The Bitcoin whales have sparked curiosity available in the market, with round $3 billion in BTC transfers in a number of transactions. Based on Whale Alert, a number of whale transactions was famous at this time, whereas the BTC value recorded a pointy decline.

Notably, Bitcoin’s current slide to $57,000 has rattled the crypto market, prompting a recent wave of concern amongst traders. With the flagship cryptocurrency down almost 5% at this time, whale actions and authorities Bitcoin dumps are fueling fears of a deeper decline.

Notably, a outstanding whale’s choice to dump 3,500 BTC to Binance amid the downturn has heightened market considerations, as merchants brace for additional potential losses forward.

Bitcoin Whale Exercise Sparks Concern Over Stability

Based on current studies by Whale Alert, a outstanding on-chain transaction tracker, Bitcoin whales have moved a hefty quantity in BTC sparking market speculations. Notably, the whales have transferred round $3B in BTC in a number of transactions, whereas Bitcoin value famous a pointy decline.

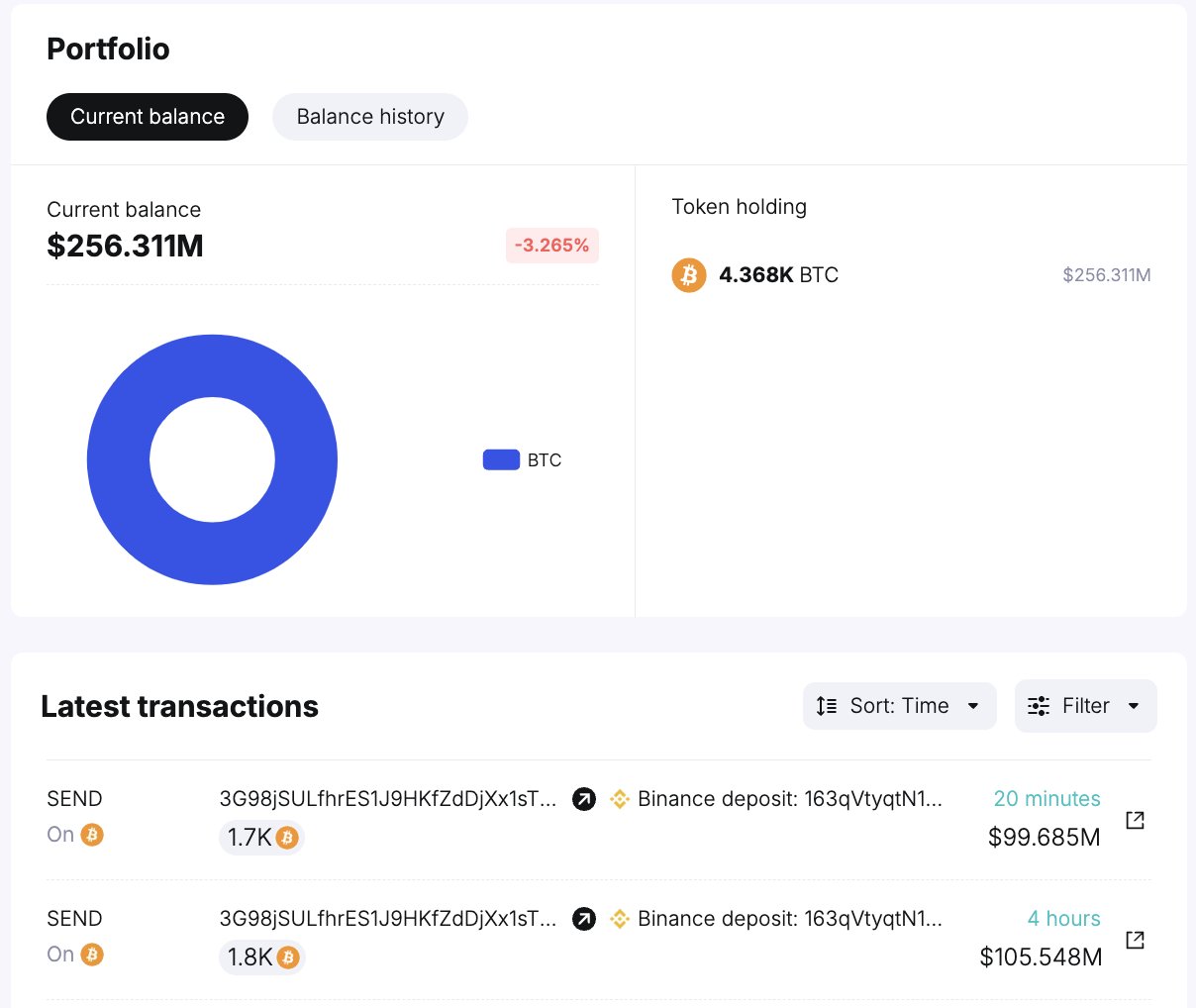

Nevertheless, the dump of three.5K BTC not too long ago has gained notable traction. The sudden switch of three,500 BTC, valued at roughly $206 million, to Binance by a major whale has fueled discussions. Based on Spot On Chain, this whale moved 1,700 BTC within the newest switch, price round $99.9 million, to Binance.

Notably, the full dump by the identical whale totaled 3.5K BTC, as per the report. The common value for these transactions was $58,891 per BTC. Nevertheless, following the sell-off, the whale retains a stability of 4,368 BTC, valued at about $256 million.

Having stated that, some market individuals additionally speculate additional dump by the whale, which may gasoline the bearish sentiment additional within the crypto market. However, Whale Alert has highlighted the reactivation of a long-dormant deal with holding 119 BTC.

In the meantime, this deal with, which had remained inactive for over 12 years, bought its Bitcoin at a mere $599 every in 2012. The awakening of this pockets, now holding BTC price roughly $7 million, provides one other layer of complexity to the present market dynamics.

