Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Hypothesis over a purported White Home plan to pause tariffs for ninety days on all international locations besides China despatched markets right into a frenzy earlier in the present day, triggering abrupt worth reversals throughout equities, Bitcoin and cryptocurrencies. In a quick-fire sequence of conflicting updates, the rumor initially floated at round 10:10 AM ET, sparked momentum in danger belongings, and was ultimately deemed “faux information” by the White Home.

The Kobeissi Letter (@KobeissiLetter) described the chronology on X, noting: “What simply occurred? At 10:10 AM ET, rumors emerged that the White Home was contemplating a ‘90-day tariff pause.’ At 10:15 AM ET, CNBC reported that Trump is contemplating a 90-day pause on tariffs for ALL international locations apart from China. By 10:18 AM ET, the S&P 500 had added over +$3 TRILLION in market cap from its low.”

Associated Studying

Nonetheless, solely seven minutes later, at 10:25 AM ET, reviews emerged that the White Home was ‘unaware’ of Trump contemplating a 90-day pause. “At 10:26 AM ET, CNBC reviews that the 90-day tariff pause headlines had been incorrect. At 10:34 AM ET, the White Home formally known as the tariff pause headlines ‘faux information.’ By 10:40 AM ET, the S&P 500 erased -$2.5 TRILLION of market cap from its excessive, 22 minutes prior. By no means in historical past have we seen one thing like this,” The Kobeissi Letter writes.

The mere suggestion of a brief reprieve from tariffs managed to shift sentiment quickly in each fairness and crypto markets. BTC, which was buying and selling round $75,805 on the time, soared by roughly 7.2% to surpass $81,200 inside half an hour. As soon as affirmation arrived that no such pause was deliberate, the positive aspects evaporated nearly as quick as they’d arrived, pulling Bitcoin again to roughly $77,560.

The abrupt flip of occasions unleashed a wave of commentary amongst crypto observers. Pentoshi (@Pentosh1) remarked that “The faux information tweet confirmed there’s numerous sidelined capital a minimum of for aid rally and the danger is to the upside on any constructive information a minimum of briefly.”

Will Clemente III cautioned: “Bear take: Liquidity is dangerous and this volatility may break one thing. Bull take: This headline was the cointelegraph intern BTC ETF headline however for equities.”

Associated Studying

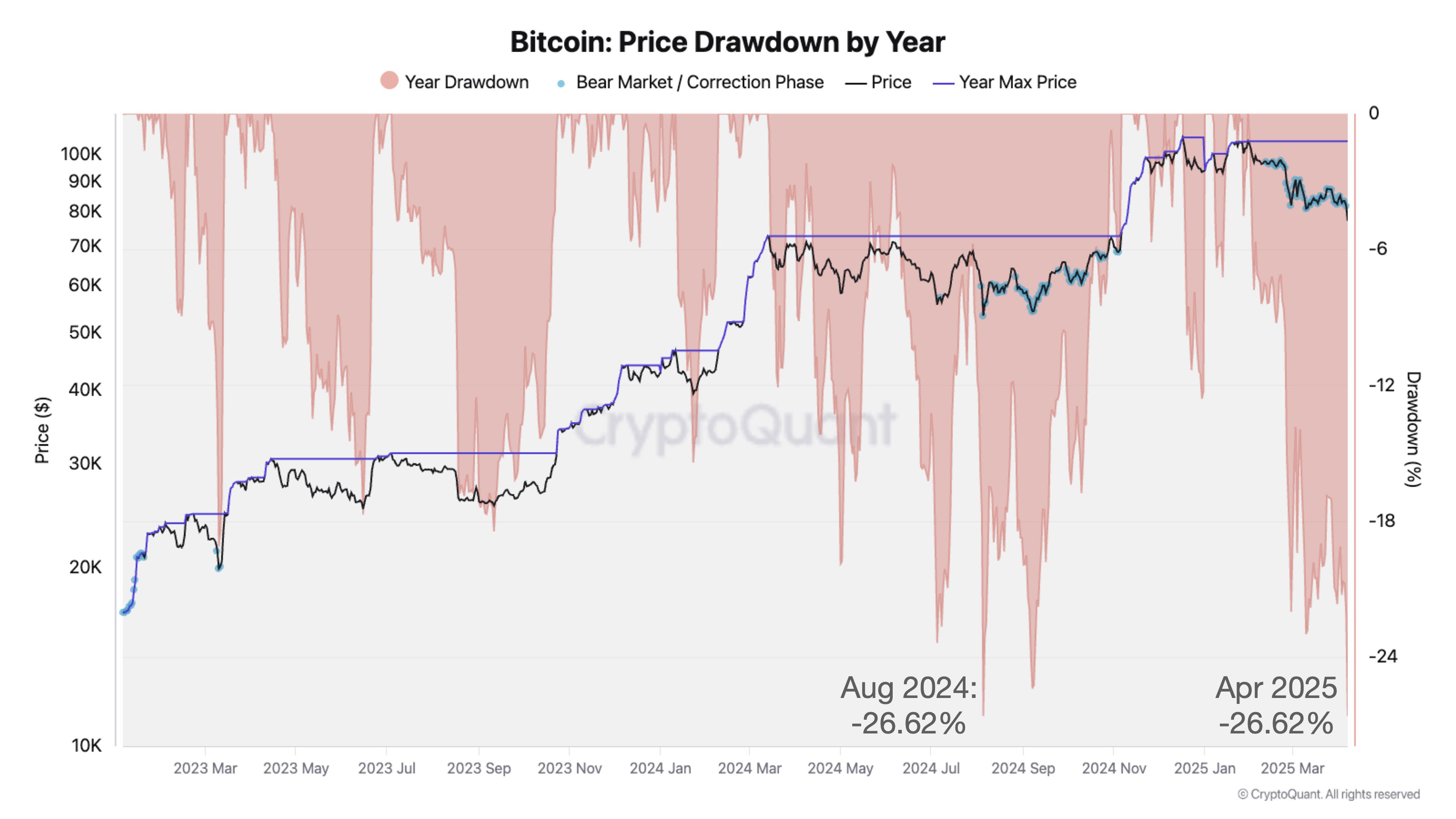

Julio Moreno, Head of Analysis at CryptoQuant, remarked that “Bitcoin’s present worth drawdown is about to change into the most important of the present cycle,” illustrating his level with a chart that confirmed BTC’s correction reaching -26.62%, matching the dimensions of August 2024’s correction.

Macro analyst Alex Krüger (@krugermacro) invoked BlackRock CEO Larry Fink’s statement that one other 20% market drop is just not out of the query, saying: “That’s the factor. Below regular circumstances, likelihood of such situations or issues corresponding to stagflation are so low you may simply brush them off. Trump opened up the left tail => something is feasible. We’re one headline away from a 7% candle in both course.”

Podcast host Felix Jauvin (@fejau_inc) agrees: “What’s so loopy about this crash vs different is its totally self-willed and could possibly be reversed straight away on one tweet. Has there ever been something like that?”

Within the midst of the turmoil, European Union Commissioner Ursula von der Leyen reaffirmed a willingness to hunt options, stating, “Europe is able to negotiate with the US,” together with the potential of zero-for-zero tariffs on industrial items.

At press time, BTC traded at $78,824.

Featured picture created with DALL.E, chart from TradingView.com