Ethereum has reclaimed the $3,000 stage after a robust market response to bettering macro circumstances, providing traders a much-needed shift in momentum. The transfer comes simply days after the Federal Reserve formally ended Quantitative Tightening (QT), a coverage shift that instantly boosted liquidity expectations throughout all danger property. With markets now pricing in an imminent rate of interest minimize, confidence has begun to return, and ETH is likely one of the first main property to reply.

Associated Studying

This rebound displays extra than simply macro reduction. In response to knowledge from Arkham, shared by Lookonchain, Bitmine continues to build up Ethereum at present costs, reinforcing bullish sentiment at a second when many merchants stay cautious. Bitmine’s persistent shopping for all through the correction has grow to be some of the influential indicators for on-chain analysts, suggesting that giant gamers see long-term worth even because the market wrestles with volatility.

Reclaiming $3,000 locations Ethereum again above a key psychological stage, and the mix of supportive macro coverage and whale accumulation gives a stronger basis than the market had simply weeks in the past.

Bitmine and Linked Wallets Increase Ethereum Holdings

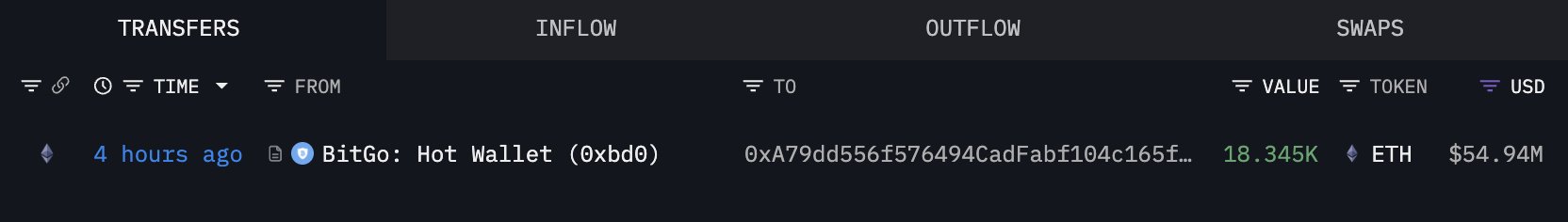

In response to data from Arkham reported by Lookonchain, Bitmine has bought one other 18,345 ETH, value roughly $54.94 million, just some hours in the past. This marks yet one more giant purchase in a rising collection of aggressive accumulation strikes that Bitmine has made all through the correction. Their continued willingness to purchase at present ranges indicators robust confidence in Ethereum’s long-term worth, even because the market navigates heightened volatility.

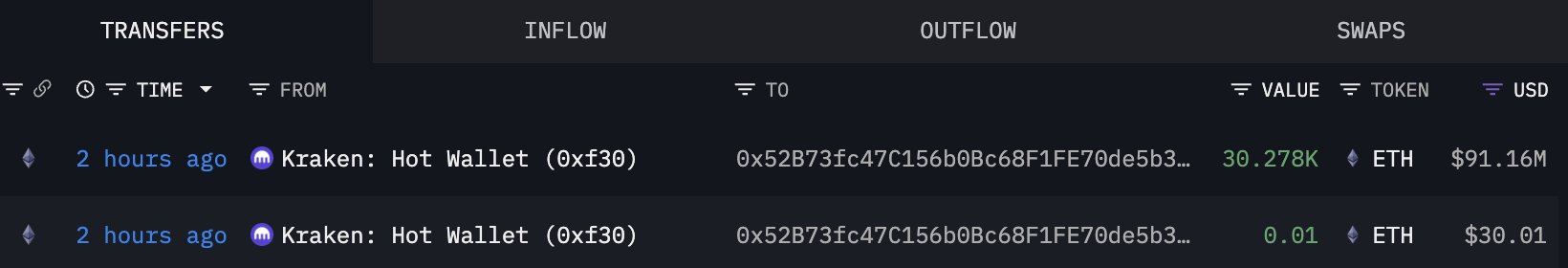

Shortly after this report, Lookonchain highlighted exercise from a newly created pockets, 0x52B7, which withdrew 30,278 ETH—valued at $91.16 million—from Kraken. The scale and timing of the withdrawal have led analysts to invest that this pockets could also be linked to Bitmine or a part of a broader accumulation technique.

Giant withdrawals from exchanges usually point out that the proprietor intends to carry the property off-exchange, typically for long-term storage or staking, relatively than making ready to promote.

If the pockets is certainly related to Bitmine, this might carry their newest mixed accumulation to just about 50,000 ETH in a single day. Such conduct suggests strategic positioning forward of potential macro-driven upside or inside confidence in Ethereum’s restoration.

This type of synchronized whale exercise typically precedes important worth shifts, reinforcing the concept giant gamers are making ready for a stronger market section.

Associated Studying

ETH Reclaims $3,000 However Nonetheless Faces Key Resistance

Ethereum’s 3-day chart exhibits a notable enchancment after reclaiming the $3,000 stage, however the broader pattern nonetheless carries indicators of fragility. The latest bounce adopted a deep corrective transfer that despatched ETH from the $4,500 area right down to the $2,700–$2,800 assist zone, the place patrons lastly stepped in with conviction. The robust decrease wicks round this space verify that demand stays lively, however Ethereum has but to completely recuperate its bullish construction.

Value now trades slightly below the 50 SMA, which sits close to the $3,100–$3,150 zone—an vital short-term resistance stage. A clear break above this transferring common would sign renewed momentum and enhance the possibilities of retesting the $3,400–$3,600 vary. In the meantime, the 100 SMA and 200 SMA stay barely above worth, reflecting the broader downtrend that has dominated since September.

Associated Studying

Quantity has picked up barely in the course of the restoration, but it surely stays muted in comparison with the promoting spikes seen in the course of the drawdown. This means cautious shopping for relatively than aggressive accumulation at these ranges. To verify a pattern reversal, ETH should shut above the 50 SMA after which problem the cluster of resistance round $3,200–$3,300.

Featured picture from ChatGPT, chart from TradingView.com