Given the jarring information in a single day that Russia have invaded Ukraine, it feels a bit trivial writing about finance this afternoon. I actually hope the folks of Ukraine might be OK and, on a private degree, I simply can’t imagine in 2022 that we’re on the point of struggle in Europe. It’s unhappy.

However in monetary markets, volatility has understandably spiked within the final 24 hours. On this piece, I wish to give attention to one thing I’ve discovered significantly fascinating: Bitcoin’s worth motion in comparison with different main asset courses. As a result of one of the crucial seductive narratives in crypto is that of the hedge concept:

• Bitcoin gives an efficient inflation hedge, a way of avoiding fiat debasement (outstanding within the latest local weather of cash printer goes brrrr).

• It’s digital gold – accordingly, it improves risk-return traits of a portfolio containing shares.

Particularly the latter level is one I wish to handle, within the context of the final 24 hours.

Market Fallout

So, Putin declares struggle. How do markets react?

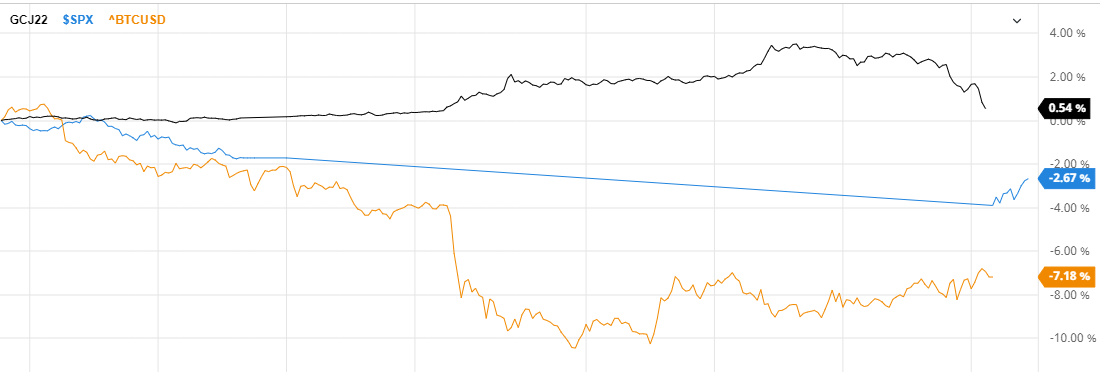

• Shares: S&P 500 falls circa 2.8%, Europe’s Stoxx 600 share index drops 3.5% and Nasdaq shut to three% down. That is to be anticipated – no surprises right here.

• Gold: The commodity hit a 17 month excessive, up circa 1.5% and subsequently making good on its hedge promise. Gold bugs rejoice, however nothing too out of the peculiar right here both.

• Bitcoin: The self-proclaimed digital gold has talked itself up as a hedge for some time now. Properly, now we have our disaster and now we have our inventory market plunge – so time for Bitcoin to place its cash the place its mouth is. The end result? A 7% nosedive.

Returns of Gold (Black), S&P 500 (Blue) and Bitcoin (Orange) within the final 24 hours, by way of BarChart.com

Returns of Gold (Black), S&P 500 (Blue) and Bitcoin (Orange) within the final 24 hours, by way of BarChart.com

Correlation -> 1

In crises, correlations go to 1. There’s a flight to high quality; traders de-risk and like to carry safe-haven property, of which money is the obvious. Gold, for its half, has lengthy had a repute as a safer retailer of worth. The occasions of the final 24 hours have proven us that Bitcoin doesn’t but qualify as such a safe-haven asset. Volatility and crypto go hand in hand like peanut butter and jam; till that normal deviation comes down, Bitcoin’s intention to determine itself as a retailer of worth gained’t be achieved.

So, Bitcoin continues to be the apprentice to the grasp that’s gold. With newest 30-day estimates on Bitcoin’s volatility sitting at 3.36%, it’s hardly shocking that traders are shedding publicity in turbulent instances. For avoidance of doubt, this isn’t to say gold is a greater funding than Bitcoin (I exploit the “grasp” time period very loosely above). Personally, I can’t persuade myself to carry gold given the return traits that it has displayed over the past decade (lower than a 5% return since 2011, a time interval when each different asset has rocketed upwards). The chance price of holding gold has been catastrophic in latest instances. However this piece is about hedging properties, not anticipated return – and proper now Bitcoin hasn’t been in a position to maintain up in instances of market downturns.

Gold is just simply above 2011 highs, by way of BullionVault.

Gold is just simply above 2011 highs, by way of BullionVault.

Maturity

What we want not overlook right here (and I’ll say it time and time once more) is the infancy of Bitcoin. Created solely in 2009, its development into the mainstream has been past even the wildest crypto fanatic’s goals. Nonetheless, nevertheless, individuals are impatient with the volatility – however what do you anticipate? A good retailer of worth, totally established after scarcely a decade? Cultures first found the shiny fantastic thing about gold again in 4000 BC, that’s hundreds of years for it to work on its retailer of worth properties. Do you assume the pharaohs in Egypt in 1200 BC have been making jewelry out of Bitcoin? Was Spanish conquistador Hernán Cortes’ eye drawn by the glowing high quality of blockchain know-how within the sixteenth century?

So, whereas Russia’s march into Ukraine exhibits us that Bitcoin will not be but a good retailer of worth, this could not come as a shock. Proper now, in fact you’ll reasonably be in money or gold than crypto when a struggle is introduced. You don’t have to dig into the numbers for that to be apparent.

Precedent

Let’s rewind the clock to March 2020, when our pleasant neighbourhood pandemic first exploded onto the scene, sending seismic waves all through markets. Granted, it was a much bigger shock than Putin’s aggression final night time, with S&P 500 having two of its worst six days ever within the area of every week (-12.0% and -9.5%), nevertheless it’s the latest disaster we are able to level to. Bitcoin, however, shed half its worth within the blink of an eye fixed, plummeting from $7,900 to $4,100. Like my roommate used to say, when you get into crypto, shares really feel…boring.

Bitcoin chart amid onset of COVID, March Eleventh-Thirteenth 2020

Bitcoin chart amid onset of COVID, March Eleventh-Thirteenth 2020

Progress

Since March 2020, now we have seen Bitcoin added to Tesla’s steadiness sheet, grow to be authorized tender in El Salvador, enter mainstream media protection and march past a $1T market cap (earlier than falling again this yr). The vicious dips, nevertheless, have nonetheless appeared:

• Could 2021: $58,000 to $33,000

• Sep 2021: $53,000 to $41,000

• Nov/Dec 2021: $68,000 to $33,000

So at the moment’s pullback barely even scratches the floor, and that’s with real-world occasions inflicting them. The Could 2021 crash specifically was seemingly random, with crypto simply….being crypto.

