Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Metaplanet has once more beefed up its Bitcoin holdings. In line with the Tokyo-listed funding agency, it bought 1,111 BTC on Monday for about $118.2 million.

The typical value paid was roughly $106,408 per coin. Bitcoin has fallen greater than 5% during the last week, buying and selling simply above $101,000.

Associated Studying

Efficiency Metrics Climb Greater

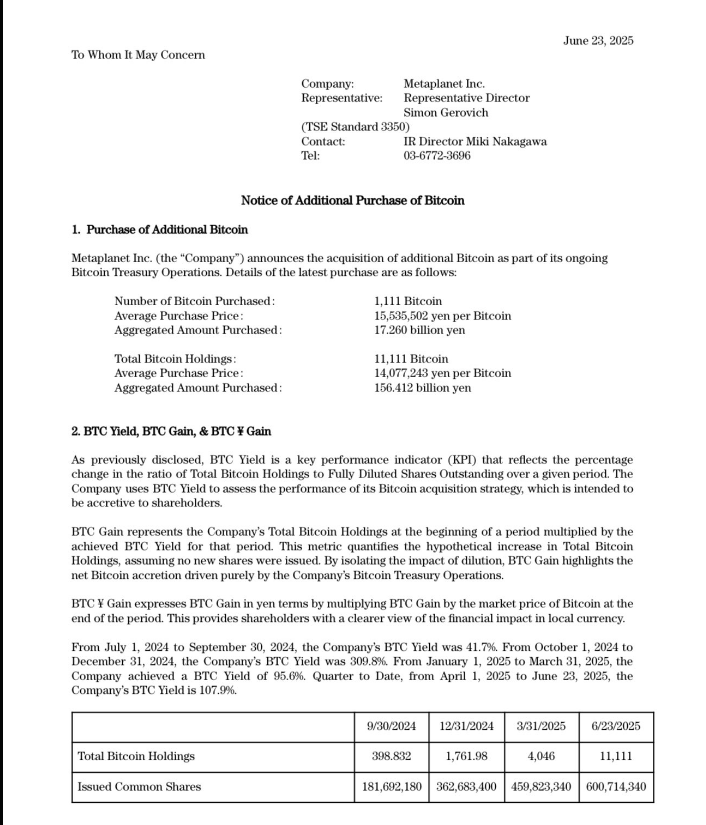

Metaplanet’s own numbers present a quarter-to-date BTC yield of 108%, up from 96% in Q1 and a hefty 310% in This fall 2024. That metric tracks Bitcoin per absolutely diluted share, so it places the agency’s technique underneath a transparent highlight.

Primarily based on reviews, the corporate gained 4,367 BTC valued at $451 million on this interval, utilizing costs from Bitflyer.

*Metaplanet Acquires Further 1,111 $BTC, Complete Holdings Attain 11,111 BTC* pic.twitter.com/7ceEeSh1X4

— Metaplanet Inc. (@Metaplanet_JP) June 23, 2025

Steadiness Sheet Swells to 11,111 BTC

With the brand new buy, Metaplanet’s total stash now stands at 11,111 BTC, price simply over $1.07 billion. Its value foundation for these cash sits at about $95,869 every.

Metaplanet’s shares dipped 3.5% on the day of the announcement, an indication that buyers could also be frightened about how the agency is funding its buy-ups.

Supply: Metaplanet

Funding By means of Bonds And Shares

Primarily based on reviews, the corporate has raised money by way of zero-coupon bonds and fairness rights since January. It issued over 210 million shares underneath a program it calls the “210 Million Plan.”

Evo Fund has snapped up lots of these bonds and rights. Between Could and June 2025, Metaplanet pulled in over $300 million, earmarking each greenback for extra Bitcoin.

Formidable Goal Of 210,000 BTC

Metaplanet has set a purpose to carry 210,000 BTC by the top of 2027. That’s 10 occasions its present pile. To succeed in that quantity, it might want to hold tapping the capital markets—and it plans to.

The agency even created a devoted Bitcoin Treasury Operations arm in December 2024, shifting away from its lodge administration roots.

Associated Studying

Dilution And Threat For Shareholders

Metaplanet’s absolutely diluted share rely rose to shut to 760 million as of June 23. That places its Bitcoin per 1,000 shares at 0.0146 BTC. Extra bonds and shares imply extra dilution for present buyers. If Bitcoin’s value slips, the price of elevating cash might climb, consuming into any features from the crypto itself.

Metaplanet’s strategy mirrors what another large holders have completed. It’s a daring stance. If Bitcoin holds up or heads increased, the agency might see large returns. Nevertheless it might want to steadiness recent capital raises in opposition to the chance of pushing down its personal inventory.

For now, Metaplanet exhibits no signal of slowing down its Bitcoin shopping for. The one actual query is how far this technique can run earlier than the payments come due.

Featured picture from Imagen, chart from TradingView