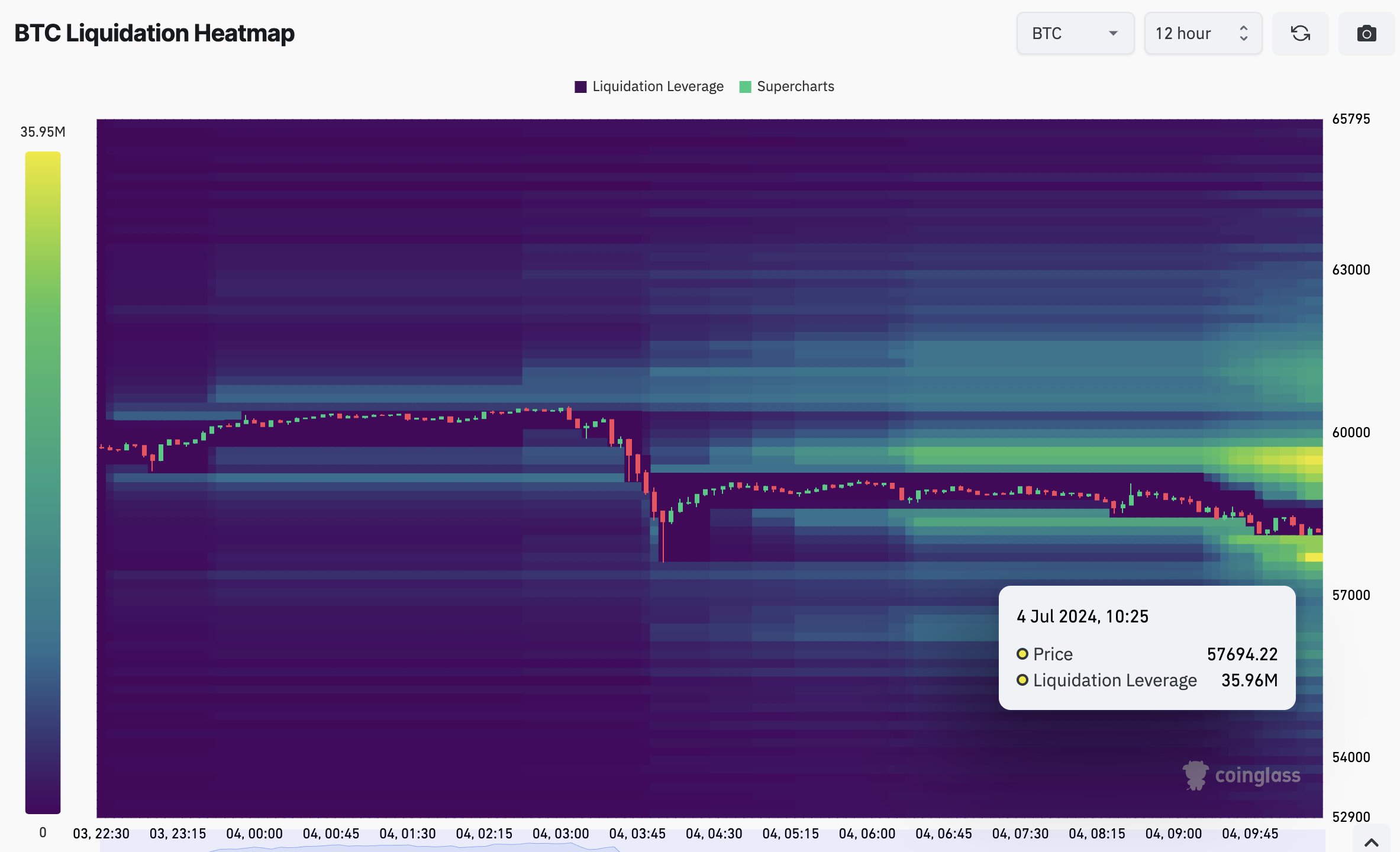

Market analysts are carefully watching these whale actions. Outstanding crypto analyst Ali Martinez remarked, “The Bitcoin dip retains dipping as a result of too many individuals maintain shopping for the dip!” As well as, he famous {that a} $36 million liquidation pool is now poised at $57,700, suggesting potential volatility forward.

Authorities Dump & Mt. Gox Payout Additional Provides To Bearish Sentiment

Including to the bearish momentum, the current Bitcoin gross sales by the German government have raised alarms. The German authorities transferred 1,300 BTC to main exchanges like Coinbase, Bitstamp, and Kraken at this time, additional pressuring the market. This important dump has fueled fears that extra such gross sales may exacerbate Bitcoin’s decline.

As well as, the U.S. government moved 237 BTC, price roughly $14 million, to a pockets not too long ago, in response to Arkham Intelligence. This transfer has sparked speculations about potential additional value dips. Observers are cautious of the likelihood that authorities actions may set off extra market sell-offs, contributing to the continuing volatility.

However, the looming considerations over the Mt. Gox reimbursement plan have additionally unsettled the market. Collectors of the collapsed change are set to obtain round 142,000 BTC, price almost $9 billion, beginning in July. The anticipation of this substantial launch of Bitcoin into the market is contributing to the nervousness over potential downward strain on costs.

In the meantime, the mixture of whale actions, authorities BTC gross sales, and the approaching Mt. Gox payouts has created a cocktail of things contributing to Bitcoin’s present instability. Because the market digests these developments, merchants and traders are bracing for potential additional declines.

As of writing, Bitcoin price fell 4.56% and traded at $57,850.23, with its one-day buying and selling quantity hovering 51% to $37.59 billion. The crypto has touched a excessive of $60,558.36 and a low of $57,338.45 within the final 24 hours. Apart from, the Bitcoin Futures Open Curiosity fell over 4% within the final 24 hours and about 2% within the final 4 hours, as per CoinGlass knowledge.

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: