Bitcoin whales are witnessing a historic exodus. @CryptoVizArt, a senior researcher at Glassnode has make clear the numerous shifts inside the whale cohort in a brand new evaluation.

Bitcoin Whales’ Influence: Unveiling The Numbers

In a outstanding revelation, the research highlights the substantial impression of whales on latest market exercise. In accordance with the info, “34% of promote stress within the final 30 day was from Binance whales.” These influential entities have been instrumental in shaping the latest market dynamics.

Furthermore, the analysis additionally highlights a development in whale conduct: a noteworthy decline within the whole steadiness of whale entities on exchanges. Within the final 30 days, the report states, “Whale Move to Exchanges witnessed the biggest month-to-month steadiness decline in historical past, hitting -148,000 BTC/month.” This dramatic decline marks a big shift inside the whale cohort, elevating intriguing questions on their motives and techniques.

Because the market witnessed the rally above $31,000, the inflow of whale funds to exchanges surged remarkably. Glassnode’s information reveals that whale influx volumes reached a powerful +16,300 BTC/day, signifying their lively involvement in latest market actions. Notably, this whale dominance accounted for 41% of all alternate inflows, which is corresponding to each the LUNA crash (39%) and the failure of FTX (33%).

All through June and July, whale inflows have sustained an elevated influx bias of between 4,000 to six,500 BTC/day. Amongst all exchanges, Binance emerged as the first vacation spot for whale inflows. The report discloses that round 82% of whale-to-exchange flows have been heading into Binance. In distinction, Coinbase accounted for six.8%, and all different exchanges account for 11.2%.

Whereas the general steadiness of whales might have declined, @CryptoVizArt’s evaluation factors to intriguing inner dynamics inside the whale cohort. As some whales elevated their balances, others skilled declines. This phenomenon led the researcher to introduce the idea of ‘Whale Reshuffling,’ suggesting that not all whales comply with the identical technique.

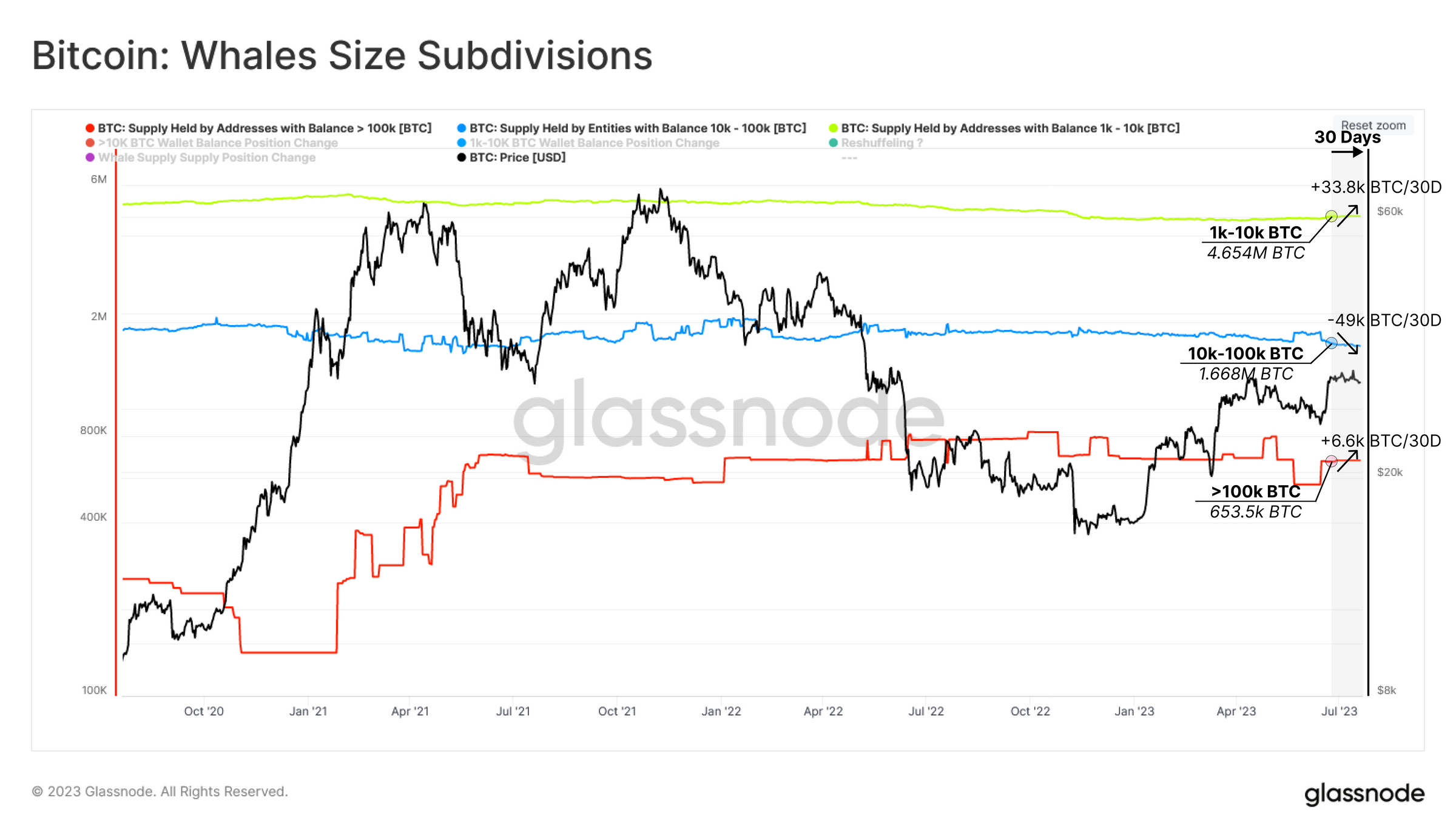

The examination of the whale cohort over the past 30 days reveals that whales with greater than 100,000 BTC have recorded a rise of +6,000 BTC, whales with 10k-100k BTC have decreased their account steadiness by -49.0k BTC and whales with 1k-10k BTC have elevated their account steadiness by +33.8k BTC. Nevertheless, in combination, the whale group has seen simply -8.7k BTC in internet outflows.

