After the U.S. Securities and Trade Fee (SEC) greenlights spot Bitcoin ETF listing and buying and selling, the most important asset supervisor BlackRock’s iShares Bitcoin Belief ETF (IBIT) debuts with a bang by skyrocketing practically 25% in pre-market hours on Nasdaq. Specialists anticipate a large influx within the Bitcoin ETFs from the primary day itself.

BlackRock Spot Bitcoin ETF Up 25%

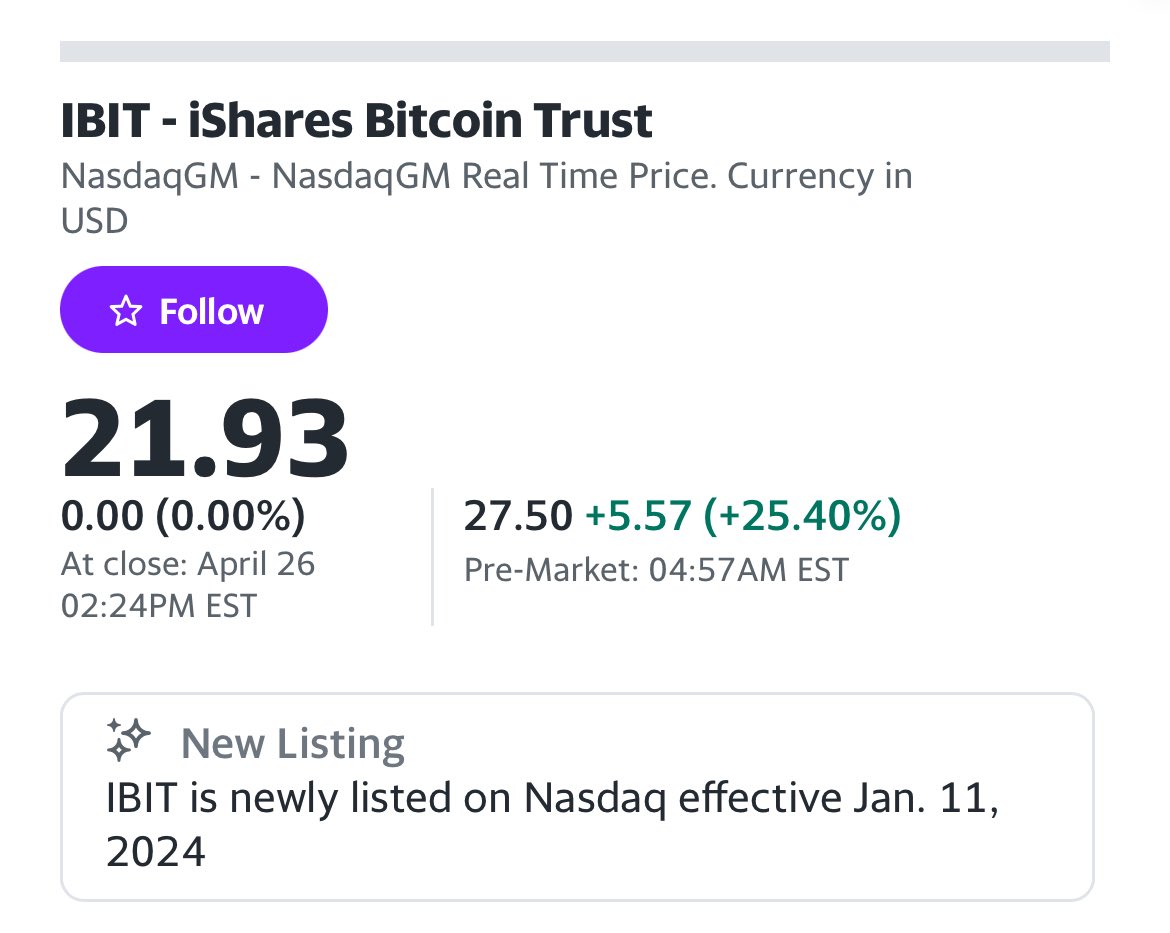

BlackRock’s iShares Bitcoin Belief (IBIT) exchange-traded fund is buying and selling at $27.50, up over 25% in pre-market hours on January 11. The BlackRock spot Bitcoin ETF internet asset worth (NAV) was at $26.12 on the approval date.

Bloomberg predicts $4 billion may move into spot Bitcoin ETFs on the primary day, with BlackRock grabbing practically $2 billion influx immediately.

BlackRock spot Bitcoin ETF is stay on their iShares web site, Nasdaq, and throughout 175000 Aladdin investor platforms after the itemizing. BlackRock introduced to cut back the charge to 0.25% and waive part of the charge for the primary 12 months. Thus, the charge shall be 0.12% of the online asset worth (NAV) of the primary $5 billion of the Belief’s belongings.

“Via IBIT, buyers can entry bitcoin in an economical and handy manner,” stated Dominik Rohe, head of Americas iShares ETF and Index Investing enterprise at BlackRock.

BlackRock spot Bitcoin ETF will assist take away some obstacles and operational burdens that stop buyers, from asset managers to monetary advisors, from immediately investing in Bitcoin.

Additionally Learn: Bitcoin ETF Live Updates – US SEC Approves All 11 Spot Bitcoin ETFs, What’s Next?

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: