- Bitflow launches Automated Greenback-Value Averaging (DCA) for Bitcoin and Runes investments on Stacks.

- The AI-powered DCA allows trustless, recurring investments.

- Future plans embody including yield methods and cross-layer flows.

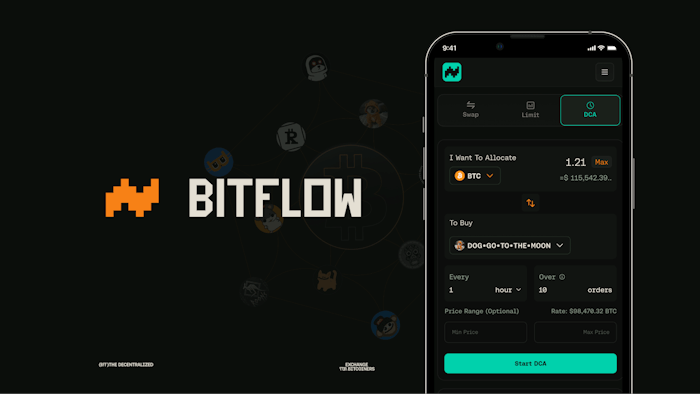

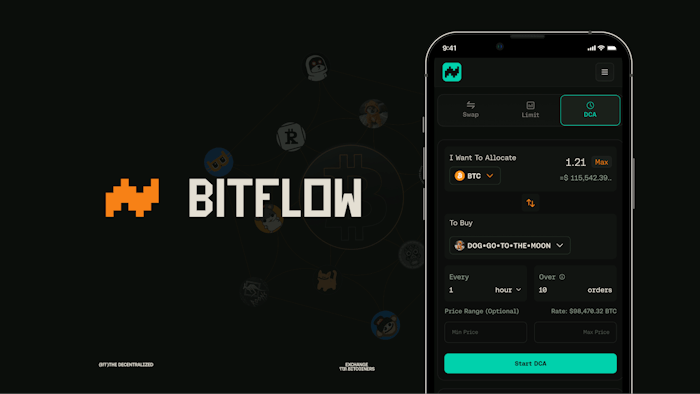

Bitflow, a decentralized alternate constructed on the Stacks ecosystem, has unveiled Automated Greenback-Value Averaging (DCA), a groundbreaking characteristic that introduces AI-driven funding methods to Bitcoin and its related belongings.

The automated DCA permits customers to automate recurring purchases of Bitcoin (BTC), stablecoins, Stacks’ native STX token, sBTC, and common Runes tokens like $DOG, all whereas retaining full management over their funds.

Designed to simplify and improve participation within the rising Bitcoin-native financial system, Bitflow’s newest providing marks a big milestone in decentralized finance (DeFi) on the Stacks Layer 2 community.

Simplifying Bitcoin DeFi funding with automation

On the coronary heart of the Automated Greenback-Value Averaging (DCA) is Bitflow Keepers, an clever automation engine that powers the DCA characteristic. This expertise allows trustless, recurring transactions with out requiring customers to time the market or execute trades manually.

By supporting a variety of belongings, together with SIP-10 tokens and the memecoin sensation $DOG (DOG•GO•TO•THE•MOON), Bitflow ensures that customers can diversify their portfolios seamlessly.

For the primary time, DeFi lovers on Stacks can program their funding methods, remodeling Bitcoin right into a dynamic, yield-generating asset.

Significantly, Bitflow’s non-custodial design retains transactions totally onchain, offering transparency and safety whereas eliminating dependence on third-party intermediaries.

Dylan Floyd, Bitflow’s Co-Founder and Lead Developer, emphasised the transformative potential of this characteristic, noting that Bitcoin DeFi is getting into a brand new period of automation, the place customers can harness superior instruments to develop their holdings effectively.

Notably, the Automated DCA characteristic is step one in a roadmap geared toward integrating AI-driven automation into DeFi. Upcoming enhancements will embody automated yield farming methods, enabling customers to optimize returns on BTC-based belongings with out fixed oversight.

Plans are additionally in place for market-triggered swaps, which can permit merchants to set circumstances for executing transactions primarily based on value actions or volatility, including a layer of sophistication to Bitcoin buying and selling.

Moreover, Bitflow intends to enhance liquidity by facilitating seamless asset transfers between Bitcoin’s Layer 1 and Stacks’ Layer 2, bridging the hole between the 2 ecosystems.

This formidable agenda underscores Bitflow’s function as a pioneer within the Stacks ecosystem, the place it serves as a liquidity hub for buying and selling Bitcoin belongings.

By incorporating Runes and SIP-10 tokens into its decentralized alternate, Bitflow is broadening the scope of Bitcoin-native finance, interesting to each seasoned merchants and newcomers on the lookout for environment friendly methods to have interaction with the market.