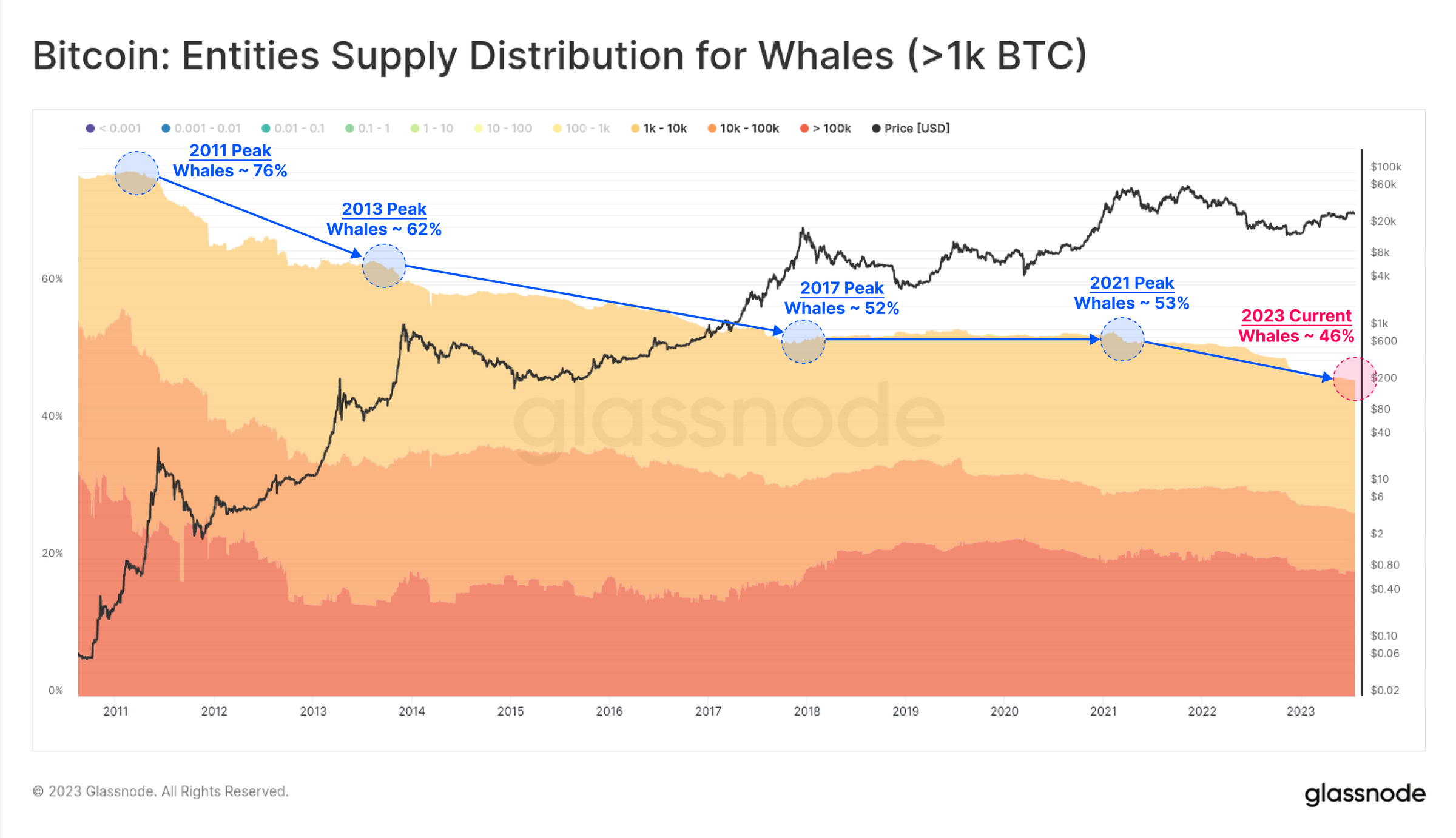

Remarkably, whale entities now account for less than 46% of the full provide, down from 63% at first of 2021. For the reason that early days of Bitcoin, a gradual downward development may be noticed.

Quick-Time period Holders: The Driving Drive

The analysis additionally sheds mild on the dominance of short-term holders (STHs) among the many whale entities. The info signifies that STHs symbolize a good portion of latest buying and selling exercise, actively buying and selling the market. This conduct is clear as market rallies and corrections result in notable upticks in revenue or loss amongst this group.

Quick-Time period Holder (STH) Dominance throughout Alternate Inflows has exploded to 82%. That is drastically above the long-term vary over the past 5 years (sometimes 55% to 65%). “From this, we are able to set up a case that a lot of the latest buying and selling exercise is pushed by Whales lively inside the 2023 market and thus categorised as STHs”, states the analyst. Every rally in 2023 has seen heightened revenue taking.

BTC whale transactions can due to this fact presently be a very good indicator. Nevertheless, particular consideration additionally must be paid to the STHs, which can finally run out of bullets in some unspecified time in the future.

At press time, the BTC value stood at $29,203.