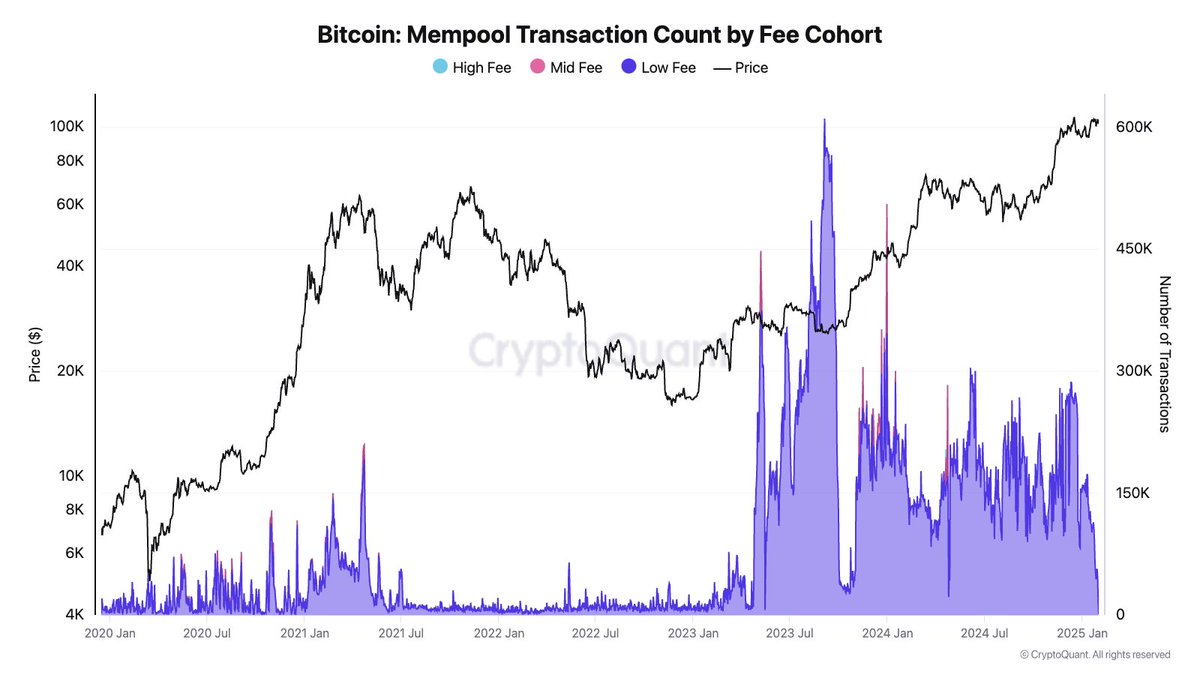

In a brand new publish on the X platform, CryptoQuant head of analysis Julio Moreno discussed how Bitcoin is witnessing an uncommon interval of low transaction exercise, with the mempool nearly empty and transaction charges falling to 1 sat/vB. This represents the bottom stage of community exercise since March 2024, indicating a notable decline in on-chain demand.

For context, the mempool refers to a brief storage space the place pending Bitcoin transactions await processing. The mempool normally stays congested during times of elevated on-chain demand and community exercise. Nonetheless, new on-chain information reveals that almost all transactions have been confirmed, leaving the mempool almost empty.

Supply: JJCMoreno/X

A virtually empty mempool is a uncommon phenomenon usually related to waning on-chain exercise or shifting market dynamics. In response to Moreno, the most important contributor to this decline is the fading pleasure round Runes and BRC-20 tokens.

Runes and the BRC-20 token normal are protocols that enabled the creation and minting of fungible and non-fungible tokens on the Bitcoin blockchain. Whereas these protocols had been met with vital hype upon launch, the preliminary pleasure didn’t translate to sustained use.

Supply: JJCMoreno/X

Nonetheless, on the peak of the Runes and BRC-20 frenzy, the variety of confirmed transactions on the Bitcoin community crossed the 1.5 million milestone in a single day. Particularly, the pioneer blockchain processed over 1.6 million distinctive transactions between sender and receivers on April 23, 2024, with the launch of Bitcoin Runes enjoying a pivotal position.

The decline in transaction depend has broader implications for numerous parts of the pioneer blockchain, together with miner revenues. Miners depend on transaction charges as one other supply of revenue, particularly as block rewards have been additional slashed because the latest halving occasion. Therefore, an prolonged interval of low charges might influence mining profitability, probably influencing community hash charge distribution.

Implications On BTC Worth

An almost-empty mempool and low transaction exercise are usually not precisely one of the best combos for optimistic value motion. Particularly, it might recommend low speculative curiosity and lowered investor enthusiasm, resulting in a consolidation of the Bitcoin price.

As of this writing, BTC is valued at round $100,450, with an almost 2% decline prior to now 24 hours. In response to CoinGeko information, the premier cryptocurrency has misplaced roughly 3.5% of its worth within the final seven days.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture created by Dall-E, chart from TradingView