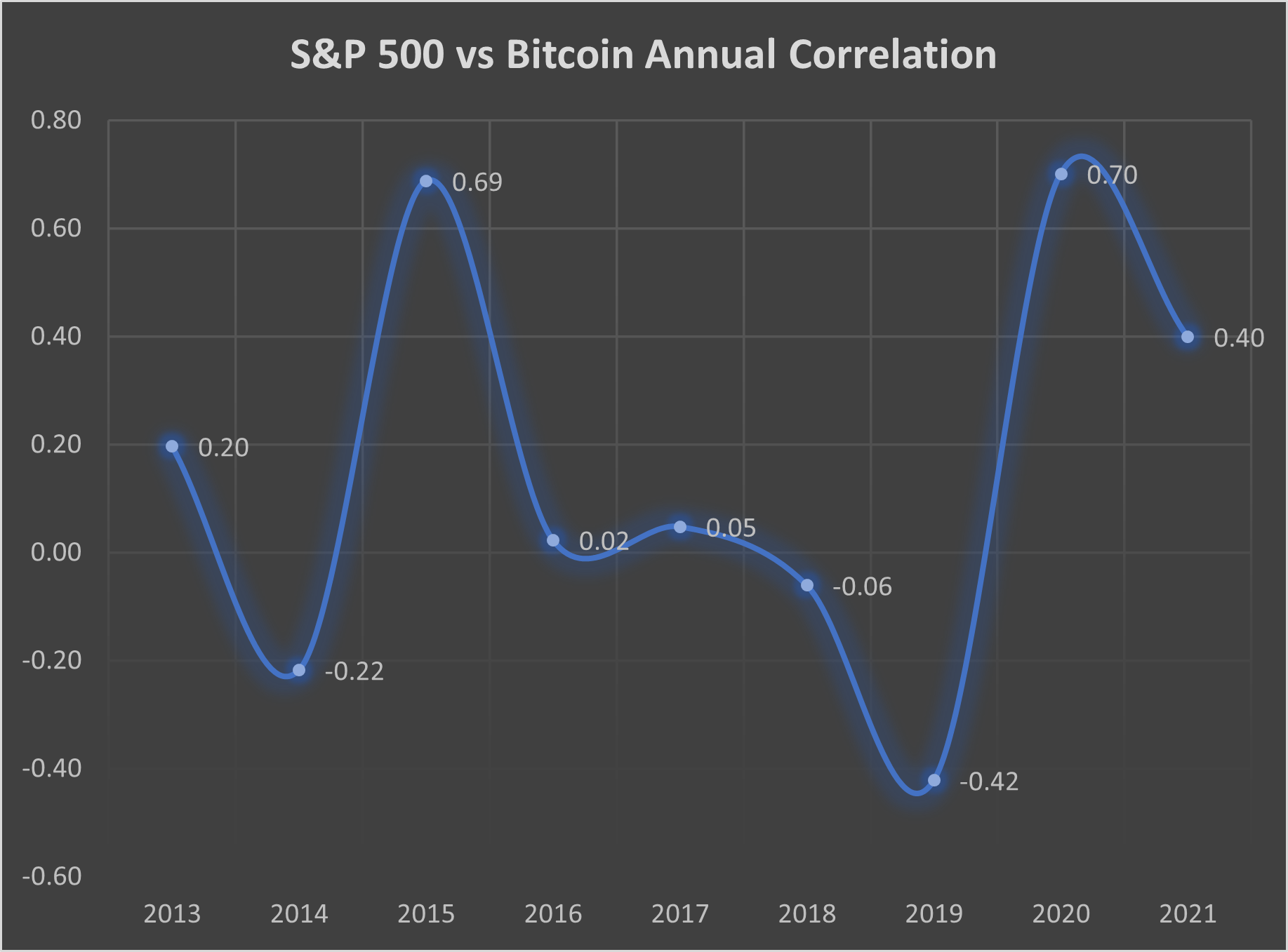

Future

Let me be clear: I’m bullish long-term on Bitcoin. I feel the progress made on the institutional aspect, the sensible minds who’ve crossed over from trad-fi and the mainstream acceptance are all extremely constructive developments over the past two years. I feel there’s a vital function for Bitcoin to play in our society’s future. Nevertheless, there isn’t a getting round the truth that all this volatility nonetheless makes it a nervous short-term maintain, and proper now it actually has not achieved store-of-value standing. For curiosity, I ran the numbers on the month-to-month returns of the S&P 500 towards Bitcoin going again to 2013, to see how the correlation has moved. You may see that since COVID it has been comparatively robust (2020 specifically has a really excessive correlation, with the Up Solely surroundings brought on by Fed printing). Previous to 2019, it’s a bit in all places, as Bitcoin had but to seek out mainstream traction. Not a lot of a sample both approach.

There could also be a day when such unfavorable macro occasions, just like the final 24 hours, will trigger Bitcoin to tick up 1% or 2%. Bitcoin might be boring, a safe-haven asset and it is going to be much less enjoyable to speak about. I actually gained’t need to be writing articles every day about it, so maybe it’s going to even put me out of a job. However that decoupling with different dangerous property has not occurred but, and the final 24 hours are additional proof of that. Bitcoin must grow to be extra…boring.

In signing off, maybe Plan B (creator of the Bitcoin Inventory to Circulate mannequin) says it extra succintly in a tweet: