Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin worth rebounded to $80,000 after a pointy decline triggered by fears over US President Donald Trump’s tariff policies. The cryptocurrency market noticed panic promoting prior to now 12 hours as financial considerations unfold throughout numerous sectors.

Associated Studying

Market Cap Holds At $1.5 Trillion As Bitcoin Dominance Grows

In keeping with market knowledge, Bitcoin’s market capitalization at the moment stands at $1.5 trillion regardless of current worth fluctuations. Whereas the main cryptocurrency has bounced again barely, altcoins proceed to wrestle with deeper losses.

Bitcoin’s dominance within the total crypto market has jumped to 60%, displaying buyers could also be in search of refuge within the largest digital asset throughout unsure occasions.

The market is responding on to broader financial fears somewhat than crypto-specific points, market analysts mentioned.

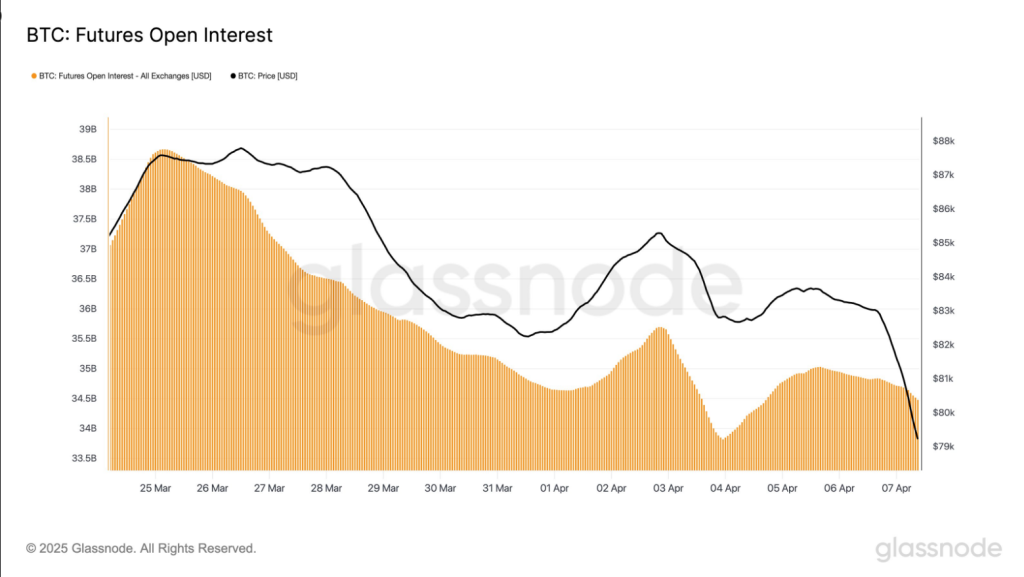

$BTC futures open curiosity sits at $34.5B. Whereas there was a quick restoration from the $33.8B low on April 3, the broader downtrend stays intact. Futures publicity continues to unwind as merchants cut back danger in response to declining worth momentum. pic.twitter.com/ZX06yOCtsA

— glassnode (@glassnode) April 7, 2025

Futures Market Reveals Shocking Resilience

Primarily based on studies from Glassnode, Bitcoin futures open curiosity has fallen to $34.5 billion, displaying a quick restoration from its April 3 low of $33.8 billion however sustaining an total downward pattern. Merchants have been lowering their futures publicity as Bitcoin’s worth momentum slowed.

Since March 25, cash-margined open curiosity declined from $30 billion to $27 billion. Crypto-margined open curiosity fell throughout the identical time from $7.5 billion to $6.9 billion. Newer figures point out crypto-margined open curiosity has began to rise once more, indicating that some merchants are shifting again into riskier positions.

The share of crypto-collateralized futures contracts has reached 21% of open curiosity from 19% on April 5. This alteration could render the market extra aware of shift in worth and, thus, result in elevated volatility within the subsequent few days.

Restricted Liquidations Recommend Managed Promoting

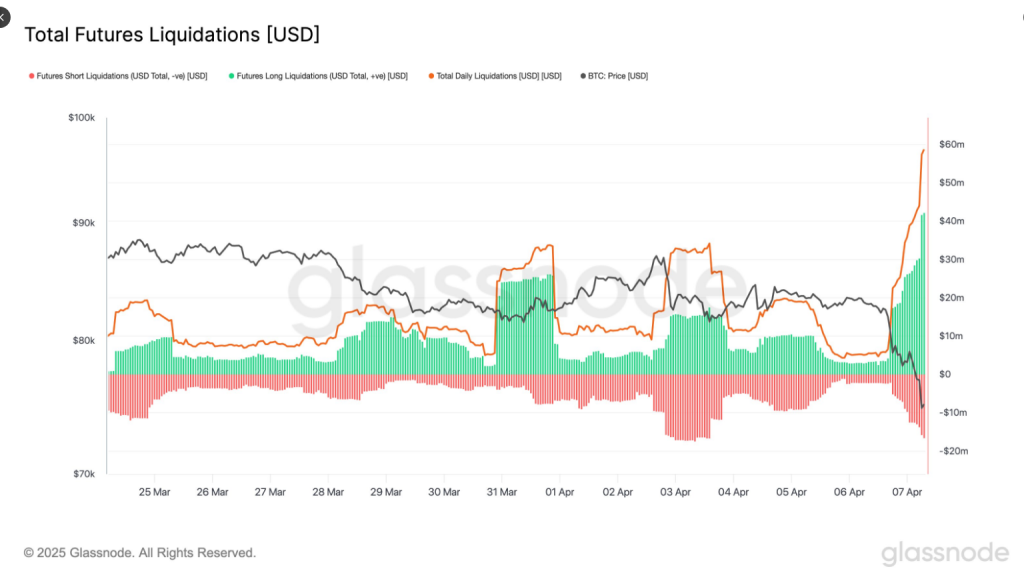

The final 24 hours witnessed $58 million price of Bitcoin futures liquidations, with longs taking $42 million versus shorts taking $16.6 million. Market watchers level out this liquidation determine is remarkably low contemplating the ten% worth decline in Bitcoin.

Whole $BTC futures liquidations hit $58.8M over the previous 24h. Longs took the heavier hit with $42.1M worn out vs. $16.6M in shorts. Regardless of the worth dropping 10%, this liquidation dimension is comparatively modest, suggesting restricted leverage chasing upside. pic.twitter.com/104kM2XQoF

— glassnode (@glassnode) April 7, 2025

The comparatively small liquidation numbers point out the market was not extremely leveraged previous to the selloff. Lengthy liquidations accounted for roughly 73% of complete futures liquidations, which signifies a mildly bullish sentiment previous to the correction.

Associated Studying

These numbers pale compared to earlier market occasions in February and March, when each day liquidations topped $140 million. The current pattern signifies a structured worth fall fueled primarily by spot promoting and never a wave of pressured liquidations because of over-leveraged positions.

Institutional Traders Proceed To Enter The Market

There are studies of elevated institutional demand regardless of current market volatility. Statistics reveal 76 new establishments with over 1,000 BTC have entered the community within the final two months, which is a 4.5% rise in massive Bitcoin holders.

Featured picture from Gemini Imagen, chart from TradingView