Since August 9, Bittensor’s (TAO) worth has skilled a gentle day by day decline. This downward pattern contrasts sharply with the altcoin’s efficiency from August 5 to eight, when costs had been rising.

Holders had hoped that TAO would construct up on the rise and retest the earlier week’s excessive. Nonetheless, it additionally seems that the identical traders are accountable for this downturn.

Undertaking Growth Is Not Sufficient to Drive Bittensor Accumulation

At press time, TAO trades at $278.93, representing a 15% drop inside the final 4 days. Based on the day by day chart, the Cash Stream Index (MFI) and the On Stability Quantity (OBV) have remained across the identical spot because the decline started.

The MFI swings between 0 and 100, measuring the shopping for and promoting strain round a cryptocurrency utilizing the worth and quantity. When it rises, it infers an increase in shopping for strain. Nonetheless, a drop suggests growing promoting.

However because the indicator stalled, it implies that TAO investors are sitting on the sidelines, not actively shopping for or promoting the token. Just like the MFI, the OBV measures shopping for and promoting strain. Nonetheless, this indicator solely considers the quantity and has an identical interpretation to the previous.

Learn extra: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

As seen above, the OBV on Bittensor’s chart stays regular, indicating that traders might now not count on a worth enhance. This sentiment contrasts with final week when TAO surged after Grayscale added it to their investments.

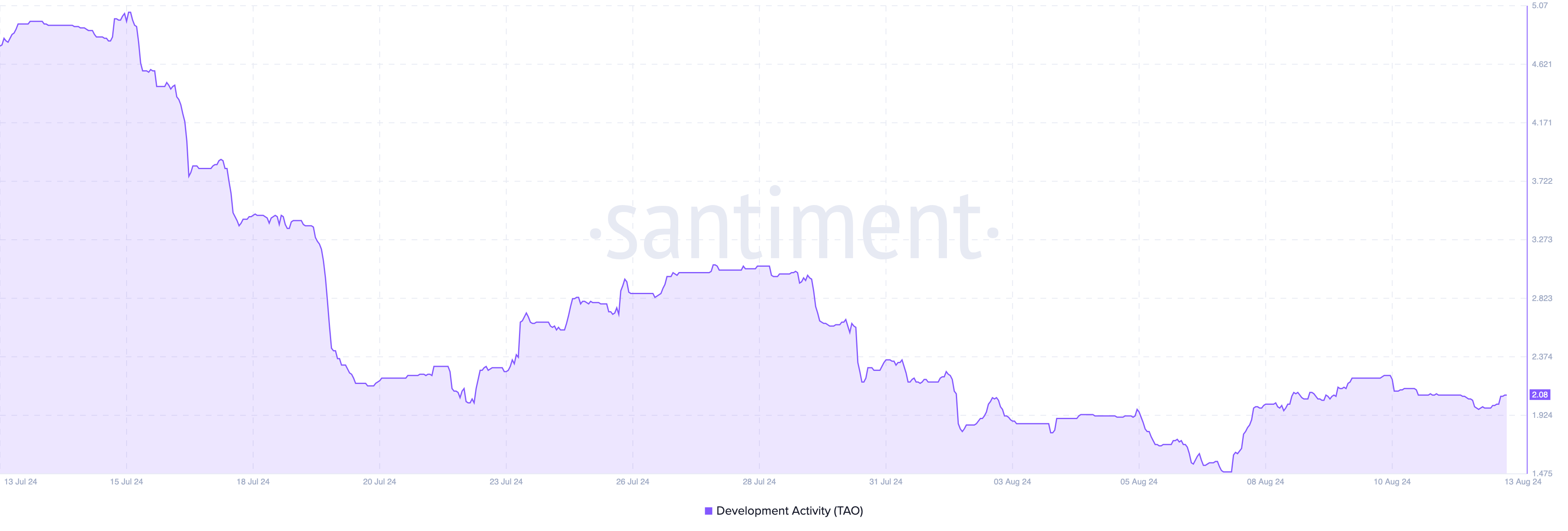

Within the meantime, on-chain knowledge exhibits that Bittensor’s growth exercise has improved, suggesting that work is being completed behind the scenes to repair points and add new options to the blockchain.

TAO Worth Prediction: Bulls Falter as Worth Eyes $241

One other have a look at the chart exhibits that bulls had attempted to push TAO higher however confronted a roadblock. That is evident from the sign proven by the Relative Energy Index (RSI).

The RSI, which measures momentum, crossed above the impartial 50.00 line on August 8, signaling a possible worth enhance for TAO. Nonetheless, that is now not the case, because the RSI has since dropped, indicating that the bullish momentum has weakened and isn’t robust sufficient to maintain a continued rise in worth.

The Exponential Shifting Common (EMA) additionally provides extra context to this place. The EMA measures pattern route over a given time period. As of this writing, the 20-day (blue) and 50-day (yellow) are above TAO’s worth, suggesting that the pattern is bearish.

Termed a dying cross, the longer EMA’s rise above the shorter one displays worth weak spot, suggesting that the token might proceed to fall. If it’s the different approach round, it is going to be a golden cross.

Learn extra: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

From the picture above, TAO’s worth might drop to $241.19, the place the 0.236 Fibonacci retracement indicator lies. For context, the Fib indicator spots worth ranges which will act as help or resistance.

Nonetheless, if traders start to purchase TAO once more, the worth prediction might change. Ought to this be the case, TAO might enhance to $288.91 or method $327.48.

Disclaimer

In keeping with the Trust Project pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.