BlackRock, Constancy Investments, and different spot Bitcoin ETF filers and the U.S. Securities and Trade Fee (SEC) will maintain a gathering subsequent week. The transfer comes in spite of everything spot ETF candidates have refiled their purposes with the U.S. SEC, mentioning their surveillance-sharing companions and different required particulars.

Spot Bitcoin ETF Candidates to Meet US SEC Subsequent Week

Bloomberg ETF analysts Eric Balchunas and James Seyffart tweeted spot Bitcoin ETF candidates and the U.S. SEC assembly subsequent week, in accordance with their dependable supply. Balchunas believes they need to meet and positively want to speak in regards to the prospects of spot Bitcoin ETF and amendments required to guidelines.

“Simply to be clear, we will’t 100% verify that is true! Simply making an attempt to share issues we discover attention-grabbing or helpful in all this from legit sources.”

The US SEC employees routinely meets with ETF candidates after an official submitting to determine on approval or denial and make clear their stance over it. Nevertheless, assembly to approve spot Bitcoin is essential for the crypto business because the SEC underneath Chair Gary Gensler continues to disclaim a spot Bitcoin ETF whereas approving different related ETFs.

After a flurry of Bitcoin ETF filings final month, the US SEC authorised the first leveraged Bitcoin futures ETF — Volatility Shares 2x Bitcoin Technique ETF.

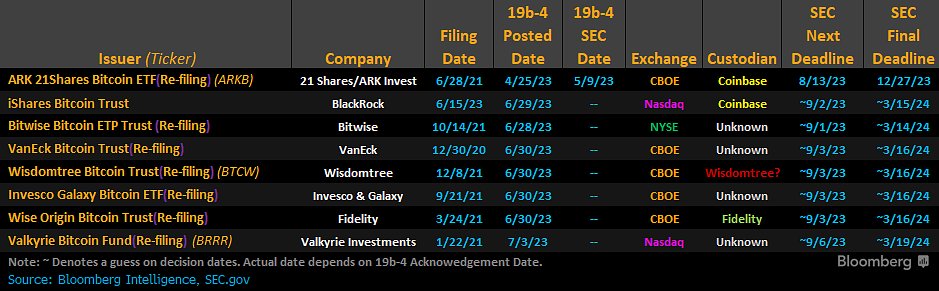

In the meantime, BlackRock, Fidelity Digital Assets, Invesco, Valkyrie, WisdomTree, and others have refiled their spot Bitcoin ETF after particulars on their surveillance-sharing agreements.

Additionally Learn: Massive 5292 Bitcoin (BTC) Linked To Terra Founder Do Kwon And LFG On The Move

BlackRock CEO Larry Fink Praises Bitcoin as Digital Gold

BlackRock CEO Larry Fink on Wednesday mentioned their ETF submitting is a “technique to democratize crypto and make it cheaper.” He asserts Bitcoin is a global asset and new gold. BlackRock hopes to work with regulators to approve its first spot Bitcoin ETF utility.

Bloomberg analysts agreed that Bitcoin ETF would make it cheaper, which is able to price 0.01% to commerce on all main crypto exchanges. Examine that to any crypto alternate and you may see the potential right here.

Additionally Learn: Binance CEO “CZ” On Bull Market, US SEC Lawsuit, BNB Chain, & Others

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.